It’s been a crazy week in the markets. With earnings season, there are dozens of stock gapping up and down on high relative volume. It is a momentum trader’s dream. Here is a trading recap of some of the day trades I took and some of the swing trades Paul took:

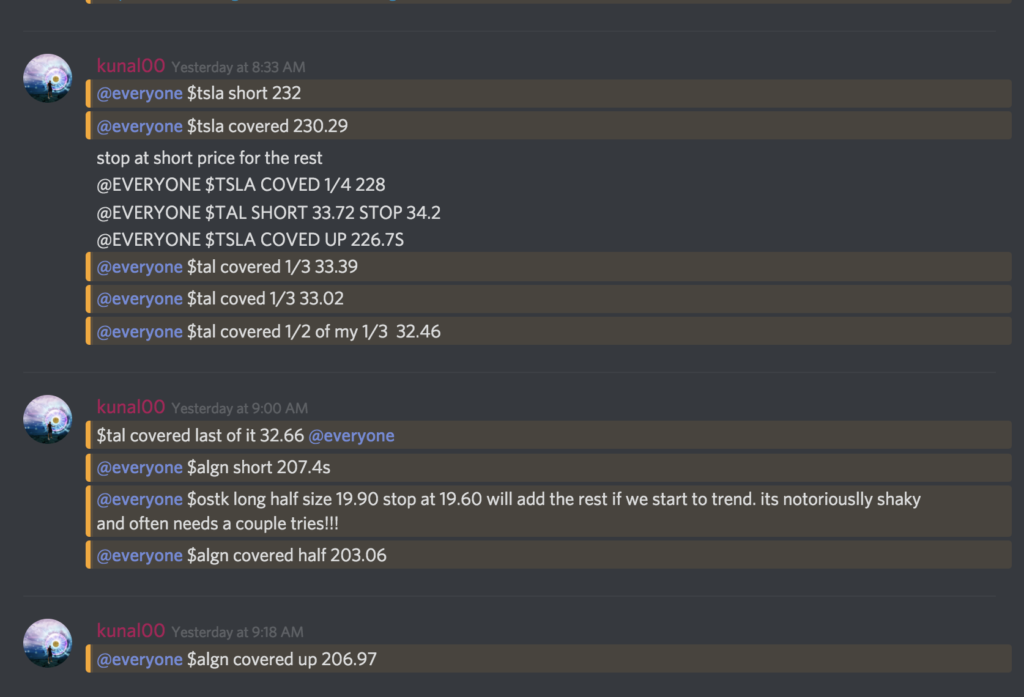

TSLA, TAL, and ALGN were all similar setups: Earnings breakdown short plays. All 3 had gapped down in response to negative earnings reports, and all 3 of them gave setups at the open for entries. TAL and ALGN offered great ORB (opening range breakdowns) setups at the open to offer, low-risk high reward entries. On TSLA my trigger was the break of pre-market market lows. My exit strategy on all of them was to scale out and cover on dips.

OSTK was a tough trader this week, and I ended up taking a few small losses on it. It’s always a choppy one, it never trends clean from breakouts or breakdowns. If you’re new, I’d recommend avoiding trading it altogether. Here is an video breakdown my trading week and my trades in more detail:

You can learn more about my trading thought process and execution in our free chat day next week where you can watch me trade live.

Some of Paul’s Trades

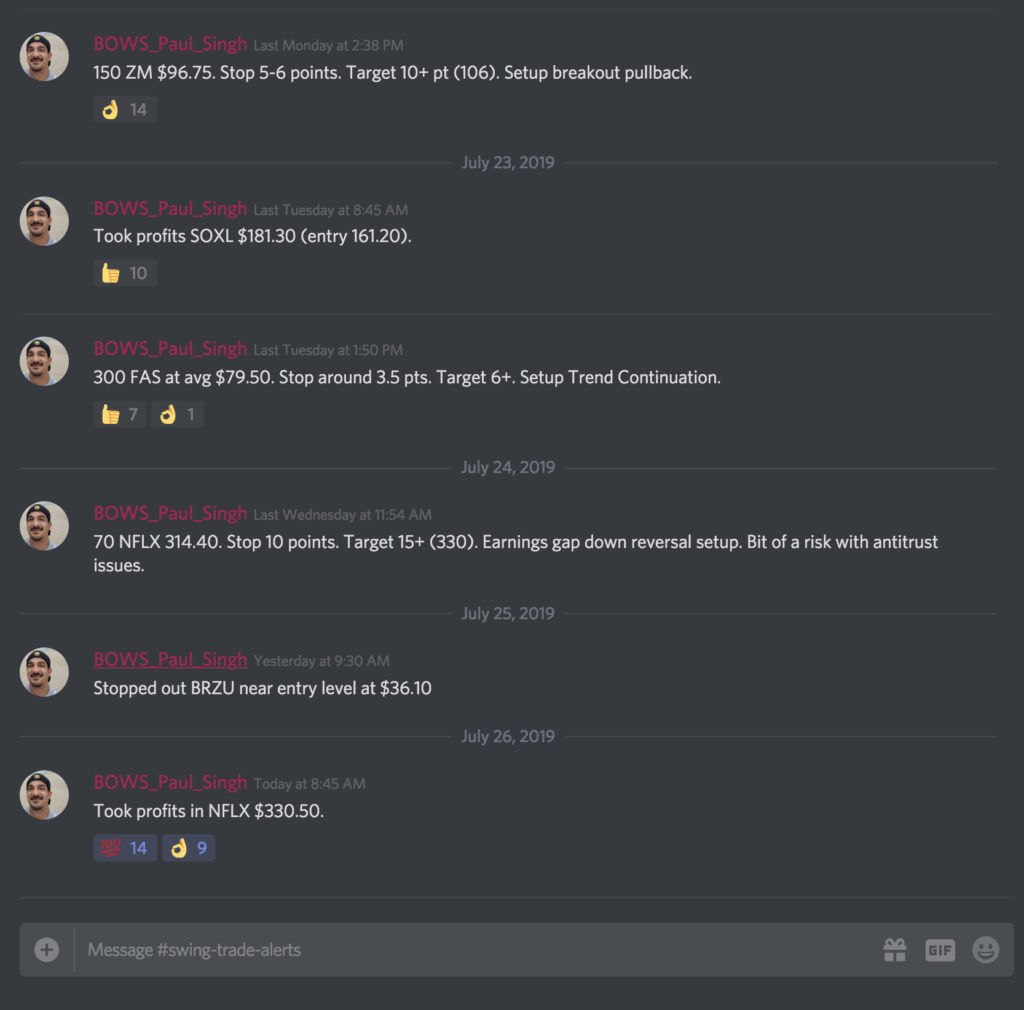

Paul had a ton of great trades throughout the week. Had great timing with NFLX on the earnings gap down reversal. A nice exit in SOXL, and some great entries in ZM and FAS. He had a scratch trade-in BRZU as well, which didn’t end up having any follow-through. Here is a trade recap of Paul’s NFLX trade-in cased you missed it. A lot of momo names offering great swing opportunities this month, and we have been capitalizing!

Free Chat Day 7/29: Watch Me Day Trade Live

Next Monday, July 29th, we are doing a free chat day with our day trading chatroom. During the free chat day, you get to watch me day trade live on screen share. Watch all the day trading setups, see all the trades I take in real-time, and see all the scans, charting layouts, and other gimmicks of my trading style!

Click Here to Sign Up For Our Free Chat Day