Another week that defies the “slow summer trading” stereotype. Many great earnings plays, explosive biotech catalyst, and even small-cap runners! Here is a recap of some of the day trades I took this week. The good, the bad, and the ugly!

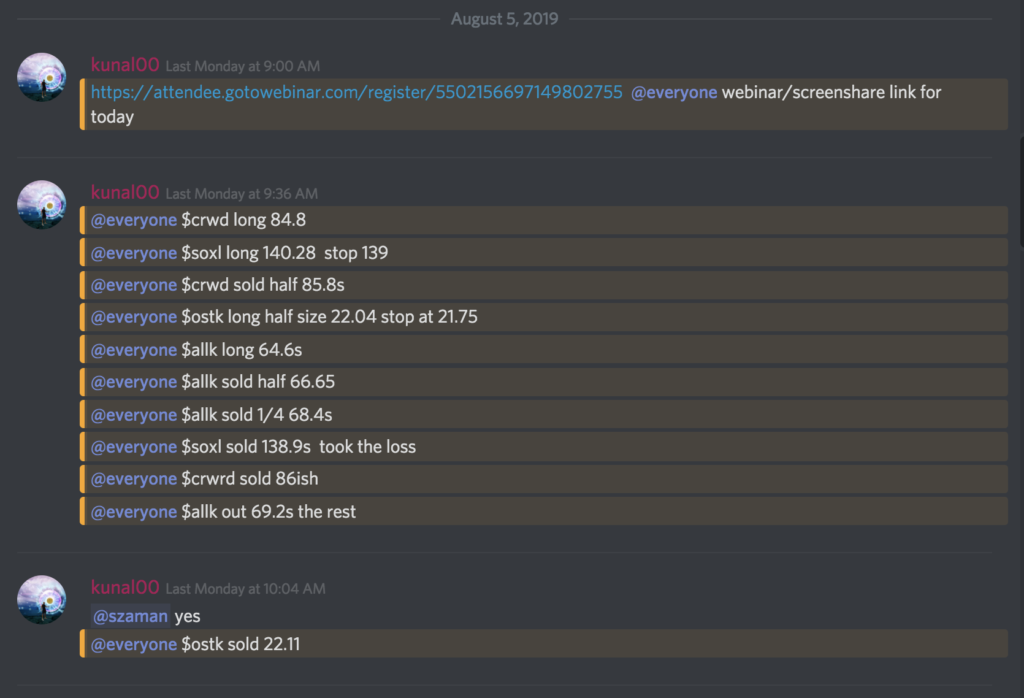

$CRWD, $ALLK, $SOXL Papercut, $OSTK Scratch

$CRWD

On Monday, the overall market had just had a big pullback, and I knew it was not the environment to marry a long trade that had no unique catalyst. CRWD was a name I was watching for a quick red to green play. Once it started to push green, I quickly scaled out into strength. I decided to trade CRWD cause of its large range and was a nice spot on its daily chart for a quick bounce.

$ALLK

ALLK was gapping up huge in response to positive Phase 2 drug results. In hindsight, I sold way to early, but it was gapping up huge, and it’s hard to expect it to go on a run like that after being up so much on the day. I wasn’t worried about the overall market affecting this trade because it had a strong fundamental catalyst. I scaled out into strength after getting long at the opening range breakout at the open. I scaled out quickly and kept a tight leash on my shares since it was up a lot on the day.

$SOXL Scratch

The SOXL trade was with the expectation that the market would bounce. The market ended up continuing to fade, so I cut it for a small loss.

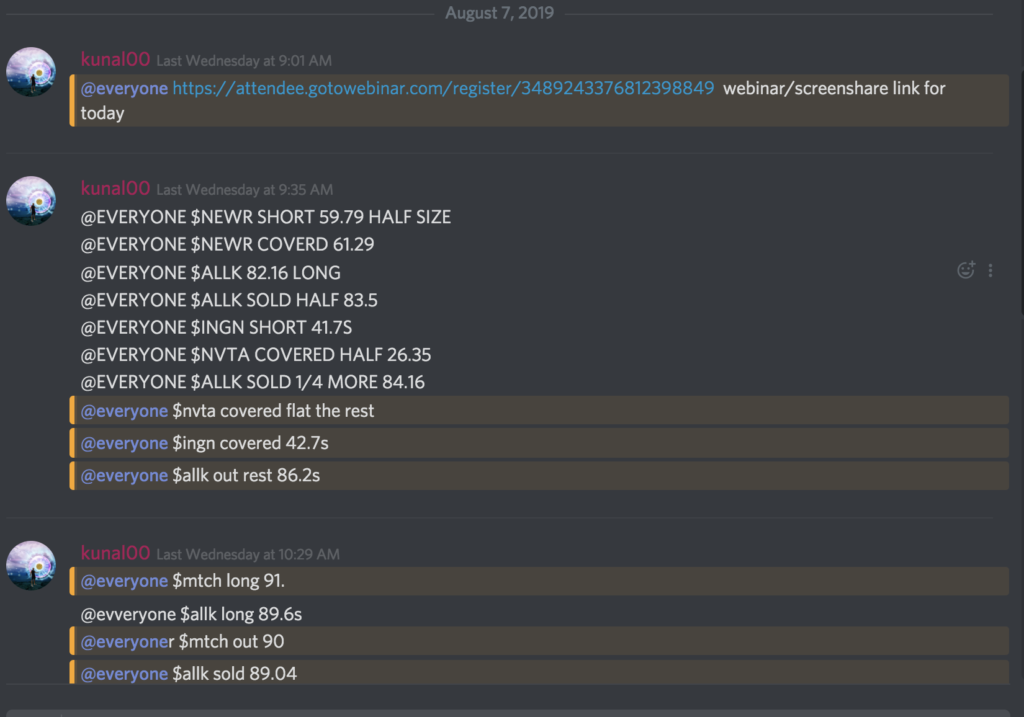

$NEWR, $MTCH Botched Trades, $ALLK

$NEWR

This was a big fuck-up on my part. Not going to BS you guys and pretend its all winners and rainbows. I got in too early, and failed to get back in after it did finally setup and flush. Tough lesson about the importance of timing, and having the conviction and mental capital to reenter even after you get stopped out.

$ALLK

Another trade I didn’t handle correctly. Sold half way too early. It was partially due to the fact I had a losing trade on $NEWR, and I was afraid ALLK would reverse on me. So when I had a bit of green I took it, and wasn’t patient enough. I then relonged it too high because I got FOMO, and took a small loss.

$MTCH

Another big miss from me. Missed the move to $95 and stopped out prematurely, after getting decent entry. I should’ve been more patient with this one, and kept a wider stop. A $1 stop loss was too tight consider it already had $6 range on the day.

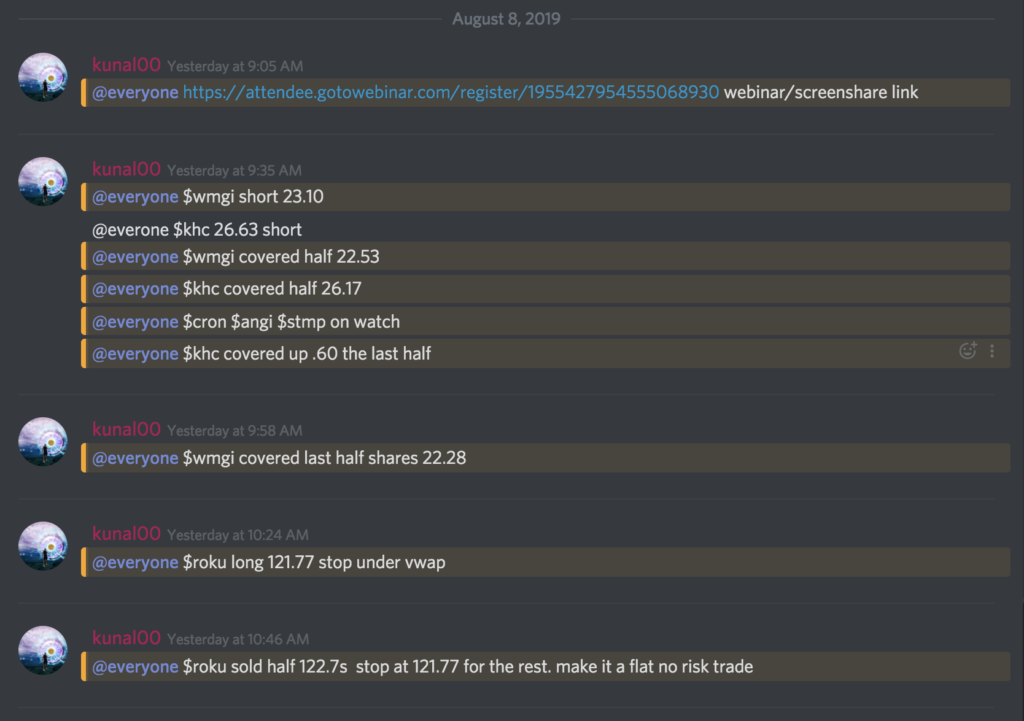

$WMGI $KHC $ROKU

This day made up for my sub-par performance the day before. Some of you guys may who were in my free chat day saw most of these trades, so I’ll break down my thought process on some of them for you guys to learn from:

$WMGI

WMGI was an earnings breakdown play: My go-to setup. It was gaping down on worse than expected earnings, and my thesis was that it would continue to fade off at the market open. I hit it on the opening range breakdown after it broke under the low of the first 5-minute candle. I scaled out into flushes, taking profits as it continued to drift lower.

$KHC

KHC was a similar play to WMGI, expect that the context was that it was a day 2 earnings breakdown play. This was more of a scalp short, since it had shown signs of strength yesterday, I didn’t want to overstay in case it started to squeeze. In hindsight, I covered too early, as it ended up drifting lower later in the day.

$ROKU

ROKU was an earnings breakout play that was gapping up in response to a positive quarterly earnings reports. There were no areas of major resistance nearby, so my thesis was that it would have a strong uptrend for the day.

Other Trades

This $LYFT trade taken by one of our moderator’s Nick was not a particularly big winner. But there are some good lessons from the trade. It was an interesting setup because $LYFT was actually gapping up in response to better than expected to earnings. Despite the good earnings, it rolled over big time. He got short after the $63.30s support level broke and then covered in the $61s, with support at $61.50, yesterday’s high of day.

This is a great example of how price action is king, and you cannot let news and fundamentals make you overly biased. When the consensus is bullish and you get bearish price action, it will often lead to some of the biggest market moves. When the crowd is wrong, everyone is panicking and looking for an exit.

Summary: Biggest Lessons from the Week

- Price action is always king

- Don’t be afraid to get back in after getting stopped out IF there’s a setup

- Pay attention to a stock’s range, and set stop losses accordingly to avoid premature stop-outs

- Wait for the bottom to pick itself, don’t try to catch a falling knife (with the overall market bounce this week)