Sir Isaac Newton once said “what goes up must come down”. This is a classic third law of physics that we as traders must adhere to. That’s because every stock in the history of stocks that has gone up, eventually comes back down. It does not matter how great the company is, at some point the rocket ship will run out of fuel.

What the third law does not state, but applies to trading, is that some of those stocks that come down will go back up again.

While there was a ton of excitement on the rocketing phase up, and both excitement and frustration on the way down, once the stock has bottomed most of the momentum traders move on to something else. That’s when the opportunity for a reversal trade sets in.

In today’s short Twitter clip, I reviewed recent bulls alert BYND. This stock is a recent IPO that ran up like a missile, crashed hard, and now looks like it’s bottomed and potentially reversing. I also review the current state of the market and other positions.

— Paul J. Singh (@PaulJSingh) November 29, 2019

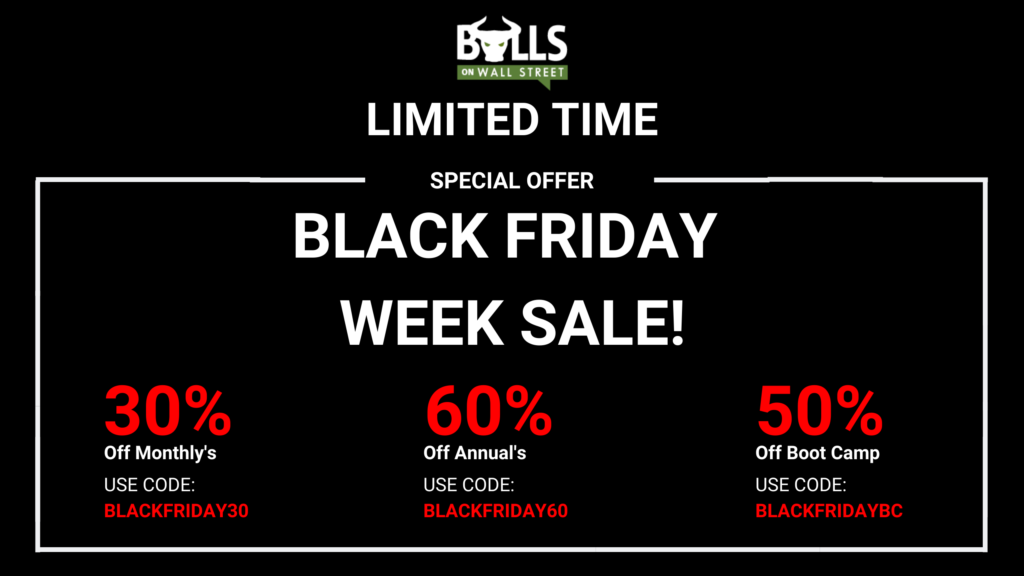

Don’t forget we have an amazing Black Friday going for the Swing Service and the Rest of Bulls services:

Take Advantage of Our Black Friday Deals

Regular Annual Price: $1499/year

Black Friday Annual Price: $599/year (Using code: BLACKFRIDAY60)

Regular Monthly Price: $199/month

Black Friday Annual Price: $139.30/month (Using code: BLACKFRIDAY30)

Regular Boot Camp + 6 Month’s Chatroom Price: $4,000

Black Friday Price: $1,999 (using code BLACKFRIDAYBC)

All of these deals will expire on December 1st!

NOTE: Space is running out in our next live trading boot camp. We only have 14 seats left. Contact us ASAP to save your seat.