We saw recently just how influential the FOMC is on the markets. If you’re brand new to trading and the stock market, you are probably baffled by it.

Today we will address the most common questions we get surrounding the FOMC:

What is the FOMC?

What happens during FOMC meetings and ‘FED weeks’?

Today, we are going to dive deep into trading around the FOMC. We will cover what it is in detail, and how you can ultimately remain safe and profitable during the FOMC.

Let’s get into it!

What is the FOMC?

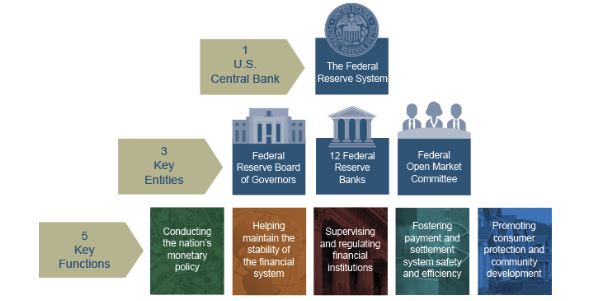

The word FOMC is short for Federal Open Market Committee. It essentially is the branch of the Federal Reserve System that determines monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

The FOMC has 8 scheduled meetings each year, but in recent times they have actually chosen to meet more often due to the volatility of markets in the recent months.

In a nutshell, the FOMC is a very important group that determines the direction of certain key economical factors, one big one being interest rates that affect not only the stock market but housing, commercial growth, and retail growth. Whenever the FOMC meets and the chair speaks, people listen and react.

The FOMC is a key part of the entire Federal Reserve System that controls so much of the country’s economy and its future.

What happens during the FOMC Meetings?

Leading up to FOMC meetings many analysts attempt to predict whether the Federal Reserve will tighten or loosen the money supply which ultimately will result in an increase or decrease in interest rates. In recent years, FOMC meeting minutes (essentially summaries of what went on) have been made public following the meetings. When it is reported in the news that the Fed has changed interest rates, it is the result of the FOMC’s regular meetings.

During FOMC meetings members discuss developments in the local and global financial markets and key economic forecasts. All members speak and share their opinion on the country’s economic stance and direction, and try to pitch their beliefs on what would be most beneficial for the country. After long debates by all participants, only designated FOMC members get to vote on a policy that they consider appropriate for the period, and that would end up affecting the economy and be announced. It has a big influence on the stock market, currency markets, cryptocurrencies, and other financial markets.

Trading During FOMC Meetings and FED Weeks

The week of an FOMC meeting (which usually occurs mid-week) is referred to by many traders as a FED week.

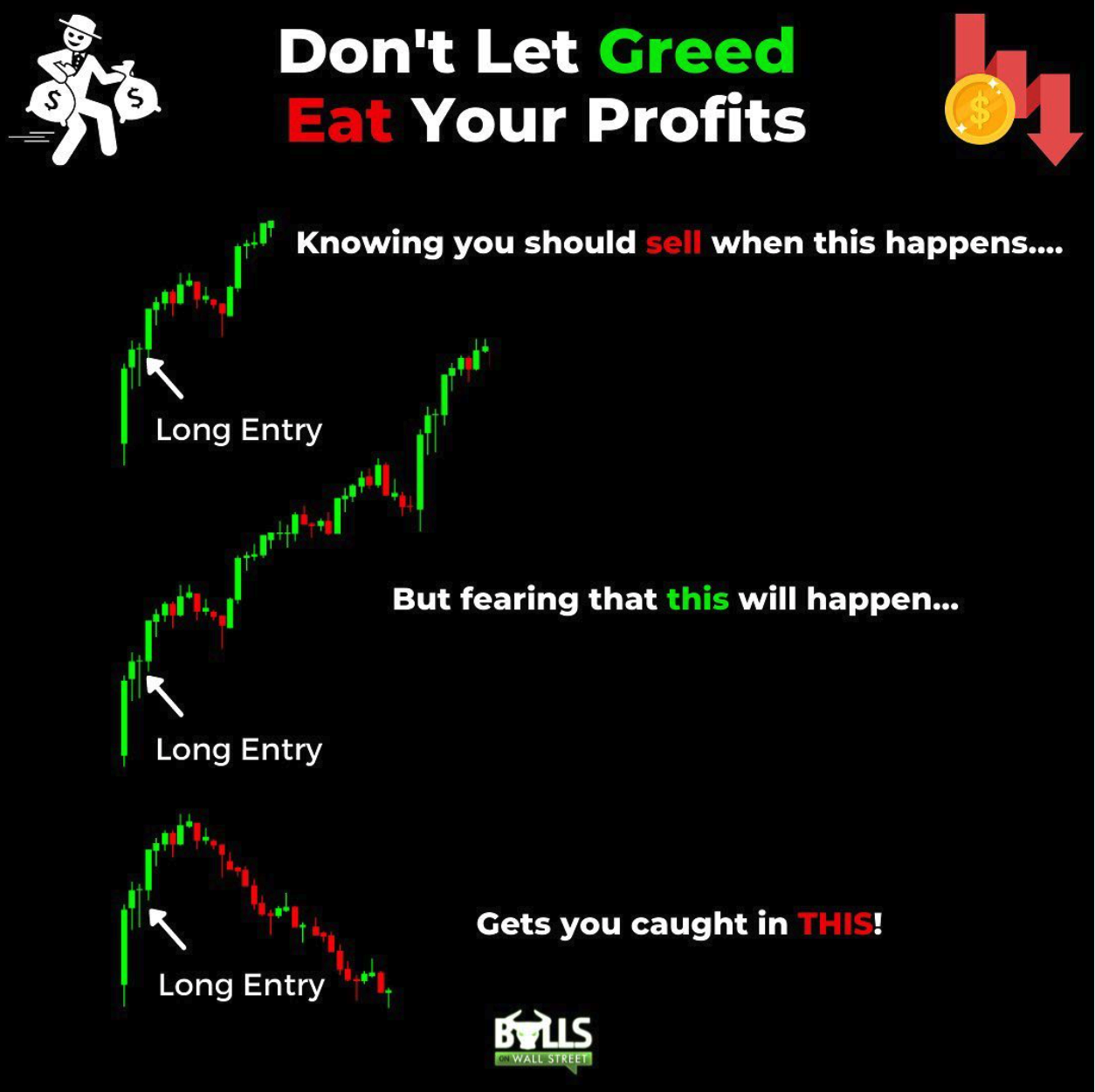

The activity in the markets tends to be very choppy and does not have much direction as banks, traders, and investors sit on the sidelines awaiting the results from the FOMC meeting. While there is some speculation in the markets and bets placed by analysts and traders over what may happen, many market participants choose to wait until the announcement is made on what the FED will do to the money supply and react to that. Do NOT get greedy and expect big moves if you are day trading. If you are going to day trade the markets after the meeting, don’t overstay on your trades:

Whenever the results are made public (usually around 2/2:30PM EST on Wednesday of the FED Week), the market will have a big impulse move up or down that traders take advantage of. You will be able to read full reports like this one after the results are made public.

The announcements made by the FOMC are extremely impactful and carry a ton of weight within the market and its participants, so you never want to gamble ahead of big news announcements like this. Wait for the news announcement to be made public, and react to the directional move that happens as a result.

For example, this week the FED hikes rates 50 basis points which is a very substantial raise, which ultimately caused a big selloff on $SPY and $QQQ. After the announcement was made, your bias should be short and you should be looking to take advantage of trending short opportunities, not gambling before the announcement is made.

Overall, during FED weeks it is smart to take it easy the days leading up to the announcement day, avoid the choppy action, and wait to trade until after the announcement is made in the direction of the larger trend.

Get Early-Bird Pricing Our Next Live Stock Trading Bootcamp!

Our next Live Trading Bootcamp is around the corner! Learn from experienced stock traders who have been trading for over 2 decades. Early-bird pricing ends soon!