One of our member asked when a trade is just a day trade and when its a swing trade.

Swing trading is based on daily chart setup. We usually anticipate swing trade based on chart and price patterns via flag, ascending triangle, consolidation, flat top base etc. Swing long trades can be anticipated when up trending stocks consolidates, pull back to support and/or moving averages on the assumption that price will continue in the direction of trends.

On the chart above ,FLTX had a flat top break out in July as the stock ran from July low 32 to August high 46.Stock consolidates after the big run as 20 SMA catches up with price. On August 20th price tested 20 MA and for the second time as it was being defended. One can initiate a swing trade at $40 anticipating that 20 SMA will hold and the stock will continue in the direction of the trends. If not the trade will be stopped out with minimal lose.

As you can see in next chart August 20th $40 swing traders were rewarded as the stock hits a high of $50 on August 30.

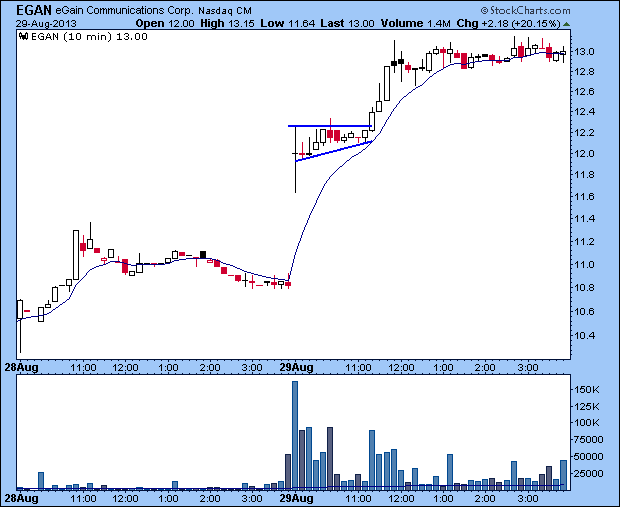

Then there are day trades. Every day, there will be a handful of stocks that will run due to earning or news. It is hard to anticipate those based on daily chart patterns because the run is due to surprise earning or other events. Those are the ones falls that into our “day trade only” not swing category. These setups are our bread and butter for consistence gains day in and out regardless what broader Market does. For this type ,the first run up usually happens at open and it is often difficult to catch the first move. We are more interested in the second move for our day trades. The stock has shown its strength for the day and there will be some profit taking after initial run up as long time holders take some gains. After the initial pull back, day traders enter into the picture for a secondary run.

After initial run most of the cases it will via gap up, the stock is usually up big in percentage point, so we just want to ride the trend for little bit more by trading the stock.

Usually I will sell all my position before end of day. My logic is stock already ran 10, 20 or 30% for the day and most of it came from morning gap up. I find the risk is much higher to hold the stock over night into next day. It doesn’t mean that the stock would not run the next day but chances are , we might be able to find better price entry to re initiate another position next few day after the initial run.

EGAN, we traded this in our chat room yesterday. Stock gapped up on earning news from 10.80 -12.20 and consolidated after initial run. That’s our day trading zone. We bought the stock 12.20 after consolidation for the second move up and sold our shares over 13.

If you want to learn strategies like this, try our Bulls trading Bootcamp Its a 3 month webinar class that takes you from A to Z of our trading strategy. https://bullsonwallstreet.com/trading-bootcamp

Please email for more info. thenyctrader@gmail.com