Buy Virgin Galactic at the open today expecting it would go to the moon? The stock had great news, why did it tank today?

The stock market isn’t that simple. Get familiar with this phrase: “Buy the rumor, sell the news”.

This is one of the most counterintuitive aspects for new and inexperienced traders. Today’s blog will clear up your confusion:

What is “Sell the News”?

One of the most important lessons you need to learn as a trader or investor in the stock market, no matter what time frame you trade on: Price action is always king.

I’ve seen stocks rally on some of the most horrendous news you can think of. I’ve seen stocks tank after reporting blow-up earnings reports. “Sell the news” events are when the stock rallies leading up into a positive company event, like an earnings release for example, and then sells off as soon as the event occurs.

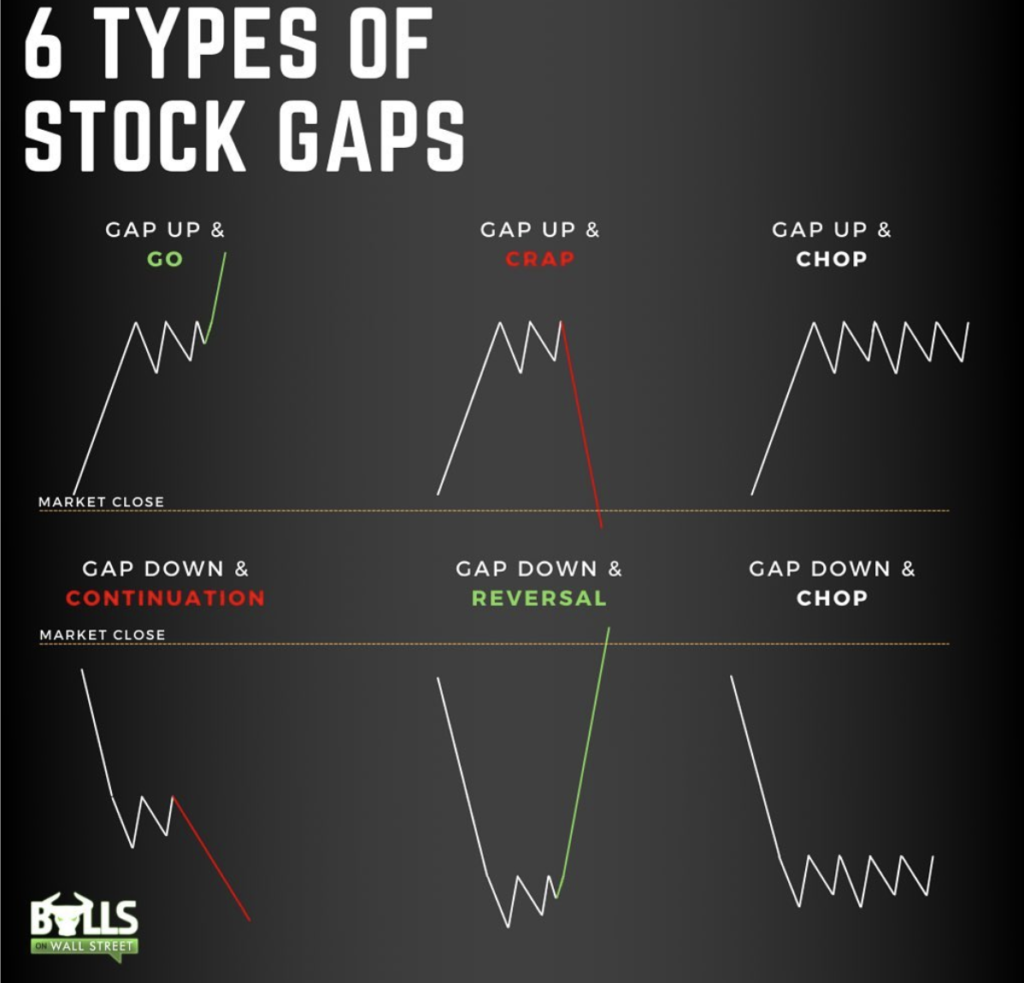

The stock will often gap up during pre-market once the press release hits, and then reverse as soon as the market opens as sellers enter the market. This is called a “gap and crap”. Here are all 6 types of stock gaps you will see at the market open:

So what causes stocks to abruptly reverse at these key moments when the outlook of the company has never looked better?

What Moves Markets

Markets are moved by supply and demand. News can cause shifts in supply and demand, but the news itself is not what moves markets.

Often the good news will already be priced into the stock BEFORE the event happens. By the time the event happens, the stock has become a crowded trade. The edge becomes to do the opposite of the crowd.

$SPCE Example

Richard Branson flew into Space yesterday in the world’s first space tourism flight. An insane accomplishment, and seemingly positive news for his company Virgin Galactic.

But look what the stock did as soon as the market opened today:

It dumped almost 20% in less than half an hour. Plus the company filed today an offering to sell up to $500 million in stock. Even the insiders understand how “sell the news” works!

Another good example from last year is Pfizer:

The day after it announced the success of it’s vaccine trials it gapped up 20%. And look what happened after. It tanked almost 20% over the next few days.

How to Trade “Sell the News” Events

News catalysts are great for bringing momentum and liquidity into a name. But they do not by themselves give you a trading edge. If it was that easy, no one would need to work a regular job. You’d just buy on good news every time, and short on bad news.

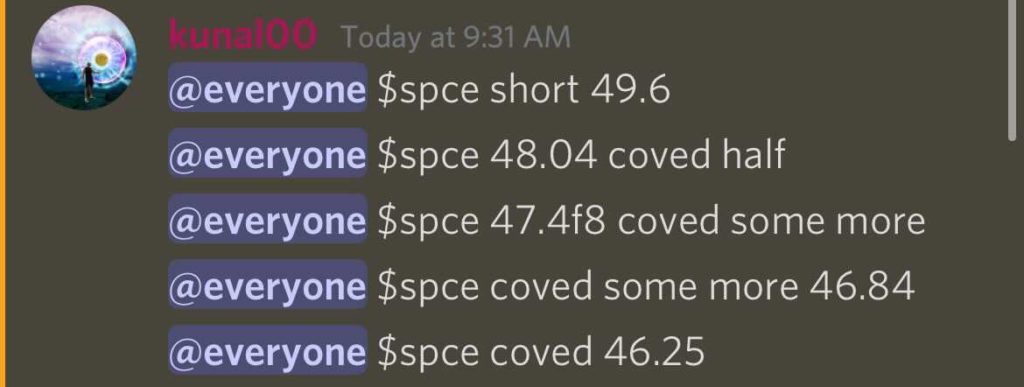

With these kinds of widely anticipated company events, you need to think about which side the crowd is on. Many of these are “crowded trades”, trades where everyone is taking the same position with the same thesis. The edgie is going short, which I did this morning:

Lately, these gaps start fading pre-market, so you need to hit them on a spike right at the open to catch the move! The key is to align the context, a “sell the news” play, with an intraday setup to give you a low-risk entry to take down these stocks.

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!