The Holiday season has started!

If this is your first year in the stock market, read this article carefully. The holidays always have always brought a shift in market conditions, as a larger than normal number of retail traders enter the markets, and many big investors and institutions make major decisions with their investments.

This year’s bear market drove many retail traders out of the markets. But many are returning during the holidays with the hope the market will rally. This article will show you what to expect through the end of the year in the stock market!

Watch out for these trends as we enter the end of 2022 and the beginning of 2023:

Inflation and the Fed

Inflation continues to be the primary driver of the trend of the markets.

These key events will have a big impact on the trend of the market the rest of the year, especially the CPI report and the Fed meeting:

11/30 Global GDP Report

12/1 PCE Report

12/13 CPI Report (Most important, learn more about this blog here, and in the video below)

12/14 Federal Reserve Meeting

Junk Stocks Will Fly

Junk stocks always run during the holidays. When a bunch of new traders start trading, they do it during the holidays, and of course, they buy the cheapest stocks. They perceive that these companies have the most upside.

No one wants high probability, consistent, 5-10% returns. Everyone wants that 1% chance of doubling their money with a turd. While pigs can fly, they don’t stay airborne for long. You will likely see many small-cap names get pumped over this next month or so. DO NOT CHASE THE HYPE. If you trade these names, don’t marry them.

All of these stocks are small caps for a reason. There is a 99% chance all the small-cap names you will see running the next few weeks will be down 80-90 percent from their highs within a few months. These are trading vehicles, not investments.

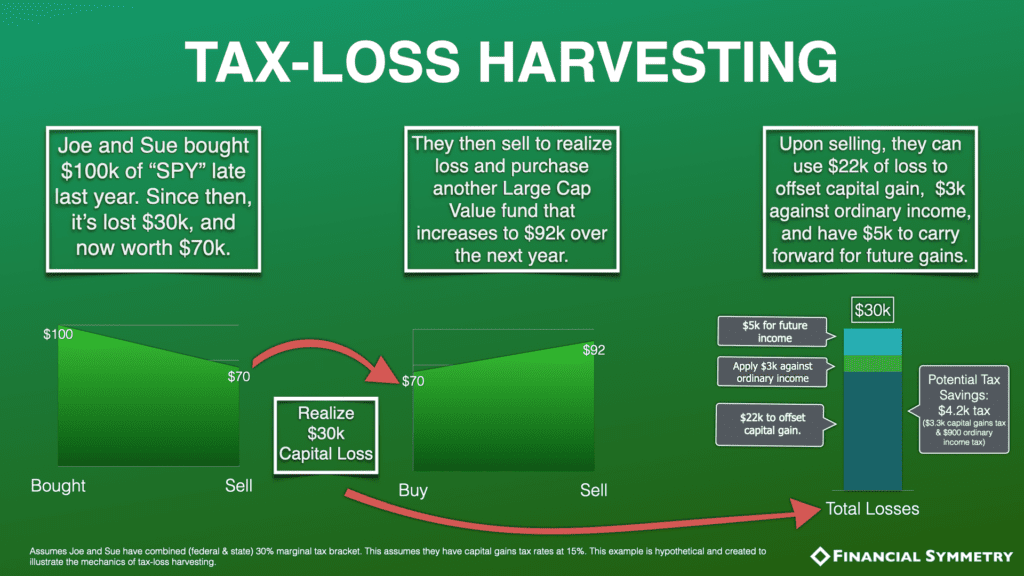

Tax Loss Selling

You will see this phenomenon as we approach the end of the trading year. Traders and investors holding losing positions will unload them close to the end of the year so they can write off the loss to offset gains to reduce tax liability.

You will see this especially in names that got hammered this year. After an ugly year like this, many investors will realize their losses in order to get the tax write-off.

“Santa-Claus Rally”

This is what follows the period of tax-loss selling. This period is when oversold names rebound from investors dumping their positions to get the tax write-off. It tends to happen during the last week or two of the trading year, hence the name.

Growing as a Trader

End of year reviews are crucial for your growth as a trader.

This is an amazing opportunity to refine your trading strategy and grow as a trader. The real money in the markets is made by the work you do when the is market closed. Make sure to do the following:

- Journaling: Review your recent trades

- Learn new strategies

- Study charts

- Run scans: Build and refine your watch list

- Read trading books

If you want to join the Bulls on Wall Street community, there is no better time than right now. Check out our Black Friday discounts below where you can save up 60% on all our trading education:

Click here to Get the Discounts!