You may have heard the phrase “Trade the ticker, not the company.” As a momentum day trader, is it a phrase that I live by. Today we will talk about how I use company fundamentals in my trading, and how to emotionally detach from the companies you trade so you can make profitable trading decisions:

The Wrong Way to Use Fundamentals

Company fundamentals matter very little to me. Mainstream Wall Street thinks I’m crazy, but I’ve tried the fundamental-based trading strategy. For the first 5 years of my trading career in the early 2000’s I knew the fundamentals inside and out of every company I traded.

I sat in on all the conference calls, I read every company filing within the past year, I knew all the important fundamental metrics about the companies. But I still couldn’t make money! I was a great stock picker, but I was an awful trader! I would always buy and sell at the wrong times, and could never consistently make money.

Timing is Everything

The reality is, company fundamentals show very little about timing the stock. They can help give you conviction on a bias, and what direction this might head at some point in the future. But it is very hard to tell WHEN this will get priced into the stock price.

Buying and selling (or shorting and covering) at the right times are more important than company fundamentals. You can buy the best stock in the world, or short the worst stock in the world, but if you do it at the right time, there is no point to your transaction.

The whole point of investing is to turn money into more money. This is a technical analysis that is essential for profitable day trading and swing trading. Your focus is on price action, momentum, and trend.

Be Right, or Make a Winning Trade?

One of the biggest issues I see with retail traders is that they get emotionally attached to a trade thesis. They fall in love with the company’s story, project or CEO, and don’t respect price action. They hold when all technical indicators are screaming sell.

This also is true for short-sellers. They are so convinced that a company is junk, they don’t respect a strong uptrend and blow up their accounts. $HEPA is a great example of that yesterday:

This is obviously a joke biotech company that should not be up this much. But that doesn’t mean that yesterday was the day to start shorting. If you started shorting it at $5 yesterday, you would be underwater right now. If it goes to $10 on Friday, your account is finished.

In trading, making money is more important than being right. Price action always trumps your opinion. Never get attached to any trade thesis. Even when you are using a great trading strategy that has an 80% win rate, there is still a 20% chance you might be wrong. You have to make sure that you survive and contain your losing trades, and live to fight another day.

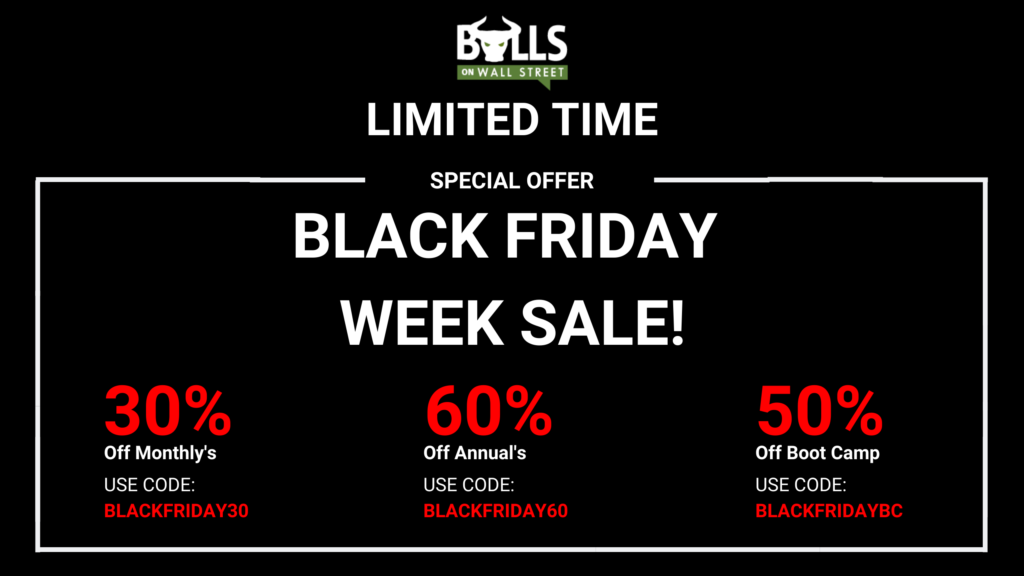

Take Advantage of Our Black Friday Deals

Regular Annual Price: $1499/year

Black Friday Annual Price: $599/year (Using code: BLACKFRIDAY60)

Regular Monthly Price: $199/month

Black Friday Annual Price: $139.30/month (Using code: BLACKFRIDAY30)

Regular Boot Camp + 6 Month’s Chatroom Price: $4,000

Black Friday Price: $1,999 (using code BLACKFRIDAYBC)

All of these deals will expire on December 1st!

NOTE: Space is running out in our next live trading boot camp. We only have 14 seats left. Contact us ASAP to save your seat.