Swing trading and day trading are the best style of trading for making large returns in just days or weeks. They do come with more risk and difficulty than long term investing and the traditional buy-and-hold.

But the reward of executing these two styles of momentum trading correctly can exponentially grow a trading account. In this article we will talk about these two styles of investing, and help you figure out which style you are best suited for:

Swing Trading vs Day Trading: The Differences

Day trading is defined as entering and exiting a position within the market hours of one day. This can mean buying (or shorting) at the opening bell, holding all day, and then closing the position right before 4PM, when the market closes. It can also mean buying a stock and then selling 3 seconds later for a quick scalp.

Swing trading is buying or shorting a stock and then closing the position more than one day later. Buying a stock right at the close and selling it the next day at the open is considered a swing trade. Swing traders are looking for larger moves in the markets that take longer to fully develop.

Why These Styles Are The Best

Day trading allows you to capitalize on profitable short-term movements and setups that are only valid on the intraday time frames, such as the 1-minute and 5-minute charts. Day trading also eliminates the risk of holding a stock overnight. Day traders can capitalize on short-term market movements, and do not have to worry about the overall market conditions as much. This style is a very efficient use of capital because you can rotate your capital into trending stocks and capture multiple high percentage moves in a short period of time.

An advantage of swing trading is that a single stock can yield substantial returns over the course of several days. Several well-timed swing trades can grow a trading account significantly in a short period of time. Unlike day trading, a swing trade doesn’t require precisely timed entries or close intraday monitoring. In general, it is a better style of trading for someone who has a full-time job during market hours that is less time consuming and less stressful for the most part.

Day Trading Pros

- Potential for large returns in a short period of time (minutes and hours)

- Only need to trade for the first few hours of the day (still need to put in work outside of market hours, especially pre-market)

- No overnight exposure

- Less concern for macro market conditions

- Capital not tied up for long periods

Day Trading Cons

- Pattern Day Trading Rule: If you have less than $25k in your trading account with a US broker, you can only make 3 day trades every 5 trading days (1 trade defined as a buy and sell). Learn more about the PDT rule here.

- Higher stress

- Requires quick reactions and decisive thinking

- Need to be in front of a computer during the market open at 9:30 am EST (many people have a full-time job which makes this difficult)

Day Trade Example: GHSI

Here is an example of a day trade one of our moderators in our day trading chatroom made on $GHSI. He bought shares of the stock at $1.76, and over the next 13 minutes, sold 1/3s of his position at $2.04, $2.33, and $2.38. The green arrow on the chart is where he bought, and the red arrows are where he sold. This example demonstrates the power of day trading if executed correctly: An over 20% return in less than 15 minutes.

Swing Trading Pros

- Less micromanaging

- Don’t need to sit in front of a computer all-day

- Easier style to execute with a full-time job

- Can capture large returns in just a few days or weeks

Swing Trading Cons

- Slower moving

- Overnight exposure

- More susceptible to news and macroeconomic events

- Capital tied up for longer periods of time

Swing Trade Example

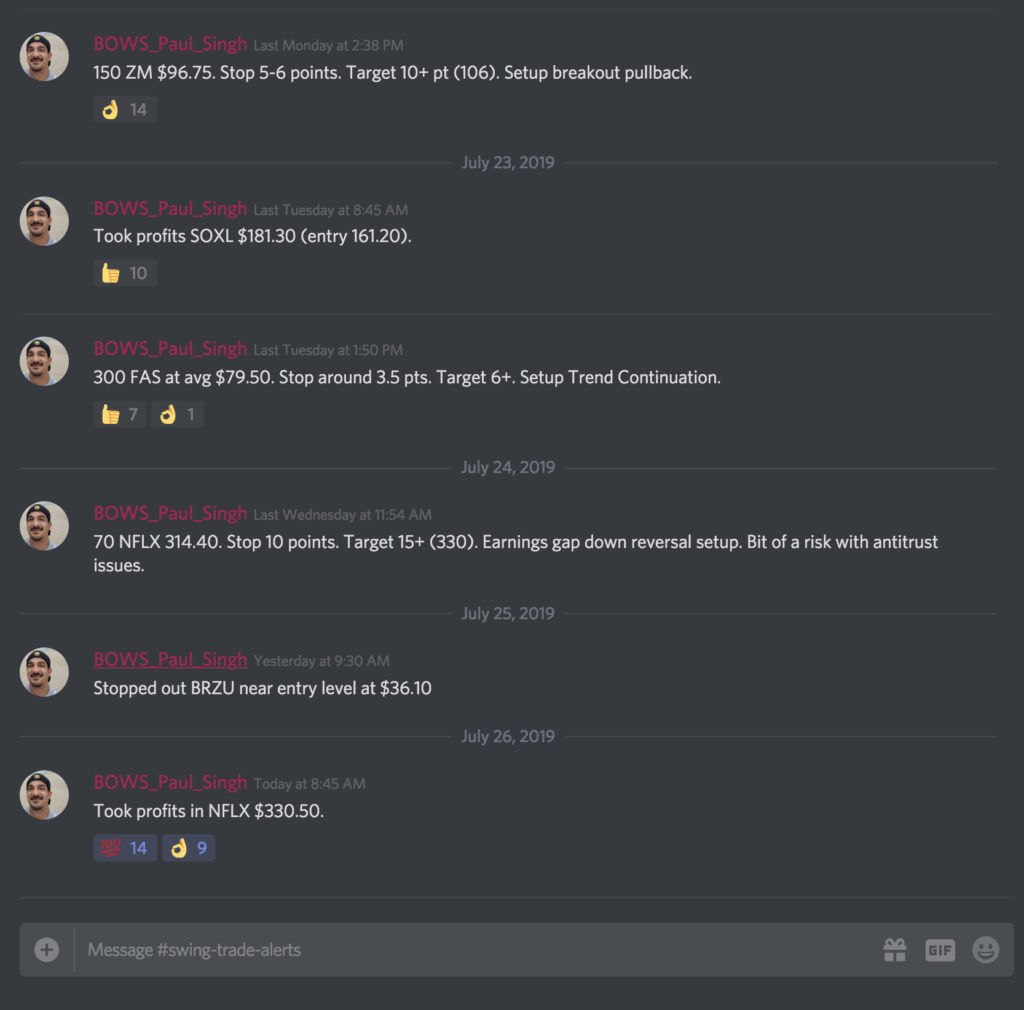

This is a screenshot of our swing trading chatroom, with our head trader Paul Singh. He calls out all of his swing trades to members. You can see how he bought NFLX at $314.40 on July 24th, and then sold his shares at $330.50. This is a swing trade, because he held it for 2 days.

Don’t Miss Our Next Free Chatroom Day

Space will fill up fast. Register ASAP.