After some range bound action in the SPY, on June 27th, the SPY finally chose a direction and sold off hard, but not before stopping right near a support level at $241.50. With this in mind, our trading watchlist had a few names that looked ripe for a bounce. Particularly, we were looking for big name stocks that sold off right into a defined resistance level. On June 28th, we had a great day buying up NVDA and TSLA for a reversal trades.

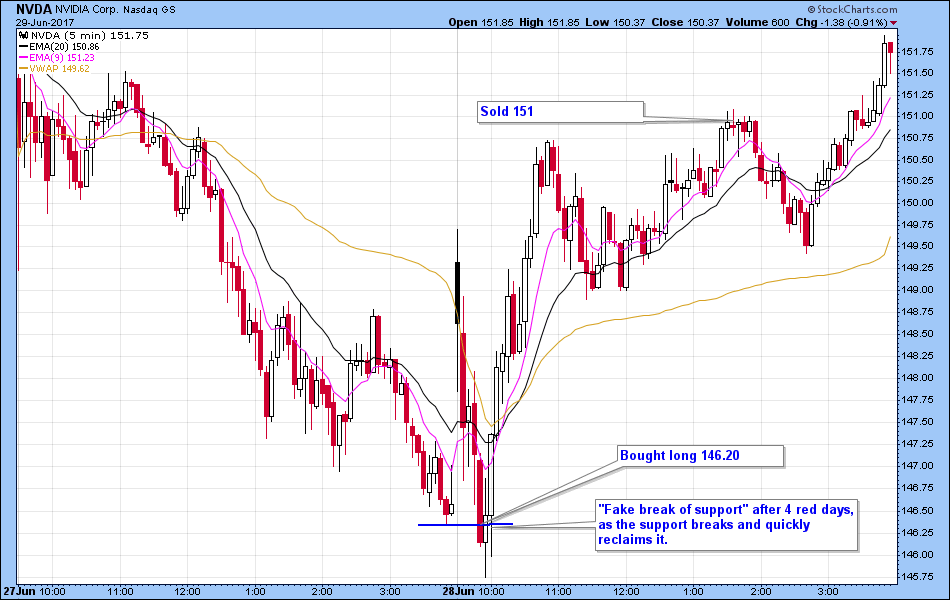

NVDA

NVDA is an incredibly strong stock that had a great run after releasing strong earnings back in early May. After hitting resistance at $160, it sold off for four days in a row but stopped right above its previous $146 support level. Now this looked like it could either flush down lower or bounce hard here. Watching intraday, we saw a fake break of the support level. Once the stock reversed from a red to green move, we bought long at $146.20 with a stop underneath. We rode it back up and sold it off at $151 .

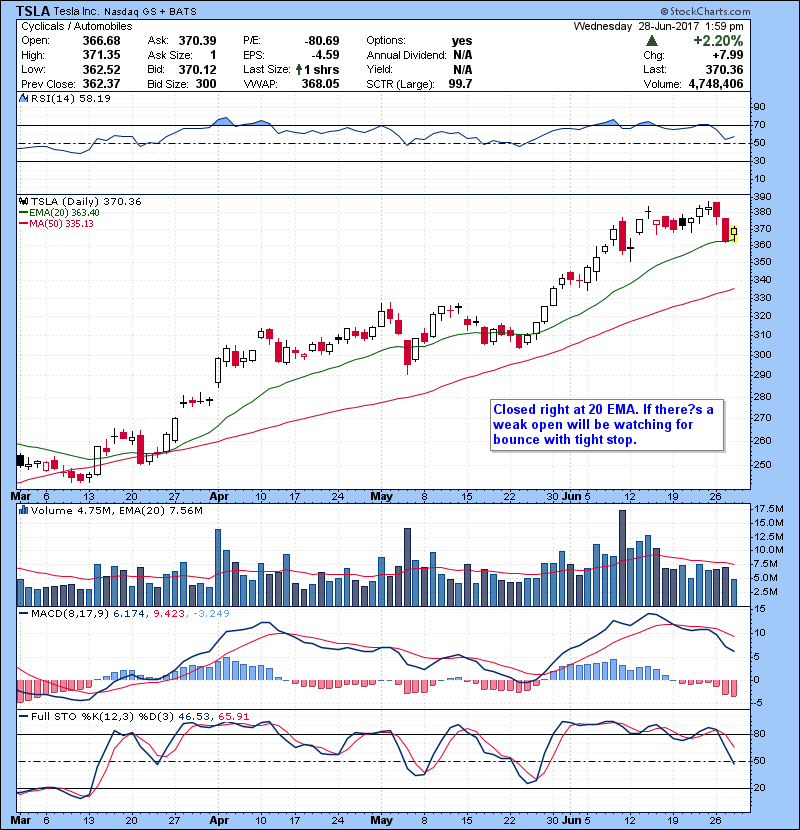

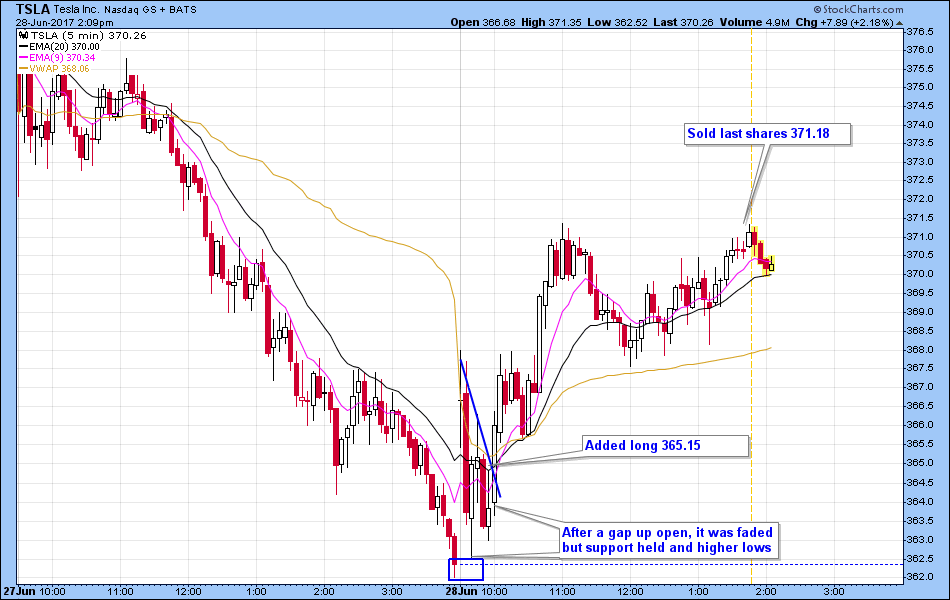

TSLA

Another great bounce play that was on our list was in TSLA. TSLA closed right at its 20EMA level after a hard flush in the last 2 days. With the moving average holding it up, we watched the stock in the morning looking for a red to green move or a bounce right at support. TSLA gapped up at the open and faded right to the previous day’s support level at $362.50. Once the pullback was sustained, we entered at $365.15 with a stop beneath the lows. We sold off our shares as we rode it up all the way to $371.18

If you’re not sure of the setups and price patterns that we’re talking about you can learn them all here at our Bulls Bootcamp. It’s an intensive 60 day course to teach you exactly how I trade and why. To learn more or signup, email me at kunal@bullsonwallstreet.com today!