CPI has been the talk of the town this year.

If you don’t know by now, CPI (Consumer Price Index) is one of the most important macroeconomic indicators that is known and released on a frequent basis.

You may have come to this article after searching the internet for no clear answer on what it is, how to interpret it, and how to use it as a trader.

Let’s answer all of this for you. We use CPI in many different ways and as a trader. Traders who trade large caps, mid caps AND swing traders, have to be aware of the CPI data and what it means. It can affect the market quite a bit in either an upside or downside direction just like we have seen this week.

It is a super important topic, so let’s dive into the Consumer Price Index and Inflation numbers, and what to expect in the coming months.

What is CPI?

CPI is short for Consumer Price Index. These numbers come out once a month. It is a measure of core and current inflation in the market.

This video lesson with veteran trader Kunal Desai dives into more depth about CPI and why it is so important for traders to understand:

The Current Market Conditions & Inflation

It is clear if you turn your TV on, go to the store, or even scroll through social media that everyone knows inflation is causing huge price swings in the market. When inflation gets high, the Federal Reserve (FED) chooses to raise interest rates, which since this early summer, the FED has been doing quite aggressively, causing the market to drop.

Now, how does rising inflation affect the market? Well, when inflation and interest rates are low (like during the pandemic), the stock market is really one of the only other places to put your capital in for consistent growth. Savings accounts, CD, Bonds, interest-based accounts, and other funds taking advantage of interest rates being high are no longer viable investment opportunities, so everyone starts flocking into the stock market.

Now, this has all changed. Rates like we said are going up, inflation is rising, and people are starting to take money out of the stock market because they feel with interest rates high across the board, they can get a better return elsewhere.

Inflation numbers continuing to rise as well are causing people to expect more raises in rates even before new CPI numbers come out, scaring more people out of the market.

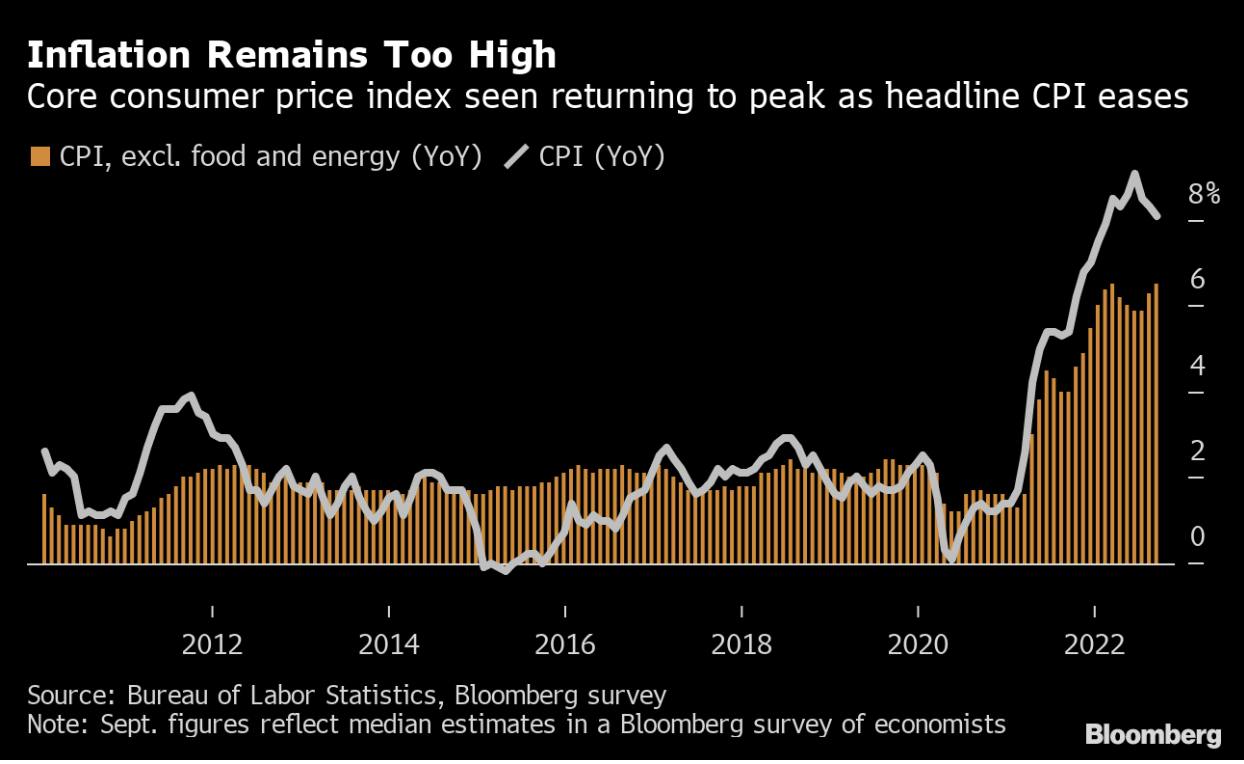

In September, we saw a big drop in the market after the FED surprisingly continued to raise interest rates. September 13th was one of the biggest down days of the year after this news shocked the market. You can see how aggressive these moves can be when these inflation numbers rise.

Right now, CPI data has just recently been released as well on October 13th, and the inflation data is again higher than expected across multiple industries, scaring market participants and the general public out of their positions, and causing them to further seek other alternatives than the stock market to invest in.

October 13th Core CPI Updated Chart:

The ‘Bubble Effect’

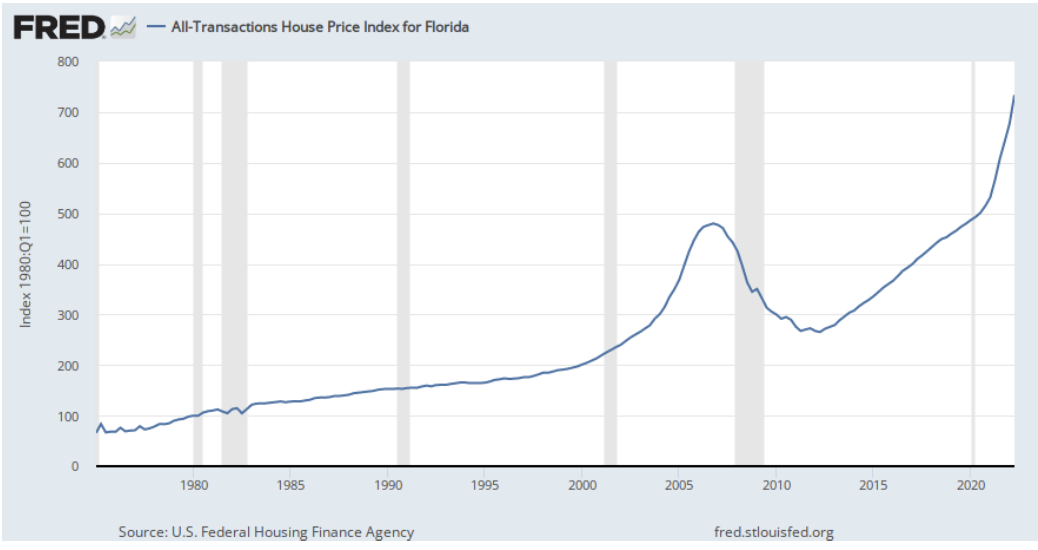

Beyond just rising rates and inflation scaring people out of the market, because of the years of low rates, high growth, and low inflation, many bubbles have been created in things like real estate and tech stocks that saw extremely high growth in the past few years, growth that was abnormally high. Now we are starting to see the unwinding in all of these asset classes.

Right into 2022, you can see just how aggressive the moves in the real estate markets have been in the past few years. Like we know in stock trading, everything reverts back to a mean at some point, and that is what people are watching.

Trading Around CPI Data

What you need to look out for is the surprise of the numbers. If the expectations across the board (like in the September example above) are that rates will drop and inflation is going down, and the data tells the complete opposite by an extreme amount, expect some harsh selling (and vice versa to the upside). The bigger the difference between expectation and reality, the bigger the shock to the market will be and the harsher the moves.

We also never swing or hold open positions into CPI data days, so keep that in mind. There is way too much risk to hold into key macroeconomic data like CPI.

Get Early-Bird Pricing For Our Next Live Trading Boot Camp