Most traders on social media pretend they don’t make trading mistakes. It’s all big PNL’s and winners. With two decades of trading and working with 1000’s of traders, I can confirm that every single trader makes mistakes, usually on a weekly basis, no matter how experienced or profitable.

The difference between successful traders and ones that fail is how they REACT to their mistakes and move forward. In today’s blog, I will talk about what a trading mistake looks like (most new traders don’t know what a mistake looks like), and the best way to respond to them so you can actually learn from them, and prevent them from occurring again:

Defining Trading Mistakes

There are a lot of misconceptions about what a trading mistake is, especially with newer traders. By trading mistake, we are referring to behavior that is not apart of a profitable trading system. Many of you reading this might think that a losing trade is a trading mistake. It’s not.

This is a crucial concept to wrap your head around before reading further: A single losing trade doesn’t necessarily mean you did something wrong. And a winning trade doesn’t mean you did something right.

It is determined by the results of MULTIPLE trades. A LARGE sample size.

In order to actually understand what a trading mistake is, have defined trading rules, and a system with an edge.

Winning traders define a trading mistake as breaking their trading rules, not by making or losing money on one particular trade.

Example

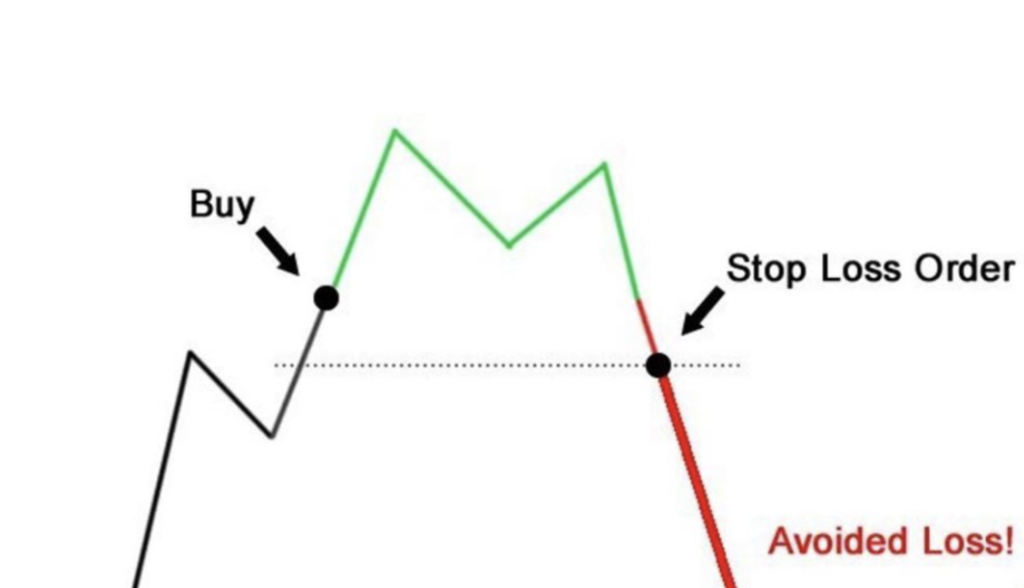

Putting on one winning trade actually takes no skill. You can buy and sell at completely random and times and possibly make money. It’s making money consistently over a long period of time that’s difficult. Here is an example of a GOOD losing trade:

The trade didn’t follow through, but the trader took the loss while it was small and manageable. Yes, he lost money, but he stopped himself from losing a lot more, and he followed one of the most important rules of a profitable trading system: Keeping losing trades small.

An example of a bad winning trade is buying a penny stock that is up 300% on the day, and selling for a profit. Yes, you made money, but you took a setup that has awful risk vs reward and works maybe 20-30% of the time. You just got lucky. You can start to see how many traders struggle to become consistently profitable because they develop an incorrect internal reward and punishment system for their behavior.

Here is why trading is so hard: We are conditioned to believe that making and losing money on a trade is a positive and negative event. But in order to become a consistently profitable trader, you have to recondition yourself to view following your proven trading process as a positive event, and deviation from your system as a negative one.

Diagnose the Trading Mistake

Now that you know you made a trading mistake, you have to figure out WHY it happened. It is painful to look at your mistakes. Everyone hates to be reminded of their own inadequacy. But it is the only way for you to develop as a trader. Through my experience and most of my students’, mistakes, especially ones that result in losing trades, actually help your development more than winning trades.

Was the mistake a technical one? Hitting buy when you meant to sell? Or did you break trading rules? Did you average down on a loser? Revenge trade? Or was it due to lack of preparation and a poor daily routine?

Reacting and Responding

Now that you’ve diagnosed the mistake, you need to figure out what you need to do to prevent it from happening again in the future.

Let’s say that you revenge traded and took a loss that wiped out a week’s worth of gains in a few hours. You know that you messed up, but you actually need to create rules and protective measures to prevent this from occurring again in the future. If you find yourself making the same mistakes over and over again, you aren’t taking enough action to address the issue.

You need to trading rules to protect your account from your own self-destructive tendencies. In the example above, the trader should use a daily max loss limit on their trading account. This will stop them from being able to trade on their account after they lose a certain amount of money during a single trading day.

Summary

- Acknowledge you made a mistake

- Diagnose what the mistake was

- Create rules and preventative measures to prevent it from happening again

ive Stock Trading Bootcamp Starts Next Week

Next week our award-winning, live 60-day trading boot camp kicks off! We teach over 30 day trading setups, and teach you everything you need to know about professional stock trading. Class starts next Tuesday, and there are only a few seats left!