Do you struggle with feeling overwhelmed by the amount of charts you have to watch each day? Are you struggling with knowing which stocks should be your focus and which stocks are just distractions? (Hat tip to our member Ben Rodts for posting this question in our Google forum)

Alot of new traders experience this problem, so you are not alone. In fact, the reason most traders lose money is because they over-trade and analyze too much data. In my experience, I have found that the keys to overcoming this are mastering a handful of setups, developing a routine and obtaining multiple sources for idea generation. Below I have outlined my personal routine for you. Develop something along these lines and you will become more consistent, make more money, and will enjoy this awesome job much more.

Master a handful of setups

Learn to master one trading setup at a time and this will dramatically increase your success rate. Once you have mastered one setup, move on to the next one. Do this until you have an arsenal of trading setups that you recognize easily. Train your brain so that you will know instantly whether your setup is present and if you should be in the trade. Keep a journal of every time you trade that setup and what the outcome was. This allows you to learn all of the ins and outs of the setup and will therefore increase your profitability in the trade. At Bulls, we refer to our master list of setups as our “Go-To Setups”. These are taught in depth in our Bootcamp course.

Develop a routine

I have both a Sunday night routine and a weekly routine that I have done over and over again for almost four years. This is something that every trader must develop for themselves. The habitual nature of the routine is what allows for consistency and gets rid of the overwhelming feeling that most new traders experience. Developing a method with great risk to reward and doing that over and over again is how you make consistent profits each month.

- Since I am primarily a momentum day trader, my main focus when I am making my watch lists are momentum stocks. On Sunday night, I pick out all of the stocks from the previous week that had momentum and put them in a big watch list. Those are the stocks that I am going to watch closely that week for prime setups. Every trader must have a handful of setups that they master and it becomes second nature for them to trade these setups.

- Each night during the week, I go back through the Sunday night watch list and see which individual stocks are setting up for that day (whether it be a pullback to a support area, bumping up against a major breakout area, great relative strength compared to the market, flagging, extended etc). This usually gives me a list of anywhere from 8-10 stocks to focus on for the next day.

- Each morning during the week, I wake up an hour before market opens and look to see which stocks are gapping based on earnings reports or news (one of our “go to” setups at Bulls, which is taught in detail in our 60 Day Bootcamp course, involves earnings gappers). I then add these relevant gappers to my list that I made the night before and I now have a specific watch list of around 10-15 stocks that I can focus my attention on for that day.

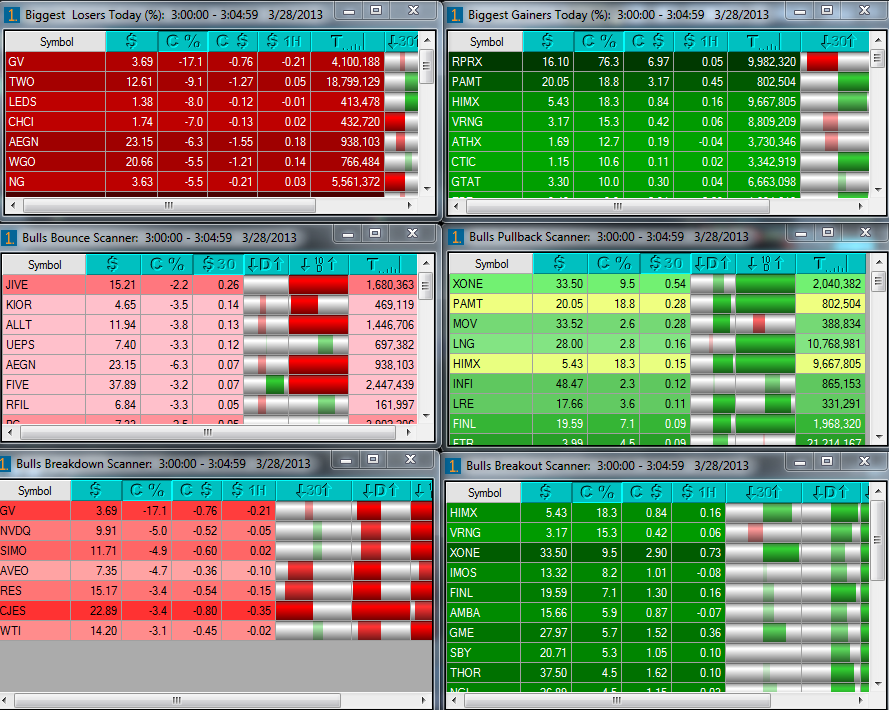

- During the trading day, I run a scan every hour for stocks that have great relative volume and have made a big momentum move on the day. Identifying these stocks allows me to watch for intraday scalp setups. I scan using a tool called trade ideas. (see below)

Idea Generation

The first thing that I highly recommend to all traders is setting alerts on stocks the night before. I personally use the Think or Swim desktop platform for my alert service. I set the alerts a few percentage points away from my desired entry. This allows time for me to pull up the chart and take a look at the stock before entering the trade. Setting alerts will allow you to not miss the stocks with obvious levels that you found the night before. I typically have anywhere from 20-30 alerts set at a time. This constantly gives me idea generation throughout the trading day. It also alleviates the stress of worrying that you will miss your favorite stock!

Secondly, finding a great source for intraday scanning is very helpful for keeping you up to speed with the movers and shakers for the day. At Bulls, we developed our own personal intraday scanner using Trade Ideas software. Here is a look at our scanner. There are multiple way to scan intraday. Learn one and stick it in your mid- day routine.

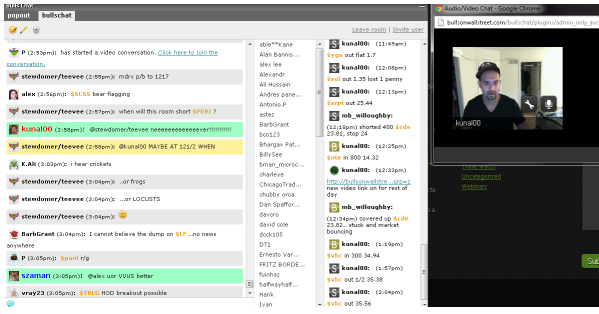

Finally, join a chat room that is full of serious traders. Don’t try to copy their every move, but instead use their expertise and the routine that you have developed to help guide you into trades. Having a seasoned mentor and being surrounded by a group of traders with the same goals is you, will help speed up your learning curve tremendously.

_____________________________________________________________________________________________________________________

If you want to learn strategies like this check out our Bulls Bootcamp. This class takes you from A to Z on our trading strategy over 3 months of class. This class is an intense class 4 days a week; it’s designed to turn you into the trader you want to become! Email me – mb.willoughby@gmail.com