Timing is everything in trading. How do you know when to buy the stock at the right time? And how do you know when to sell for profit? This is why you need to understand how to time stocks.

The best traders have a system that allows them to get an entry before a big move is made, and have a strategy for staying in the stock to ride its trend as long as possible. Here are some tips on how to time your trades correctly.

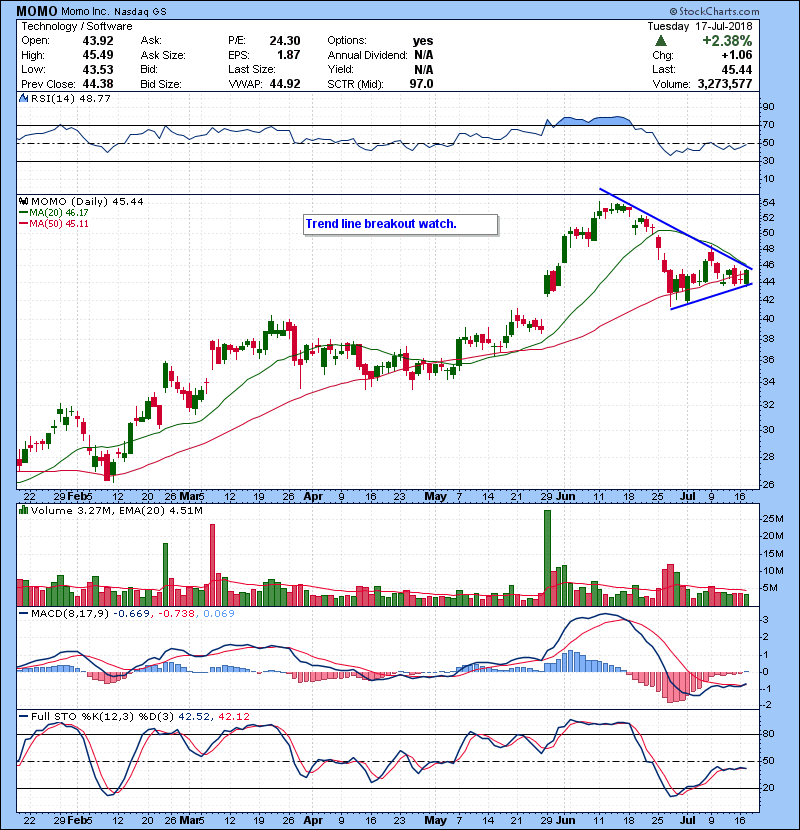

Using Trend Lines

Trend lines are a great way to see when a stock is set to start a strong trend, begin a reversal of a trend, or show you that the stock will continue on its trend.

Here is an example of how we use trendlines from our watchlist:

Here is an example on the IQ daily of how you can use trendlines to see when a big breakout is about to occur:

Nothing works 100% of the time in trading, but trendlines are a great way to help you get good entries and exits in stocks to allow you to capture strong trends.

Respect Price Action

A big component of being able to time trades is strictly focusing on price action. Fundamentals give you the conviction for a certain bias on a stock. However, they cannot give you insight about when the stock should go in a certain direction, for how long, and when it should reverse. A big mistake many traders make is that they get too biased in their opinion of what a direction a stock will go. Often they will try to go counter-trend to a stock that they believe is either up too much or down too much.

This results in them mistiming their entry, and buying or shorting way before the trend has actually reversed. In order to time trend reversals, you must focus strictly on the stock’s price action and trend. Stocks do not care about your opinion or fundamentals at any given moment.

The only thing that matters is the supply and demand of the stock. Many traders blow up because they cannot time their entries on stocks they feel are too overvalued or undervalued. No stock is up too much or down too much. “Markets can stay irrational longer than you can stay solvent.”

Breaks Over Moving Averages

When stocks go on strong trends they will often be trending with their moving averages. See the NFLX example below:

You can see how long NFLX trended with 20 MA this year during its uptrend. One of our favorite trading setups is to use moving average remounts to gain entries on trending stocks. We traded NFLX earlier this year and that is exactly what we did to get an entry in the mid 300’s after it held the 50 MA and remounted the 20 MA.

Align On Multiple Time Frames

Aligning patterns on multiple time frames is the best way to time entries and exits in our experience. The most powerful breakouts are aligned on the intraday and daily time frames.

3 Spots Left in Our Live Trading Course!

Spots are filling up in our trading boot camp FAST. Class starts January 23rd!