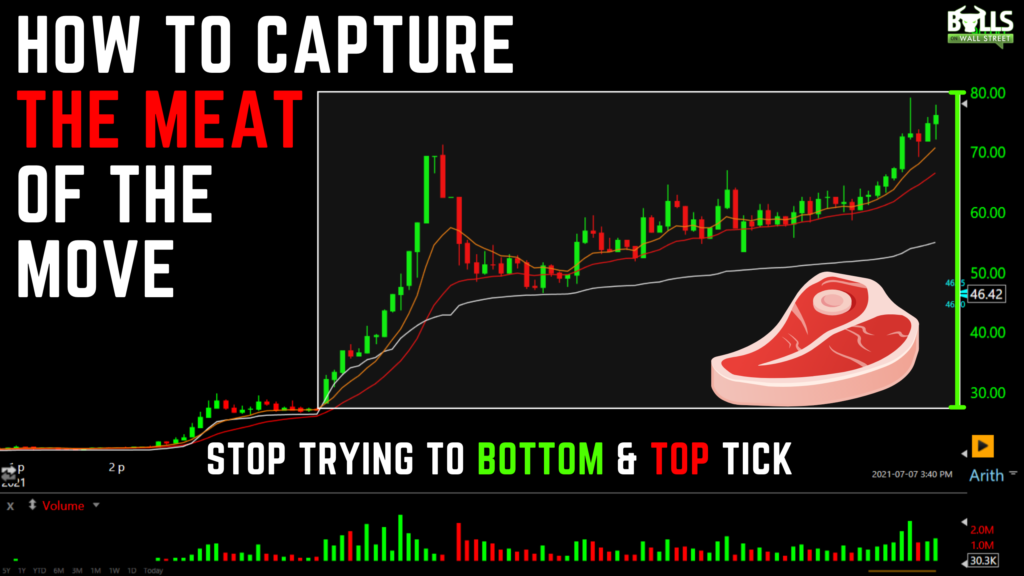

Trying to time the exact bottom or exact top is one of the BIGGEST mistakes new traders make. We see traders every day on Twitter sharing their bottom tick or top tick prints.

But what you do not see is the 5 losses they took on the way down trying to guess the bottom, and how they still ended up red on the trade.

Learning to capture the meat of a trending stock on an intraday or daily timeframe is a crucial skill for all trading styles, not just counter-trend trading.

Every time you trade a stock, you need to have realistic expectations of how far a stock should run in either direction on a given setup. Here are some tips on how you can participate in big market moves without trying to pick a top or bottom:

Scaling

Scaling is my favorite technique for capturing the meat of a stock’s move. Scaling is a strategy where you sell or cover your position in portions, instead of all at once. This allows you to realize profits while keeping yourself in a position to capture a bigger move in the market. Here’s how scaling works:

You can also use scaling for entering stocks, as you can take partial positions, and then add more shares once you get confirmation of the stock trending in your favor.

Do not let scaling into a position turn into averaging down on a loser. Make sure to always have an entry and exit plan when you are scaling your positions, so you know exactly when you will add more to an existing position or reduce your position size.

Know The Stock’s Range

Always know a stock’s average true range, especially when day trading it. The average true range is how much a stock typically trades up or down on a daily basis. Let’s look at $SPCE for example:

$SPCE’s average true range in the past 14 days was $4.92, roughly 10%. Catching a 3-5% move in this on the right day is very doable in the current market environment. If $SPCE has already made an 15% move that day, is there a good probability of it continuing? No. If it has only moved 3% on the day, does it have the potential to continue if there’s a good setup? Yes.

A stock’s range helps you create your expectations around your entries and exits. You always need to know this about any market you trade in order to put on high probability trades.

Now, do some stocks have days they trade outside of the ATR? Of course. This is why I mentioned the scaling point earlier. You take partial profits after a stock has made it’s “expected” move, and keep partial for the home run. You should NOT be putting on large positions after a stock has used up most of it’s ATR.

Expectations

NEVER get into a trade with the expectation that you caught the bottom or the top of the move. Even if many indicators and setups align in your favor, there is always a chance you could be wrong. The market can, and will, do anything. Overbought can get more overbought. Oversold can get more oversold. “Markets can stay irrational longer than you can stay solvent.”

Always manage your risk and make a plan for every scenario. Prepare for the worst, expect the best.

Knowing Key Support and Resistance Levels

Knowing key levels of supply and demand of a stock tells you where the stock will likely end up, and where it could reverse. Here are the different types of support and resistance levels you should pay attention to:

Mark out these key levels before taking a position. This will tell you when you should start taking profits, and how far the stock might rally or dump on your trade.

Let The Bottom/Top Pick Itself

When you get into counter-trend trading, you cannot fall into the trap that something seems “too oversold” and must bounce, or “too overbought” and must pull back. So many markets moves have exceeded everyone’s expectations to the long and short side. Picking tops and bottoms is a fool’s game.

Instead, let the stock end the trend it’s on, and then join once it is obvious the trend has changed. You can still get a nice gain on a stock bouncing or pulling back without catching the exact top or bottom. Jessie Livermore said it best: “ Give up trying to catch the last eighth – or the first. These two are the most expensive eighths in the world.”