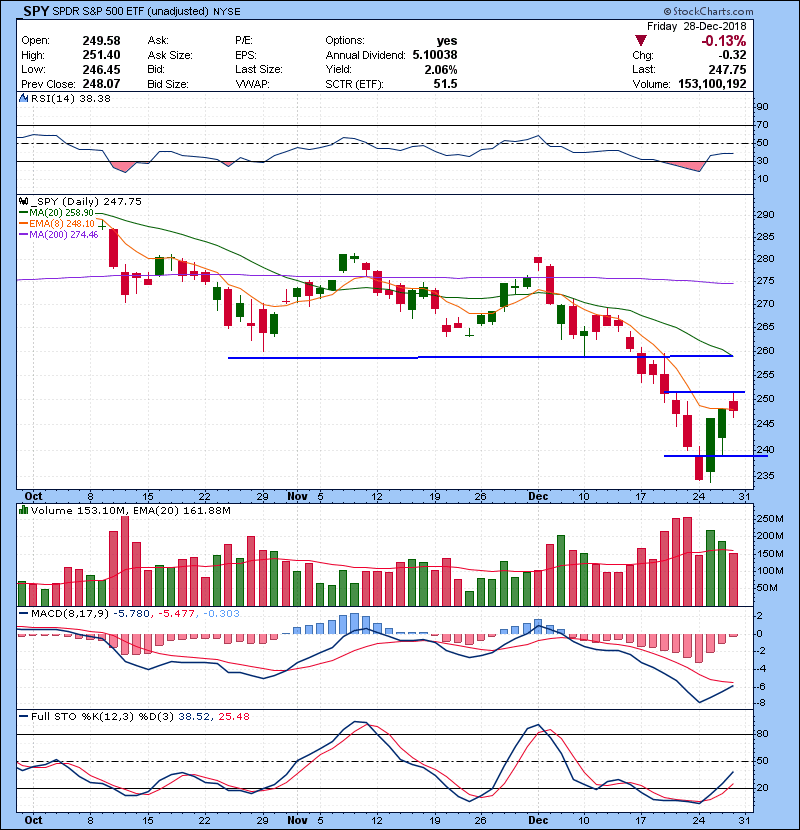

Market had it’s relief rally on oversold condition.

SPY backed off resistance zone but manged to hold 8 EMA barely . A move back over 251.40 has potential for more short squeeze. A violent break below 239 and stay below leaves the door open for more selling. Given the primary trend is down bias remain bearish and it would still be considered bear market bounce if base here a bit and go for next resistance 257-260 area. Given how volatile trading action has been, keeping my mind open to all possibilities. This volatility has been great for active traders.Not easy trades but amazing range on both long and shorts. Slim picking as far as watch list. I will be watching ETF’s again for day trades since action in most individual stock is now index driven and very few market leaders, it is much easier to trade ETF’s.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman