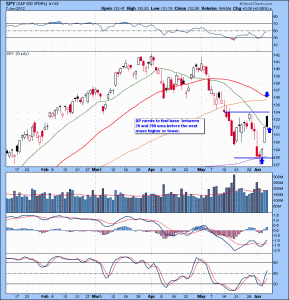

Hello all,@szaman here, even though we had a late sell off in the Market S&P managed to hang onto 20 SMA.Market still in decent shape. Digestion/ side way action is good in the index’s as it sets up individual stock for a move. S&P is in a congestion area with 50/100 sma as overhead , needs to find base between 20 and 200 sma before the next move higher or lower. We might also get stuck in a trading range for the summer. Either way as traders we will always find setups to play with.

As far as “daily’ chart setup is concerned, very few decent setups out there. Many ‘V’ shape move and they need to chop a bit before next move.Lets stick with day trading and quick gains for now.

Two decent alerts and trades from last nights watch list. Lets review.

INXN alert was 16.40,Opens right at our alert 16.40. Never buy stock if alerts right at open. Fools game. As it faded to 20 ema. I bought the stock 16.30 sold 16.55/16.80 and holding 200 shares for lotto now.

UBNT had two alerts. Long over 16.30 or short over 15.60. Opened right at 16.40, again suckers game.This thing gave short setups all day. NR7 break’s are usually very powerful and this was no exception. Stock got killed as it trended down all day.

Watch list for tomorrow:

CRAY Stock was holding up during the sell off. See if it breaks out over 11.50.

FURX Thin Bio .name. Nice bounce off 50 MA as its flags. Watching 19.20 level for a reaction.

GNE Anothet thin energy name. Decent base with with expanding volume. Watching 7.10 area.

STP Watching 1.77 area for a quick trade.

STRM Parabolic short watch.

XRTX This one looks weak. If the market weakens this one could be a short.