Things have slowed down a bit this week with earnings season starting to come to a close. Still some reports coming out, but the bulk of the juicy ones have announced already. The good news is that the overall market volatility has increased the past few weeks, and continued into this week. Leveraged ETF’s like TVIX are in play, and provide us some sick range to trade off on a daily basis. Let’s talk about some of the trades I took this week:

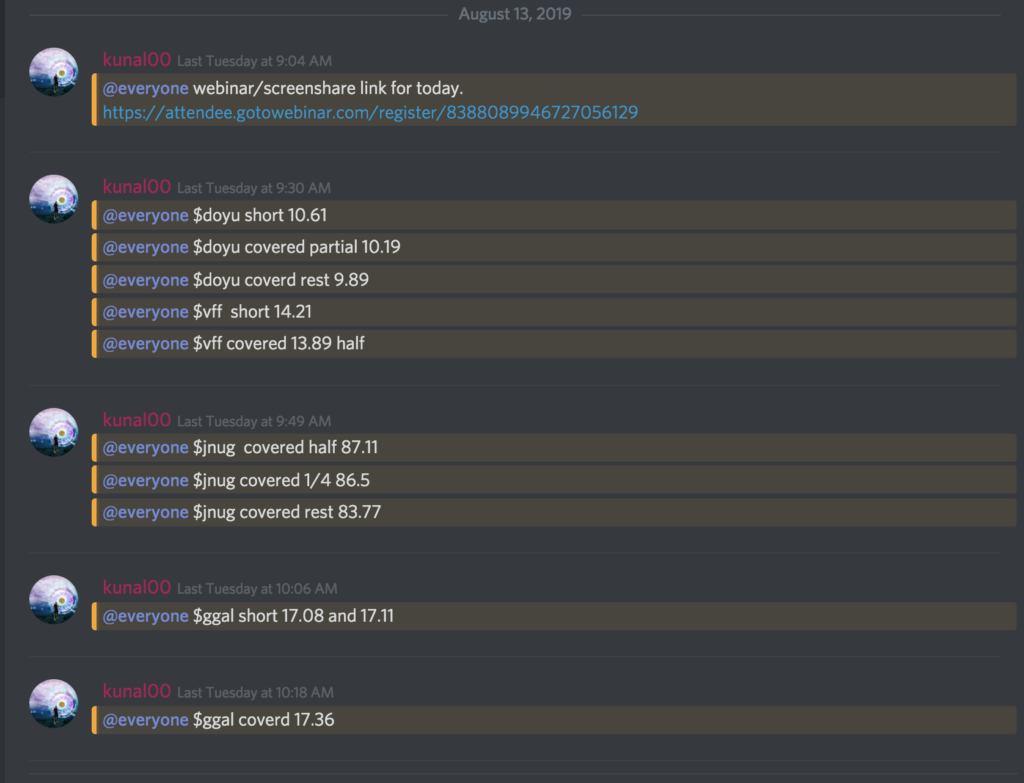

$DOYU, $VFF Nails, $GGAL Mistime

$DOYU

DOYU was one of my favorite reversal patterns: the exhaustion gap reversal. It is one of the most explosive reversal patterns out there (here we recently wrote a blog how to trade this pattern in more detail). At the open once it had the failed push in premarket and broke under premarket support, I knew that this piggy was ready to flush. My first target was yesterday’s high of day (will often act as support on these setups), and took off the rest in a flush under $10.

$VFF

Similar setup to DOYU, although not quite as A+ since it had a red day right before it gapped up. It still had a big run up, and had plenty of room to fall once it was gapping up on Tuesday. Similar intraday setup to DOYU as well, with the failed premarket push, and flush at the open.

$GGAL

GGAL had a big gap down on earnings the day before, and my thought was that it would have day 2 momentum to the downside. The intraday setup didn’t end up following through and took the small loss.

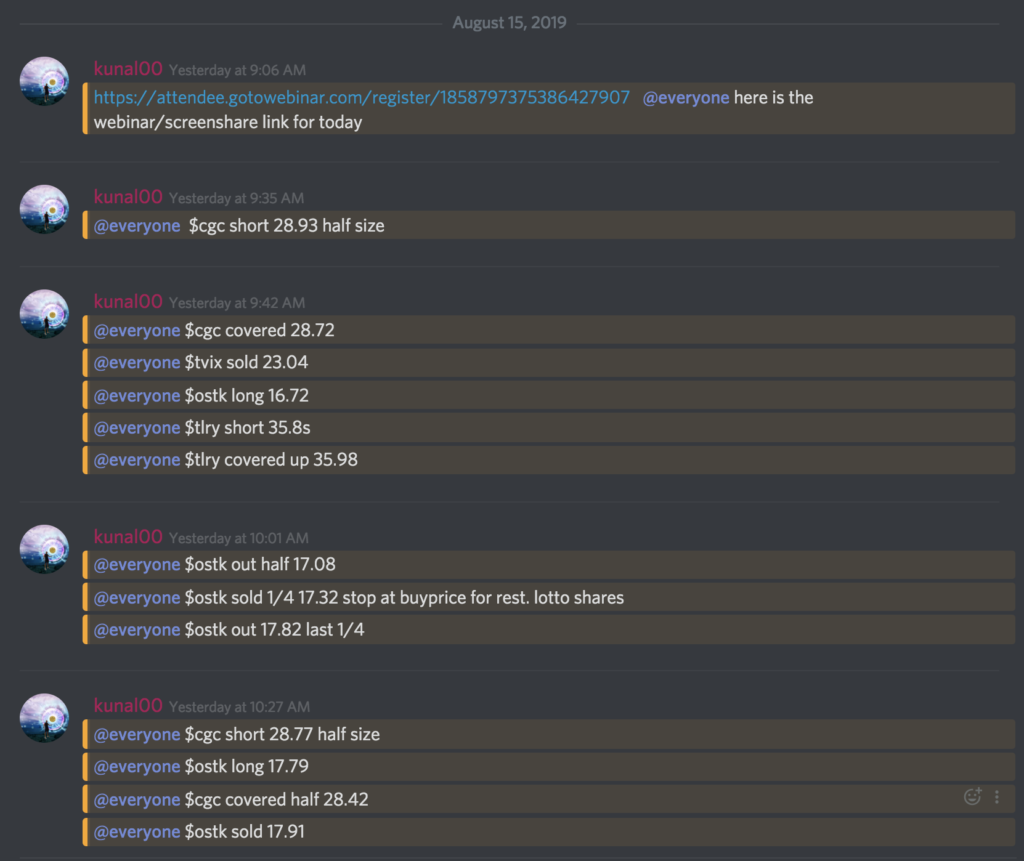

Pot Stock Shorts, $OSTK Bounce, $TVIX Loss

$CGC, $CRON, $TLRY

On Thursday a lot of pot stocks were getting hammered as CGC came up with a poor quarterly earnings report. The first shot I had at it in the morning was basically breakeven, as it was showing signs of holding up. I thought $TLRY would crack also, and ended up covering for a small loss. Once $CGC ended up rejecting again, I got short, and this caught the flush. I covered into weakness, and reshorted the turd and added to the winner. Took a small win on CRON, thinking it might roll over in sympathy to CGC.

$OSTK Long

The day before OSTK had a big down day, and I thought on Thursday it could be due for a quick bounce, as this one tends to be a big squeezer and is loaded with shorts. I got long anticipating the ORB, and scaled out into strength. I relonged it on a pullback in the $18’s and scaled-out quickly into strength again.

$TVIX Scratch

Thought the market was going to roll over after it broke under low of day, so I got long TVIX anticipating the spike in reaction to market weakness. It ended up holding up, and I took the loss on it. Luckily it barely made a dent in my PNL from my other winners. Shows the power of risk management, and adding to your winners, like I did with OSTK.

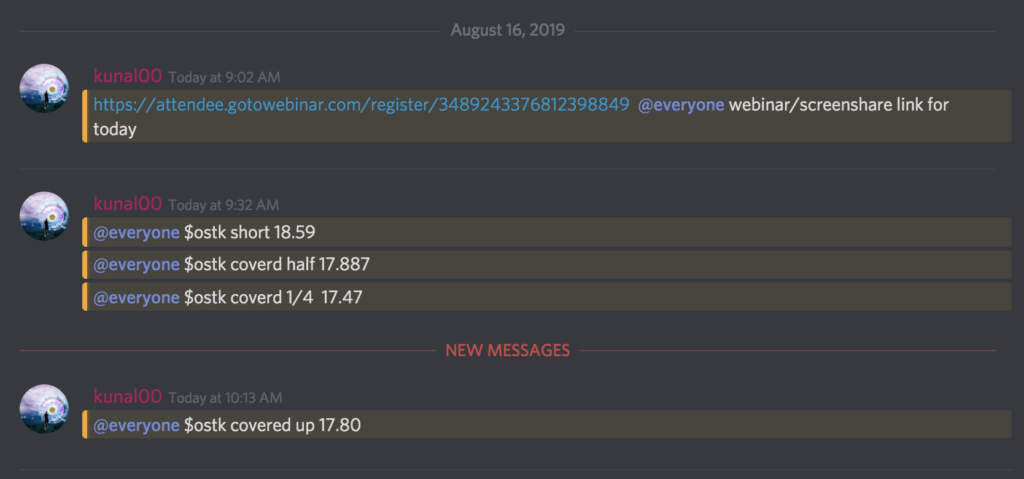

$OSTK Nail

One of my best trades this week. OSTK had a big rally the day prior, where I was actually long. It still had cracked major support on its daily recently under $20, so my thought process was that if it opened up slightly green, people would be slamming the bid on this piggy. Once we got the rejection of the round number $19 at the open, my thesis was that we would get a green to red move. I covered into the flush in pieces. I ended up longing it later for the red to green actually (see the execution chart at the top of the page)!

Free Chat Day 8/19: Watch Me Day Trade Live

Next Monday, August 19th, we are doing a free chat day with our day trading chatroom. During the free chat day, you get to watch me day trade live on screen share. Watch all the day trading setups, see all the trades I take in real-time, and see all the scans, charting layouts, and other gimmicks of my trading style!