Aligning your trades on multiple time frames is imperative to achieving consistent profits from the stock market. Whatever type of trader you are, do not make your trading decisions looking at just one time frame on a stock’s chart. As a trader, you need to know as many pieces to the puzzle as you can. In order to assign probability to a trade on a lower time frame, (like the 1 minute, 5 minute chart) you need to be able to interpret it in the context of the higher time frames (daily, weekly charts ect.). The most explosive moves in stocks come from patterns aligning on multiple time frames. Here are some tips for how to align your trades on multiple time frames.

Never Make A Trade Decision Just on A 5 Minute Chart

This is a common mistake I see in new traders. They try to play bullish patterns on the 5 minute chart in a stock down trending on its daily chart. Or they try to play an intraday breakout that is going right into a big level of resistance on the daily chart. The stocks you are looking to day trade should have the same pattern on its intraday as its daily chart. The daily chart determines how you interpret intraday price action. Never make a day trade without consulting the daily chart first.

Identify Key Resistance and Support Levels On The Daily

Always identify key levels of demand and supply on the higher time frames of the stocks you are looking to trade. Support and resistance levels on the higher time frames will be more respected than levels on the intraday.

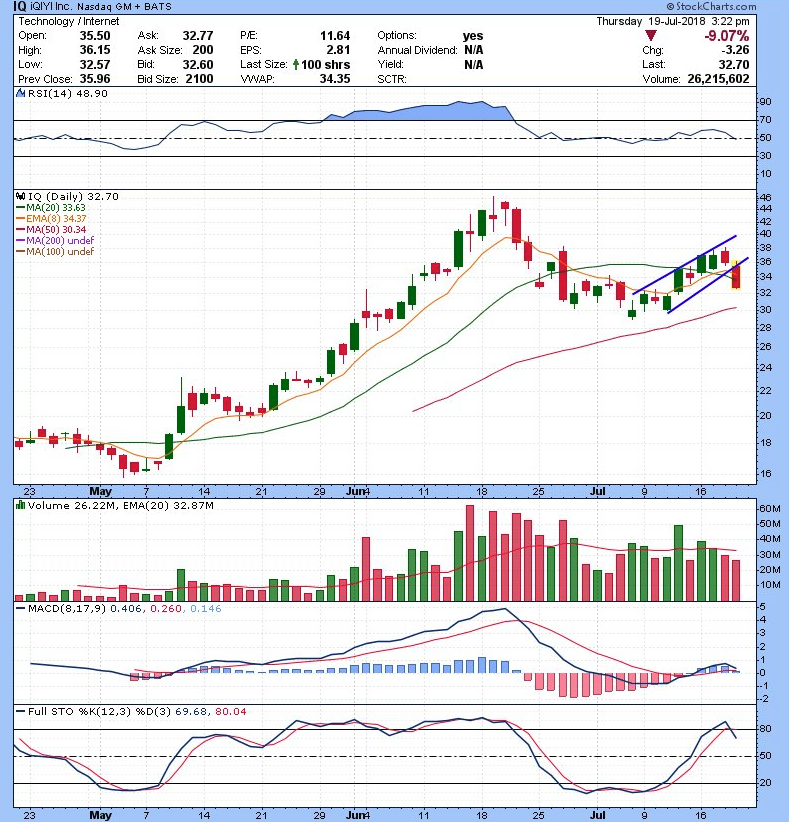

Here is a good example of a trade in IQ we took today. Check out what it looked like on the intraday chart:

You can see how it gave two bearish intraday patterns. The ORB (Opening Range Breakdown) at 35.33 in the morning, and the bear flag break in the 34.90s. Why did it follow through so well? Because it aligned with a pattern on the daily chart. You can see how it aligned with the bear flag on the daily chart:

That is the power of aligning on multiple time frames. You got a nice quick flush off of the break of the ORB to the downside. You got a great all day fader, with a big 2 point move on the break of the bear flag. Make sure to do know your homework the night before and study the daily charts of a lot of stocks to find stocks that are setting up. Aligning on multiple time frames requires extensive preparation.

Don’t Look At Too Many Time Frames

It is important to look at multiple time frames, but you cannot look at every one that is available on your charting platform. If you look at enough time frames you can basically justify any trade in either direction. Or you will achieve paralysis by analysis.

We recommend looking at three time frames maximum. One short term time frame, one intermediate, and one long term. I will usually use the 5 minute for the short term, the 10 day, 30 minute chart for the intermediate, and the daily chart for the long term, usually going back a couple years.

Sign Up For The Free 4-Day Live Course

Developing the skill to quickly align stocks on multiple time frames takes time to perfect. We will go into more depth on how to pick the best stocks to trade in our free 4-day live course starting this Sunday. If you missed our last post of the Bulls Elite Series on how to time your trades, you can check it out here.

Reserve your seat for the free 4-day live course here.

PS if you’re coming let us know on Facebook and share this event with your friends. Click here to join our Facebook event.

[rf_contest contest=’10758′]