This week was the best trading week of the year hands down! With multiple news catalysts affecting the market (Fed meeting and tariffs), and being the peak of earnings season, there have been a plethora of trading opportunities every single day. So much for slow summer trading! You may want to pullup the intraday charts of some of these names to get a better feel for the setups I took, and to see where I entered and exited, and why.

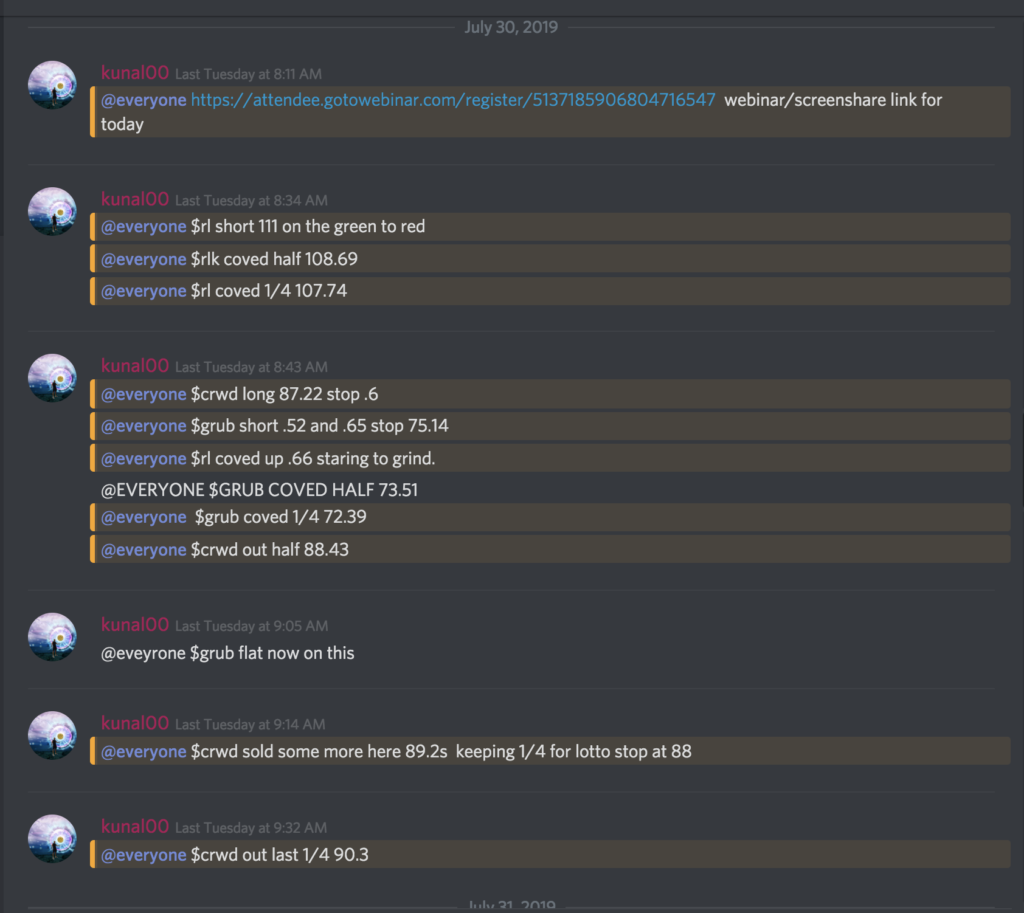

$RL, GRUB and $CRWD Trades 7/30

$GRUB

GrubHub was gapping down on worse than expected earnings on Monday. It’s daily and worse than expected earnings gave me a short bias at the open. It also gave a push right at the open back into it’s moving averages. My thesis is that it would act as resistance, and it would fade back to LOD and below.

I started in short at $at 74.62 and $74.52, and scaled out into weakness after it broke under LOD! (If you’re confused about the timestamps I live in Destin, Florida which is 1 hour behind EST, the $RL trade was taken right at the market open!)

$RL

Ralph Lauren was actually gapping up in response to their earnings report. Because it’s a retail stock, I was actually short biased on the gap and was expecting it to fade off. It was already fading off pre-market, so my plan was to short it for the green to red move and cover my position into the flushes.

$CRWD

This was a non-earnings play, but still gave a stick rip. The day before it had seen a monster 10 point dump. So my thought process was that it would bounce, so I hit it on the R/G (Red to green) move and scaled out into strength. I didn’t expect it bounce all the way back through $90 I left a bit on the table!

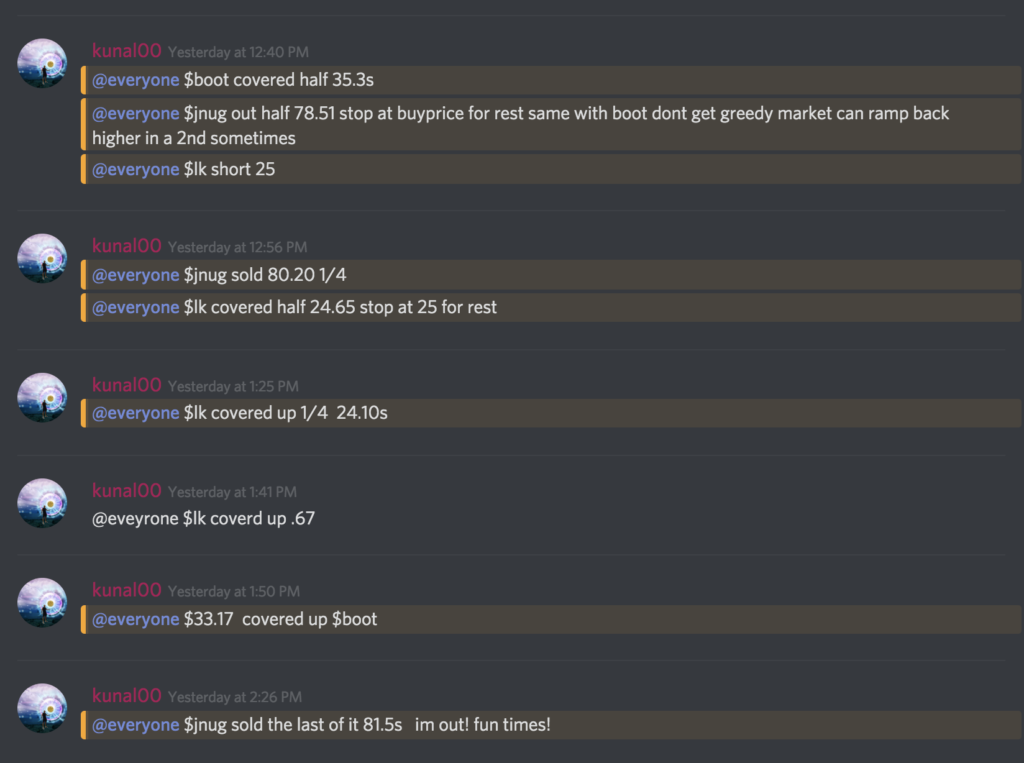

$LK and $JNUG Plays 8/1

All these trades were taken in the afternoon right after the tariff news dropped causing the overall market (SPY, Dow Jones) to crater.

$LK

This was on my radar after it had that huge dump in response to the weakness in the overall market. Once it had the big 1.5 point to $24 I got short into the bounce at $25, anticipating the green to red move. I covered partials into weakness, as it flushed red with the overall market.

$JNUG

$JNUG started to see major range and volatility once the overall market started to dump. I got long, joining the uptrend it had begun ever since weakness came into the overall market. I scaled out into strength, treating at as a short term trend, not expecting to hold trend for long.

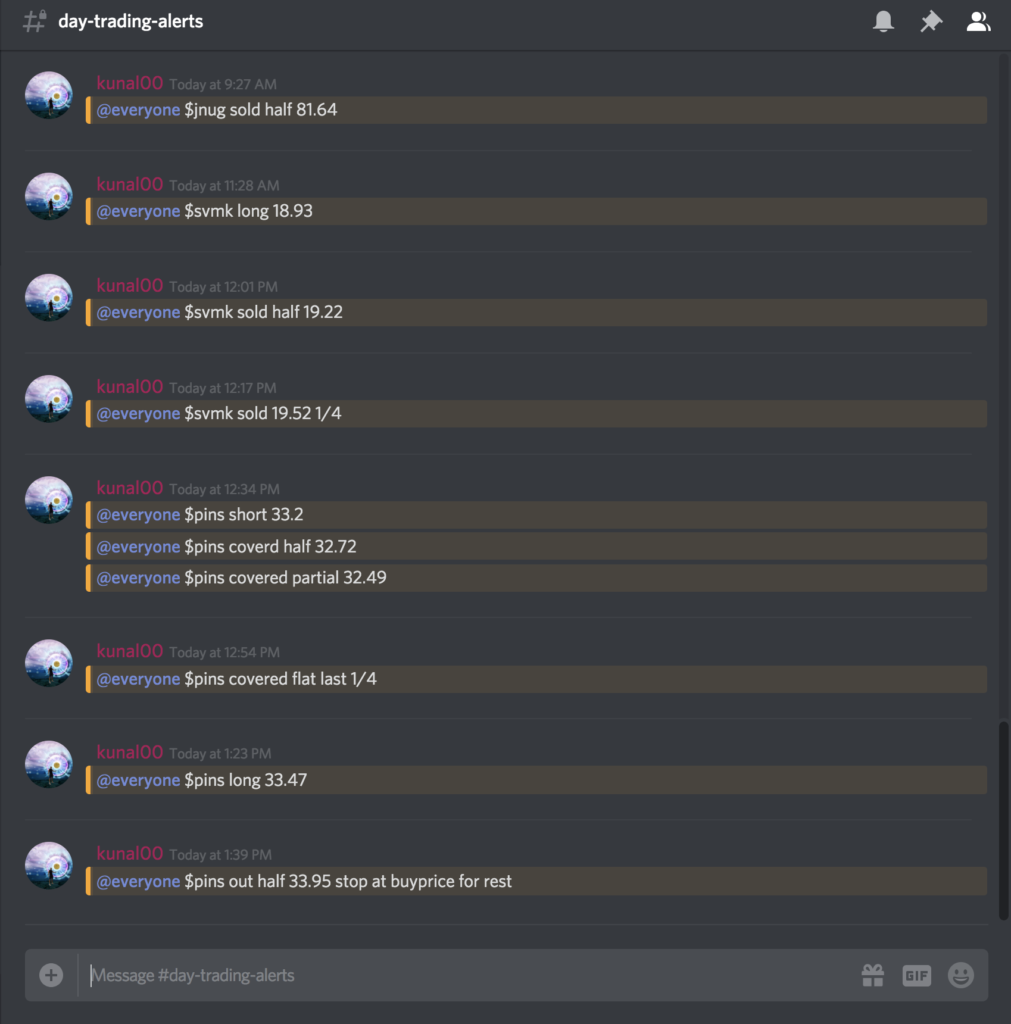

$SYMK $PINS (Long and Short!) 8/2

$SVMK

This was a nice earnings winner, gapping up right near to all-time highs today. I got long at the open for the opening range breakout under $19. It had no resistance until $20, and it was one of my top watches at the open for strong trender today.

$PINS

Another name gapping up in response to a strong earnings report. This one was a tricky one because of the weakness in the overall market. I was long near the open, but cut it near breakeven because I thought it wouldn’t hold up. It ended up holding up and going up on a strong run all the way to $35.

It looked like it finally topped out (I missed the turn cause I was eating lunch I chased a bit) and I took some short. It ended up grinding and basing, so I flipped long and ended up stopping out the other half my shares breakeven.

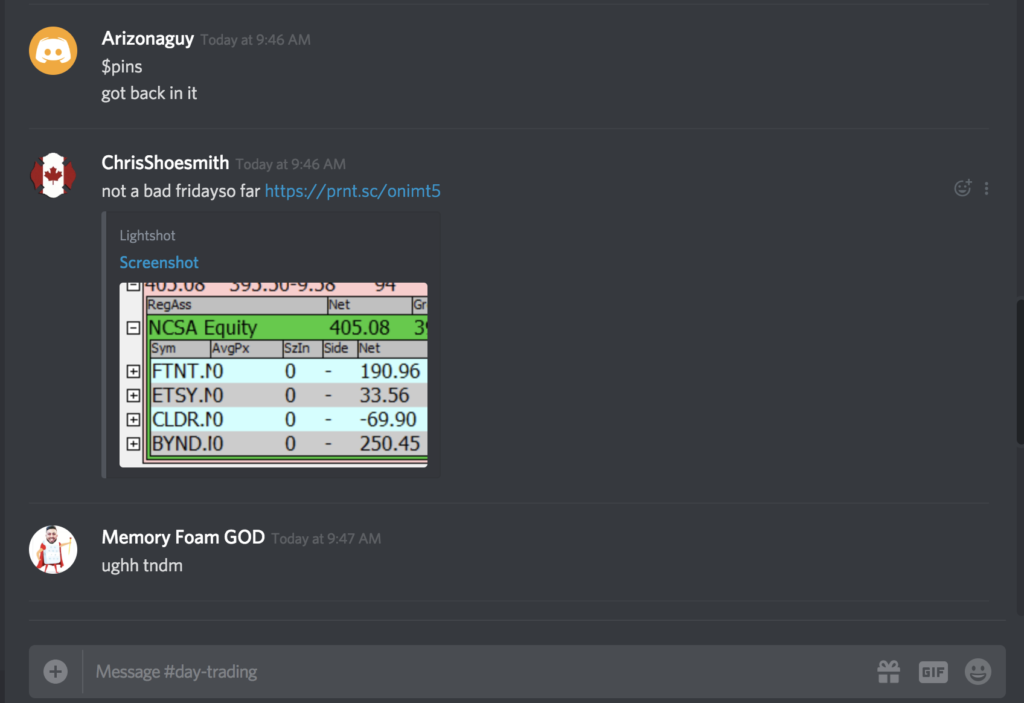

Some of Our Students Trades

$TVIX

If you have any questions about any of the trades do not hesitate to shoot me a message!

Free Chat Day 8/8: Watch Me Day Trade Live

This Thursday, August 8th, we are doing a free chat day with our day trading chatroom. During the free chat day, you get to watch me day trade live on screen share. Watch all the day trading setups, see all the trades I take in real-time, and see all the scans, charting layouts, and other gimmicks of my trading style!