The VWAP is one of my favorite trading indicators for gauging intraday momentum. VWAP stands for Volume-Weighted-Average-Price. A very important indicator to pay attention to when day trading. The VWAP trading strategy I use typically occurs during the middle and end of the trading day. This is NOT a setup to use at the open, which is the period from 9:30-11:00AM.

This video lesson I will show you how I use the VWAP in the current market environment, and how you can implement the indicator in your trading next week:

What is VWAP?

VWAP stands for Volume-Weighted-Average-Price. It tells you a very important piece of information: Whether buyers of the stock that day are in the green or in the red.

As momentum-based day traders, we consider it the “line in the sand” for intraday support and resistance. Using the combination of volume and price range, VWAP is an excellent technical trading indicator that can work for trading multiple trading strategies. Whether you look to long pullbacks or short pops, the VWAP can come in handy to do both!

Understanding How Stock’s Trend with VWAP

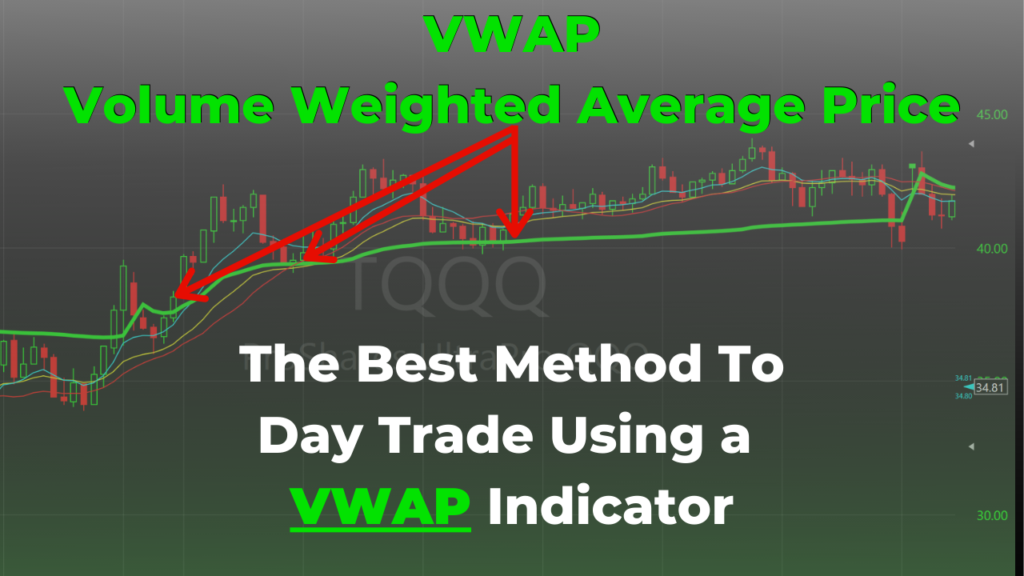

When using our VWAP trading strategy, it is important to understand how stock’s trend throughout the trading day. As we discussed in the video above, when stocks go on strong trends and get extended from the VWAP and intraday moving averages, they will at some point pullback before the continuing trend.

Waiting for this pullback takes patience. Most traders chase the stock when it is going up, and then sell for a loss because they bought when it was extended. The stock almost always pulls back to its VWAP at some point during the trading day. WAIT FOR THE PULLBACK. Don’t chase. This gives you better Reward vs Risk on your trades and helps you time your entries and exits.

A Common Mistake Traders Make

One of the most common mistakes traders make when using VWAP is that they assume a price break under VWAP immediately means it’s a sell, or a break above is a long. A break over or under VWAP is not a trade signal by itself.

What you need to pay attention to is how price RESPONDS to the VWAP area. What I tell my students is to wait for a candle to form and hold before taking a position. Don’t blindly buy or short when the price gets near it expecting it to reverse. If it was that easy everyone would be driving lambos.