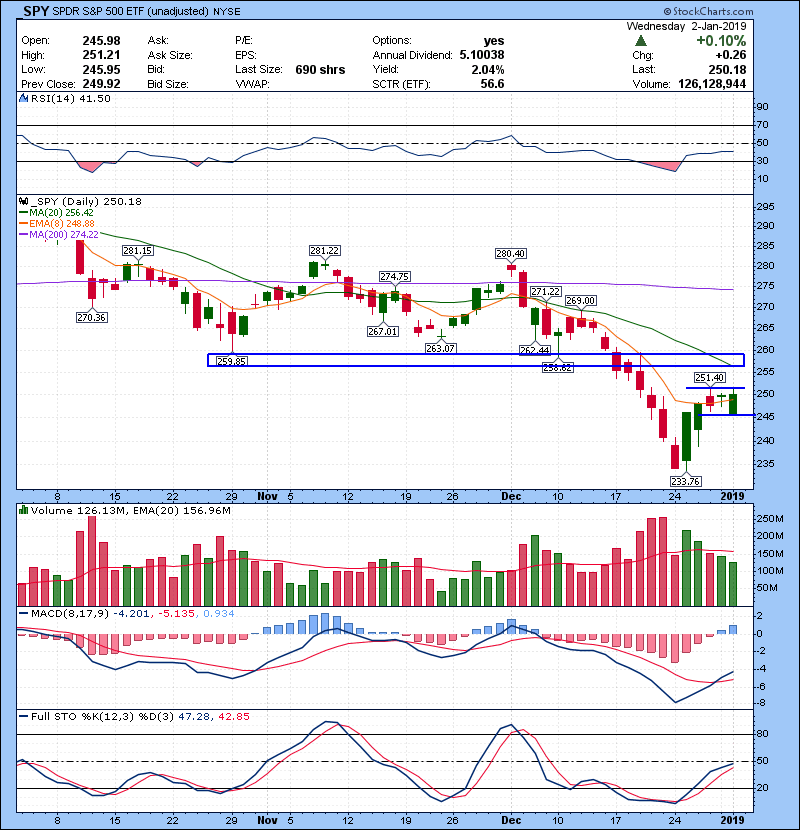

Big gap down at open but bulls stepped in bought the dip.

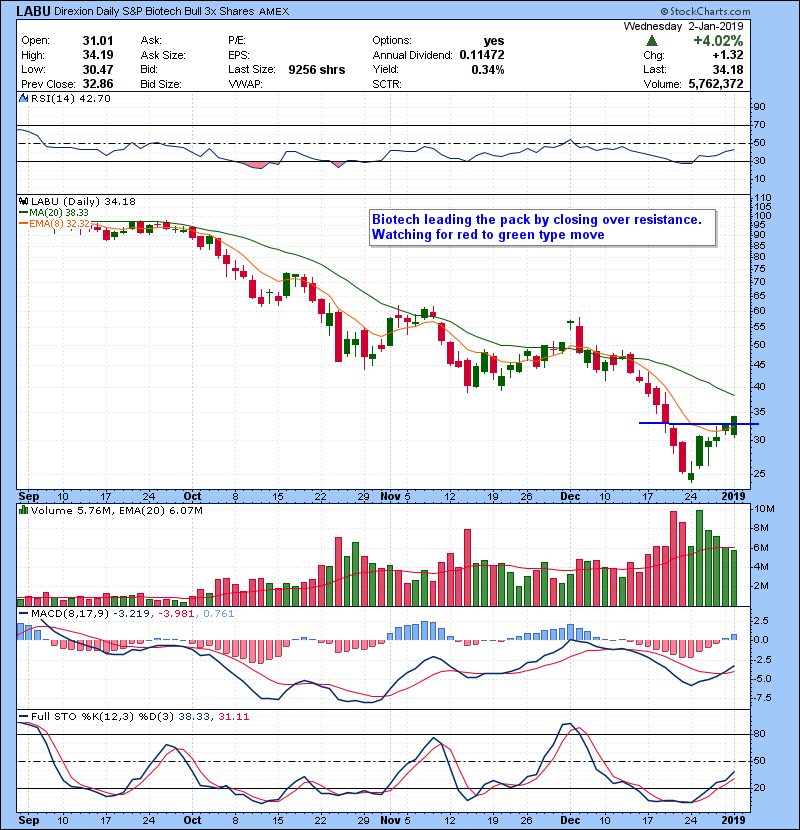

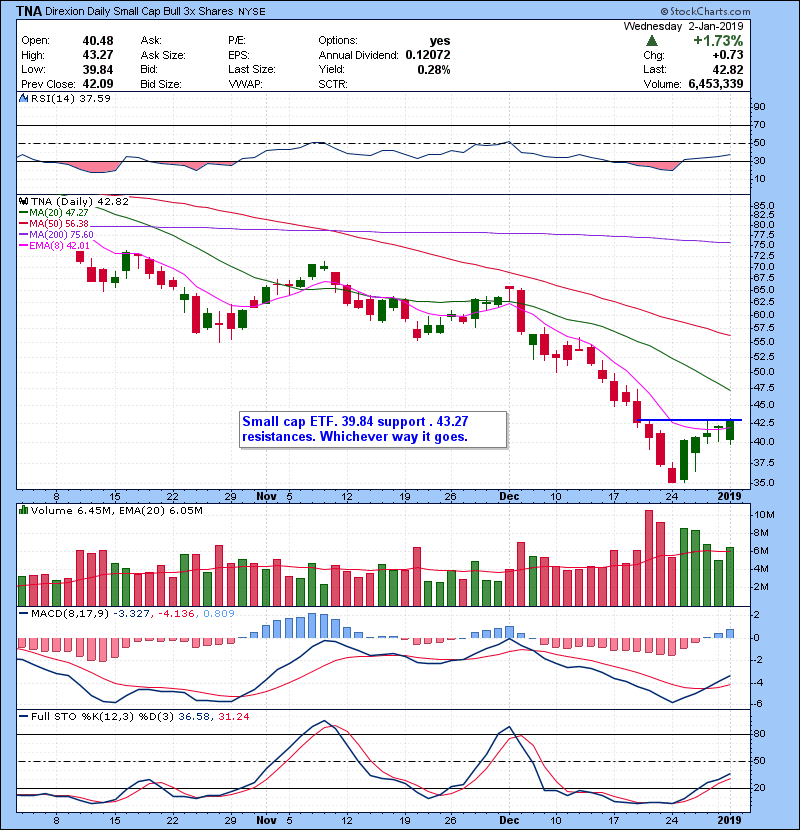

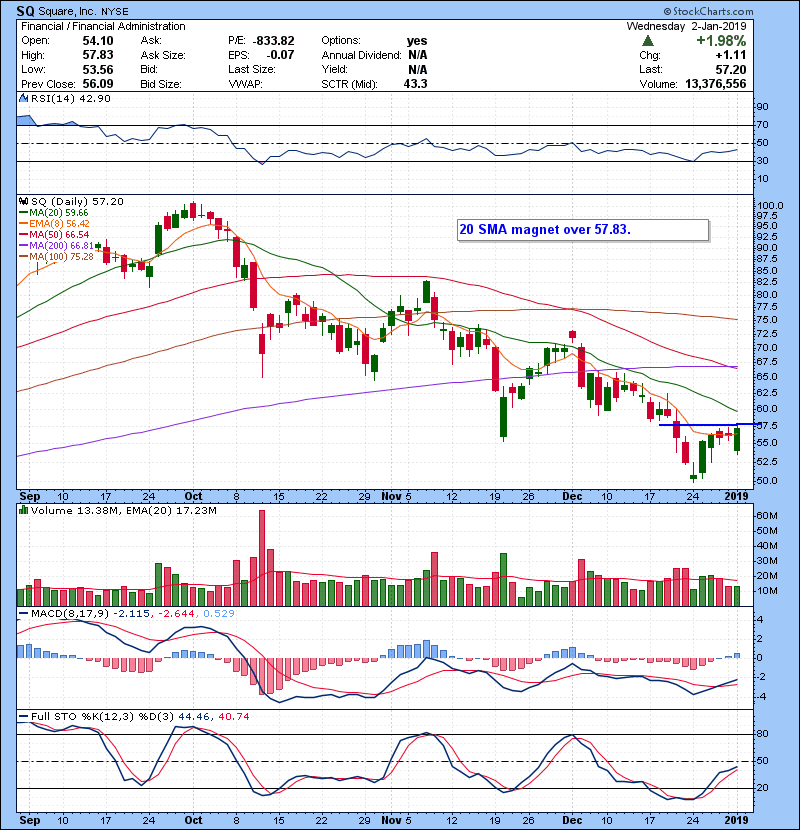

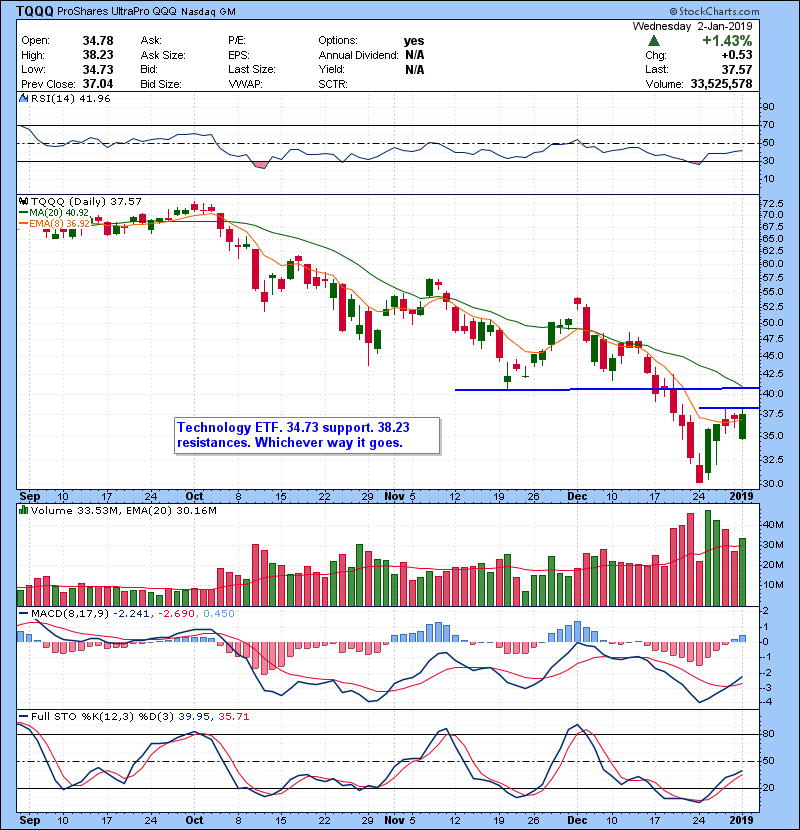

Market now in a short term tight range. SPY support 246 with resistance at 251.40. A break over 251.40 could test 257 and 260 zone. Everything looked great until AAPL earning down guidance after market. All eyes will be on APPL and how market reacts to negative earning news tomorrow. So pay attention to AAPL price reaction. SPY,a break below 246 and staying below should see some more selling. Range is getting tight so keeping an open mind for all possibilities. If market holds up despite AAPL news, there might be some more squeeze. Slim picking again as far individual stocks setups. Action still index driven for most stocks, so sticking with trading ETF’s. Out go-to ETF’s TNA, LABU, TQQQ gave decent opportunities on intra day dips. So keeping an eye on higher low setups.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman