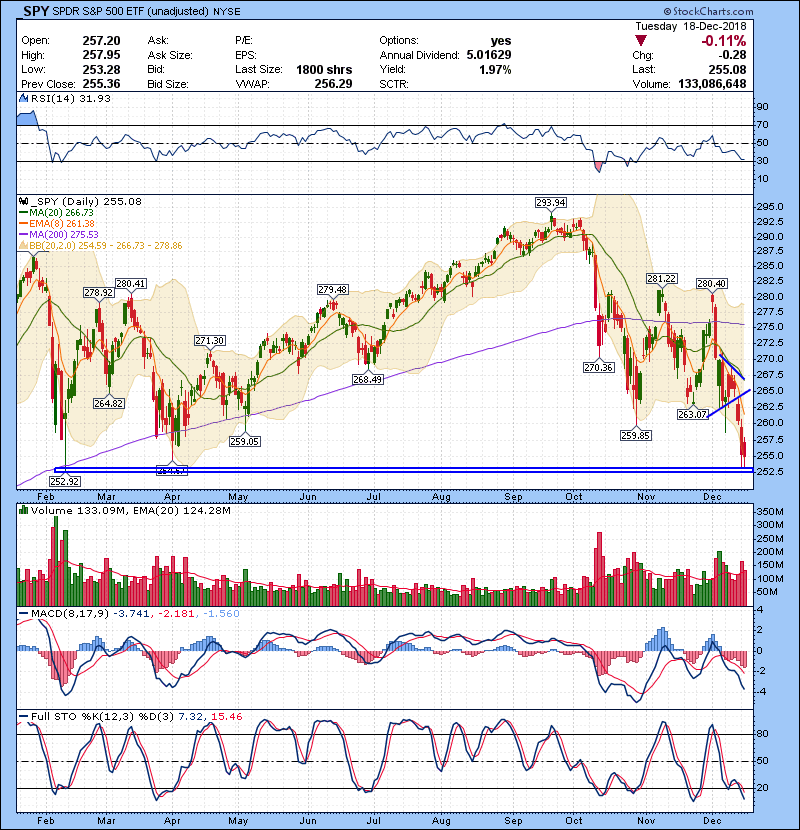

Flat day for the indices after another gap up open and a roller coaster day. Simply put, any strength being sold.

SPY holding April’s low for now ahead of big FOMC interest rate decision Wednesday 2 PM ET.Oversold and out of bollinger band yet no conviction buyers. Any positive reaction after FOMC could change that.

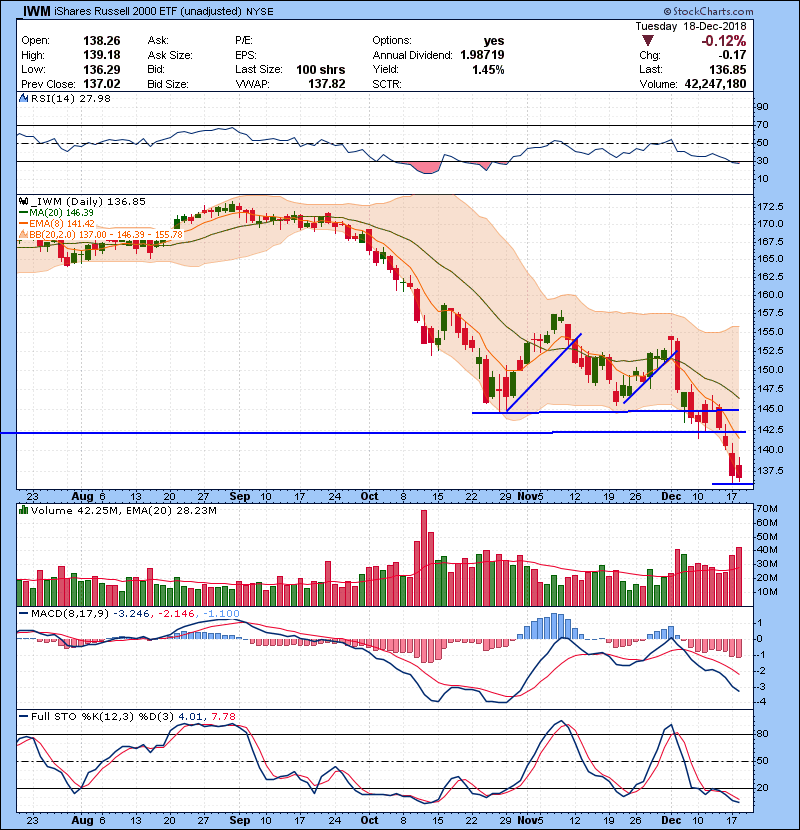

Small cap, canary bird, forming a 2 day double bottom , oversold and out side of bollinger band yet no conviction buyers.

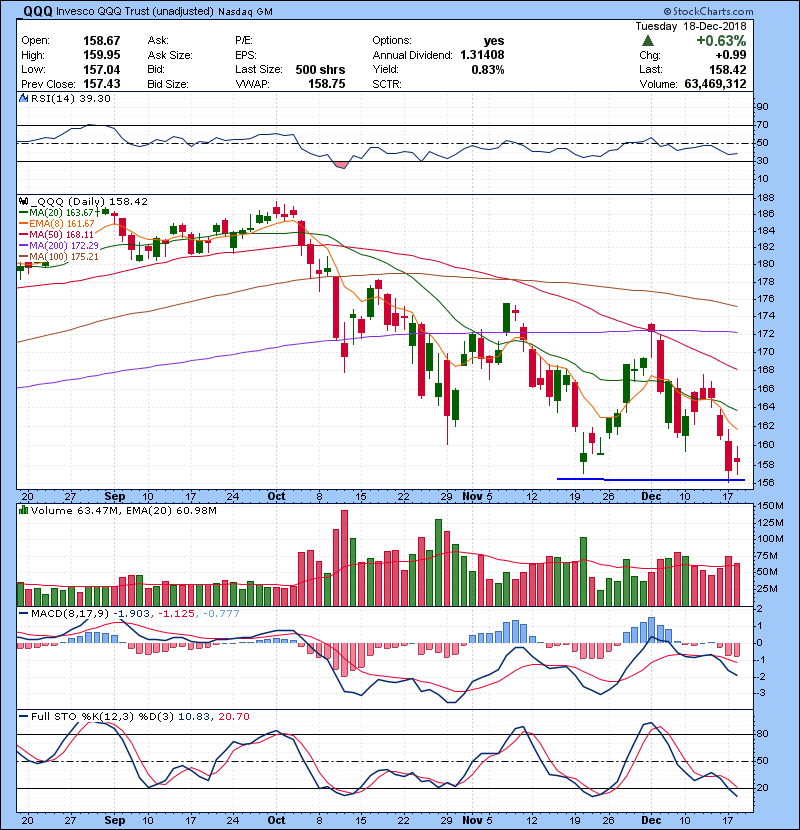

QQQ strongest index,inside day. Needs confirmation either way.

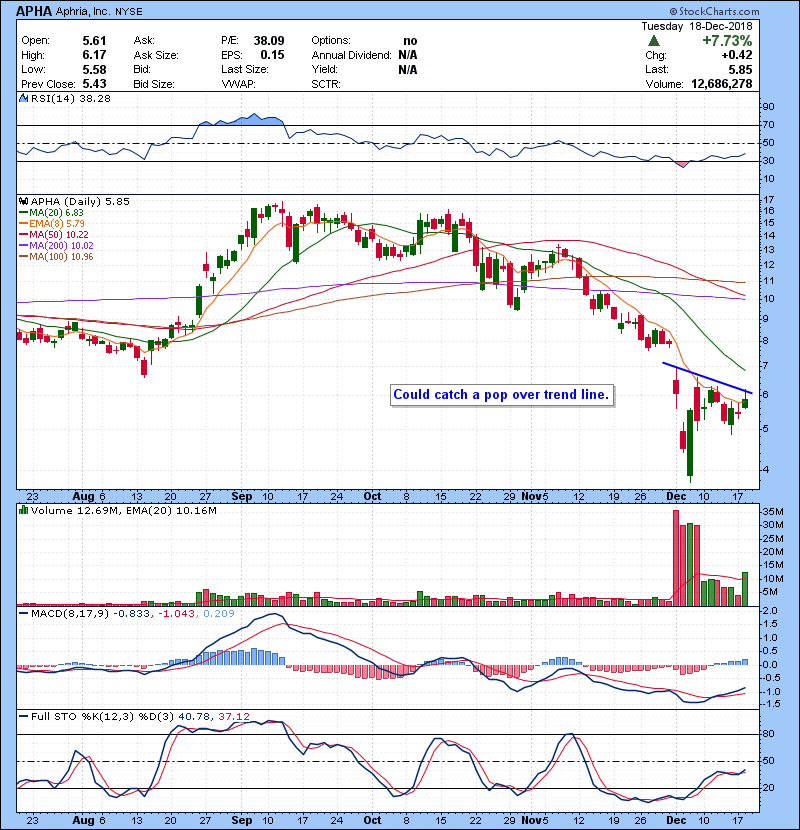

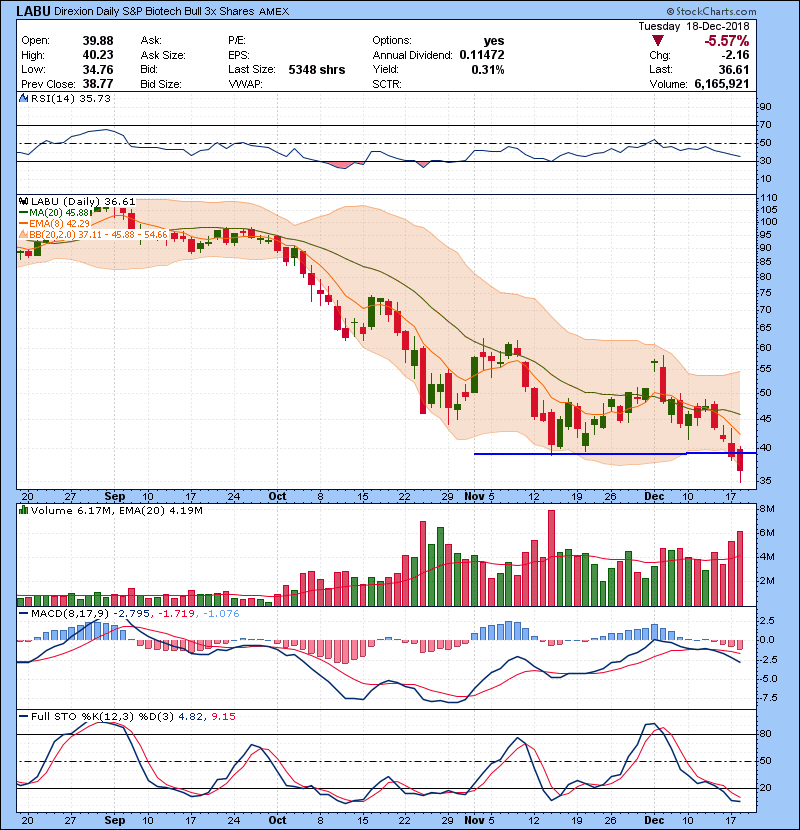

Out biotech short idea worked great. However, again oversold and out side of bollinger band yet no conviction buyers.

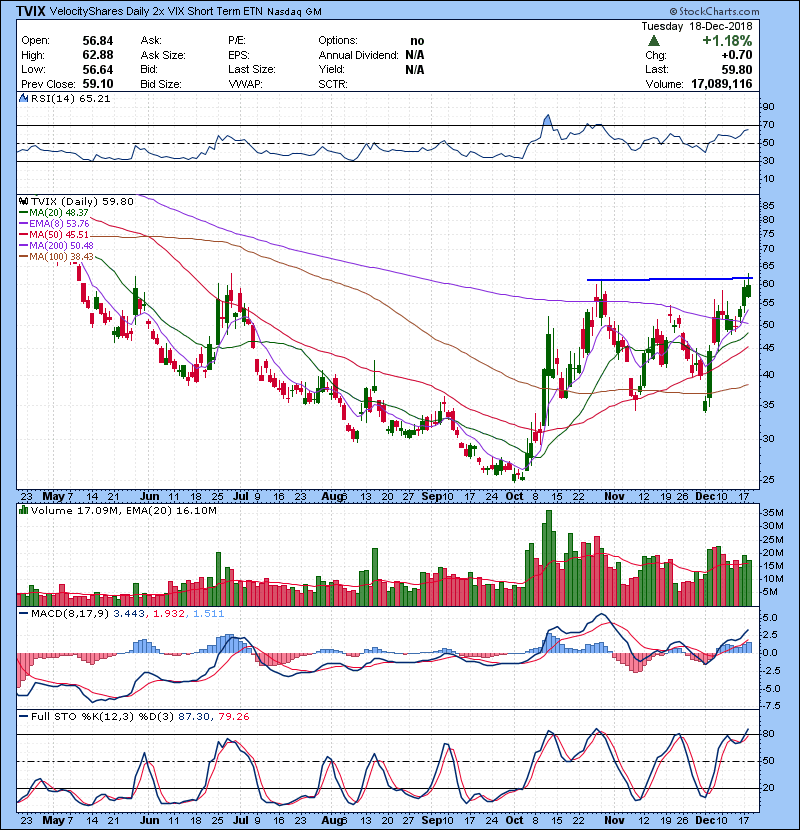

TVIX tried to breakout and failed at first try. If tries next time, shouldn’t fail. Every dip has been bought on this.

In conclusion Market has the potential here for dead cat bounce, FOMC will be the wild card. I will be watching IWM for strength for any bounce to hold. Again, keeping an open mind for all possibilities. and do not chase up anything. Bears are still in complete control and over sold can become more oversold. Mostly,I will be mostly watching ETF’s for trade. LABU, TNA, TVIX, DWT, UWT,NUGT, UGAZ, DGAZ. TQQQ.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman