$UNXL is a recent high-flying momentum stock that has been clobbered recently. It has come down from a recent high of $37.44 to $21.60 in 5 days. Indicators point to an oversold condition. Volume has been diminishing every day. Candles are becoming narrower. Narrow candles simply means reduced volatility after a big run up or down. This is where change of direction usually takes place and a trader finds opportunity.

The stock also has over 39% float short. Any stability and price in the bounce direction will cause an explosive short squeeze – a perfect example of Bulls On Wall Street’s “Rubber Band Snap Bounce/Squeeze” play. We go over this setup in more detail in the Bulls Trading Bootcamp.

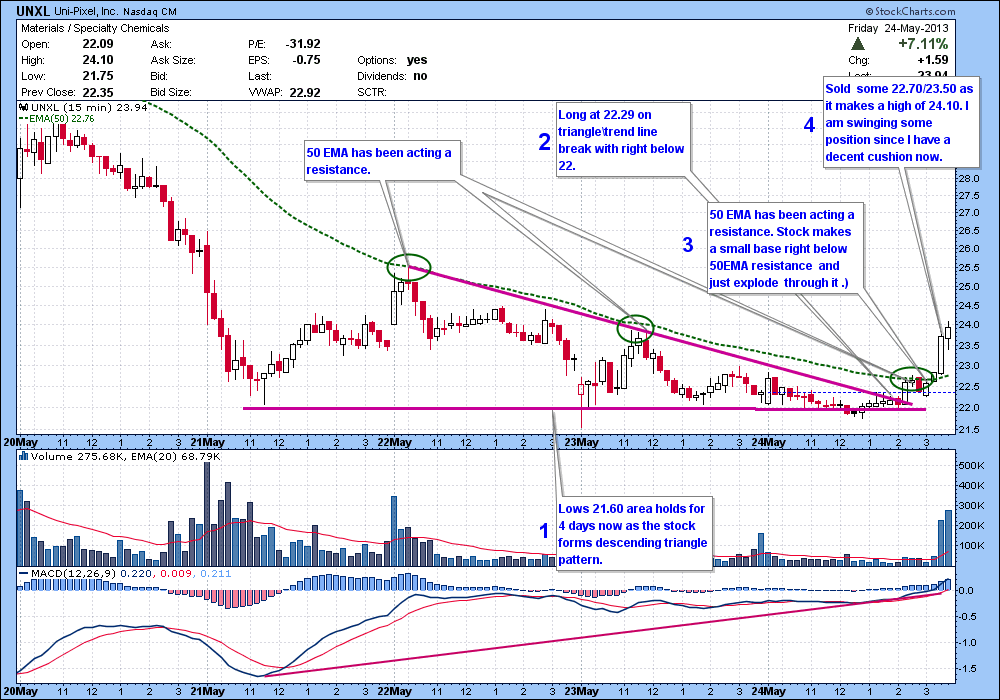

Let’s check out a 15 minute chart to see how it setup an explosive late-Friday bottom bounce squeeze.

- 1. The $21.60 area holds for 4 days now as the stock forms a descending triangle pattern.

2. Long at $22.29 on triangle trend line break with a stop right below $22.

3.The 50 EMA has been acting as resistance. Stock makes a small base right below the 50 EMA resistance (always a great sign) and just explode through it.

4. Sold some at $22.70/$23.50 as it makes a high of $24.10. Swinging some position over the weekend since I have a decent cushion now and good probability this bounce might continue more.

30 cent risk and about $1.80 gains so far.

If you are interested in trading low risk/ big gains setups with a super team of traders, checkout our subscription services. Our chat room offers live audio and video feed, a great community of traders and killer stock picks. Joining also gives you access to all our premium posts and watch lists, plus webinars, trade reviews and more! Please email me for info. thenyctrader@gmail.com