Range bound SPY action not ideal day trading conditions. Right now we are seeing distribution in SPY and other major indices, and the chop has been frustrating at times. There were still opportunities, but not as many A+ setups as we were seeing earlier this month during peak earnings season. Here is a recap of some of the trades I took this week:

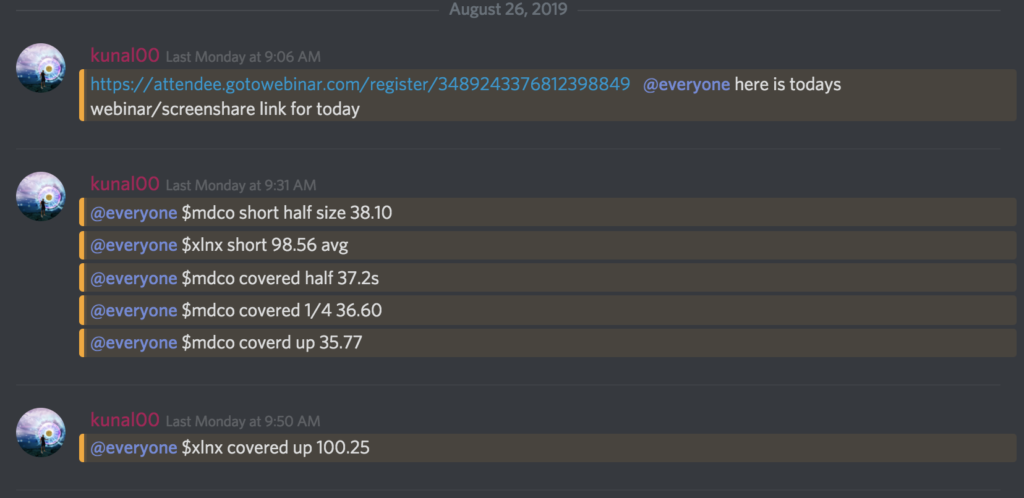

$MDCO, XLNX Shorts

MDCO is not my typical short-selling setup. Usually I go for earnings breakdown plays, but MDCO was a first red day setup. It had a multi-day runup the last few days before I traded it, and my thesis was that it would have a quick pullback. Countertrend setups like these are NOT ones you want to marry. Nail and bail.

XLNX had a weak daily, and my thesis was that it would continue to roll over once it broke under the psychological $100 level. It didn’t end up following through so I took a small loss.

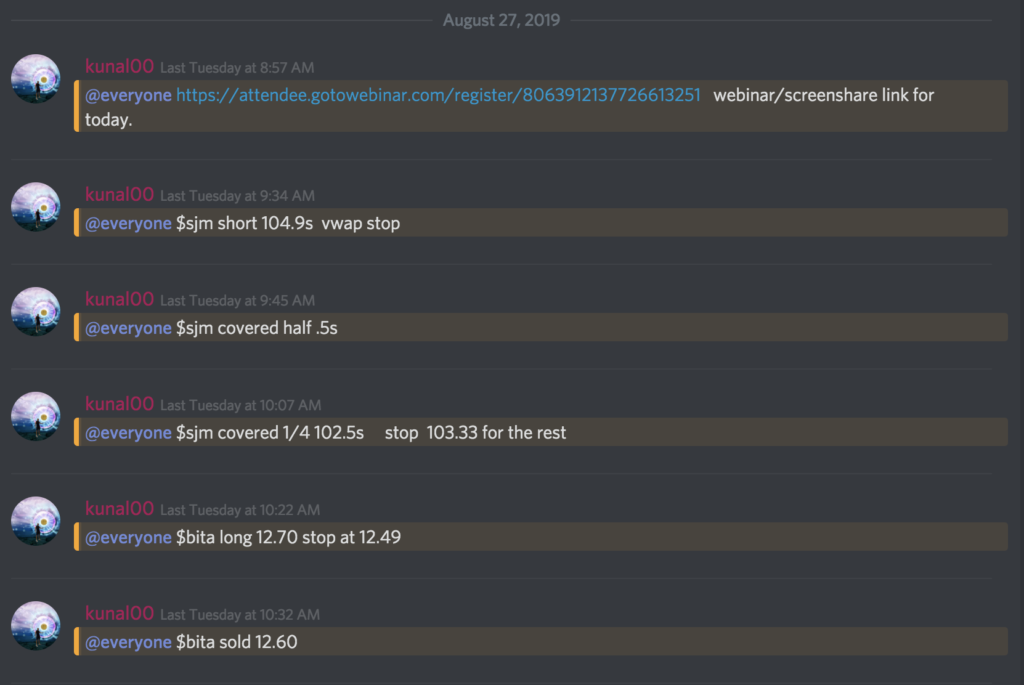

$SJM Short, $BITA Scratch

SJM reported an earnings miss and was gapping down during pre-market. It gave a great ORB set up at the open to get great risk vs reward, and I covered pieces out into weakness.

BITA was showing nice signs of a bottoming formation on its daily, just mistimed my entry bit and took a tiny loss when it didn’t end up following through on it’s a pullback to its intraday the MA’s.

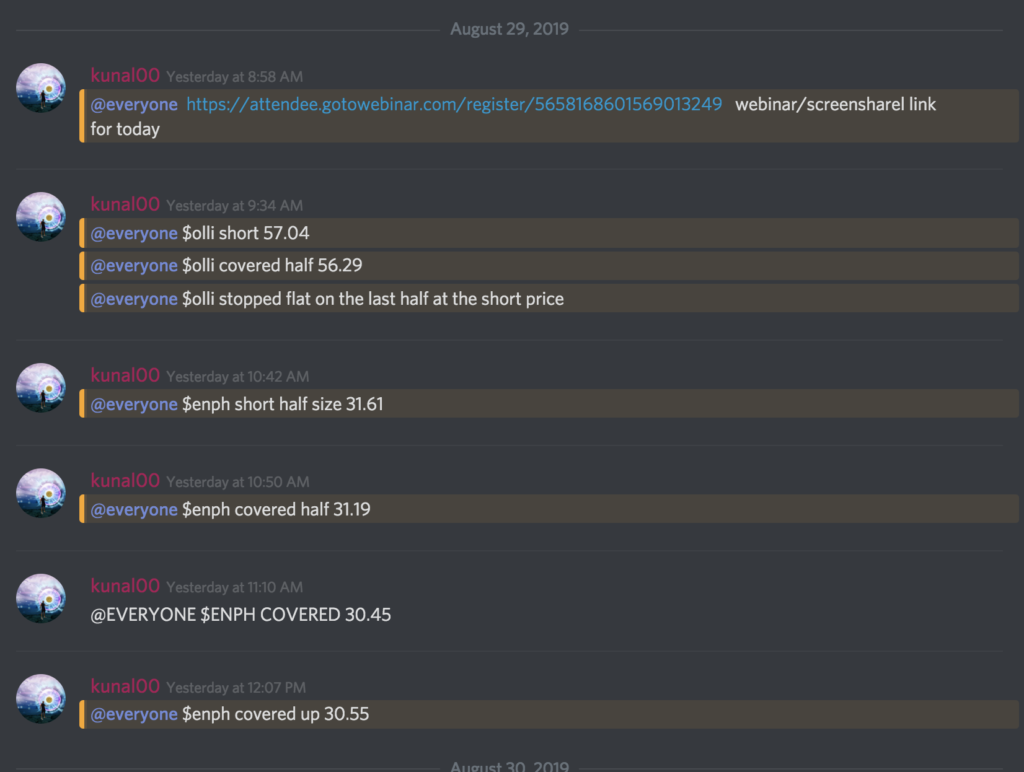

$OLLI and $ENPH Nails

You’re probably starting to see a pattern with my weekly trade recaps. Almost every day I’m trading earnings breakdown plays. OLLI is just the same thing different day. it didn’t follow through much but still gave me a small win.

Was stalking ENPH for a short for a while. After it rejected the $35 level on the daily chart the prior day, I figured that someone was trying to unload, and it had room to fall! We already started to fade off the day before, and my thesis was that we would have a day 2 of selling. Once it took out its opening range at $33, it was pure panic. Unfortunately, I missed the initial breakdown and settled for shorting into the first bounce.

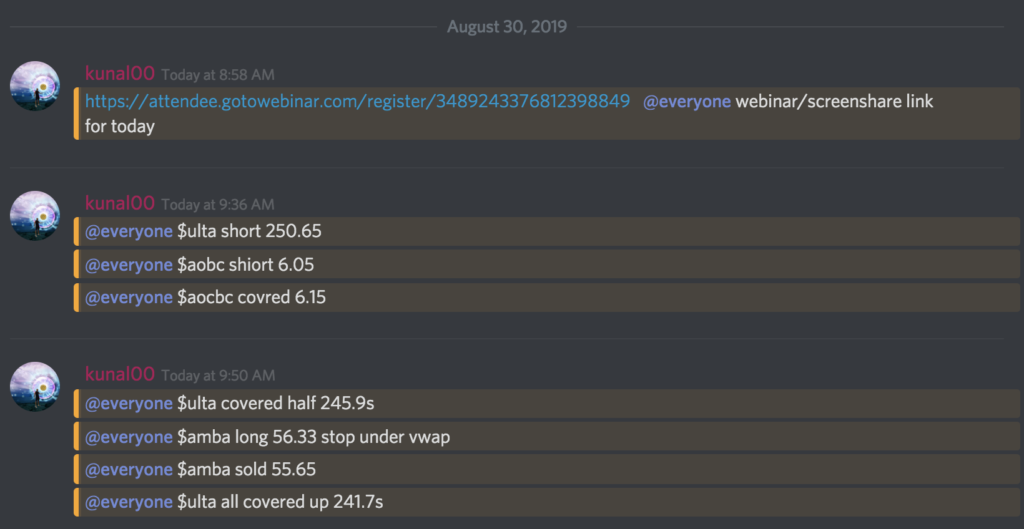

$ULTA Short, $AOBC, $AMBA Scratches

$ULTA is another earnings breakdown short. It gave a textbook ORB (opening range breakdown) to make it high probability play right near at the open, which really brought some selling into the name. The earnings weren’t actually that bad on this name, and it was gapping down big pre-market. Once we took out the opening range at $250, my thesis was that it would continue to flush, so I got short and covered into the drop.

AMBA was an earnings winners, with a nice breakout gap over $52. I got long at the flag break near the open, and didn’t get any follow-through, and took a small loss. For some reason, I’m much better on the earnings shorts!

Biggest Lessons From the Week

1. If stock’s don’t confirm as you enter right at the open, get out. You can always get back in once the trend forms

2. Be patient with your winning trades, impatient with your losing ones. Many losing traders have this backward.

3. Know your A+ setups, trade big size on them, and stay small size on non-niche plays

4. The reaction to earnings reports is what matters, not the actual earnings themselves