Most people on the internet selling trading services give you the impression that trading is easy. You wake up, you buy some stocks, you sell them after 5 minutes for 100% gains. Then you go travel to Turks and Caicos and trade on your laptop from the beach, and you become a millionaire overnight.

Sadly so many fall for this pipe dream that is shilled constantly across social media. If trading was easy, why would anyone work as a restaurant worker, a plumber, or a doctor? Why wouldn’t everyone do this?

The journey is difficult, but the struggle is worth it. Becoming a REAL successful and profitable trader is really as good as it looks. Once you become consistently profitable, there is no better profession in the world.

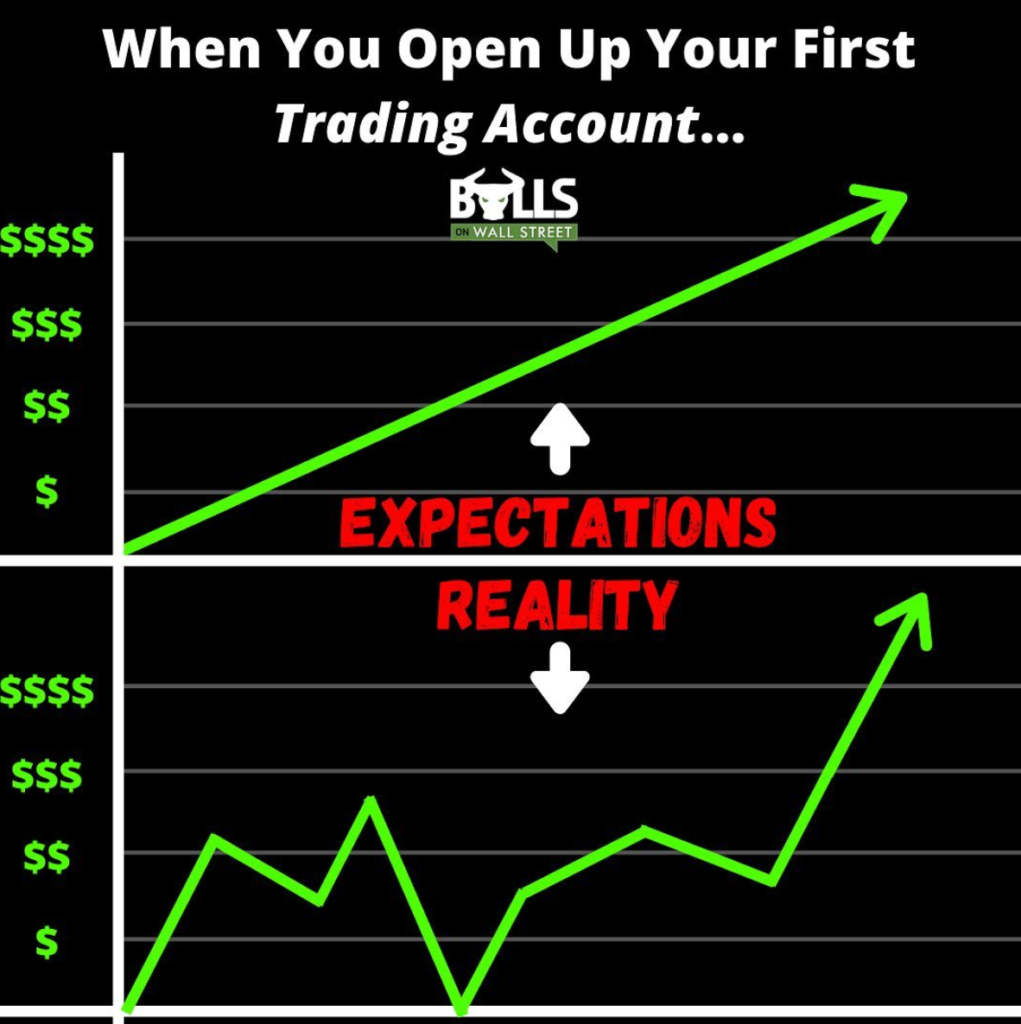

But there are HUGE misconceptions and expectations about the path to get there. Most traders treat it like gambling and give up before ever giving themselves a chance at finding success. Today we will talk about the primary reason why 95% of traders fail, and how you can become the 5% that actually succeed:

Unrealistic Expectations

Most new traders’ expectations:

Month 1: Buy a course/ join a chatroom. Study all the material for a weekend. Open $1000 trading account at Suretrader.

Month 2: Turn the $1000 into $10,000.

Month 3: Get over PDT, Turn $10,000 into $50,000. Quit day job.

Month 6:Become a millionaire. Live anywhere in the world. Bottles and models. Growing any size trading account is a difficult feat when you are new to the markets, and it is even harder when you starting out with only a few thousand dollars. Their impatience causes them to risk inappropriate amounts of capital per trade and become reckless.

They end up feeling depressed that they didn’t become profitable after a month or two of trying and give up too soon. These expectations are not just unrealistic, but they mistakenly assume a linear progression in trading account growth. In trading, you will have hot in cold spells.

You will have months where you can do no wrong, and months where you couldn’t place a winning trade to save your life. The best traders have losing months that are a small fraction of their winning months. And the reason they have consistency in their profits is that they trade with a proven strategy with sound risk management.

No-Risk Management

New traders think that once you get educated, you come to the stock market every day, you win on every trade and you make money every day. They put on 1 or 2 winning trade and think they are a trading expert. In trading, the hard part is actually not putting on winning trades. It’s about keeping the profits you make, and capital preservation.

Risk management is what separates winning and losing traders. Not having or obeying a stop loss on a trade is like going all-in on every hand when you play poker. You might make money in the short-term, but in the long term, you will inevitably lose all of it and go broke.

For consistent traders, red days will happen occasionally. Red weeks will happen rarely. But losing months should never happen if you have sound risk management combined with a proven trading system.

Consistency and risk management go hand and hand. Focusing on aggressive risk management and trading a system with an edge SIGNIFICANTLY increases the probability of you becoming a consistently profitable trader.

Take-Aways

Trading is easy to get into. But not easy to find success. If it was easy, everyone would be doing it.

The key is treating trading like a business. You need a business plan. A system. Discipline. Work ethic. You cannot wing it.

If any of these concepts don’t make sense to you, make sure to check out our free chatroom day this week and learn live from experienced traders: