More size means more profits right?

Most of the time, this is not the case for new traders. Money creates emotions. If you increase your size too much, it becomes difficult to control and manage your emotions.

Emotions will be in your trading no matter what. Succesful trading requires not the elimination of emotions, but management.

If any of these signs sound familiar, you need to start reducing your trading position size:

You Focus on Your PNL All the Time

You chase PNL, it runs. This is one of the most common errors a new trader makes: They constantly pay attention to how much they are up or down in a trade.

This causes poor decision-making because you’re making decisions based on your PNL instead of the market trend.

Pro tip: Hide your unrealized PNL on a trade. This will help keep your focus on what matters: The charts.

You Cannot Leave the Computer

A trade shouldn’t chain you to your computer to your phone. You should be able to comfortably leave for a minute or two without panicking. If you feel too scared to leave a position unwatched for a few minutes, you’re trading too large.

You Take Profits Too Soon

That’s my mortgage. That’s my car payment. That’s a week’s worth of groceries.

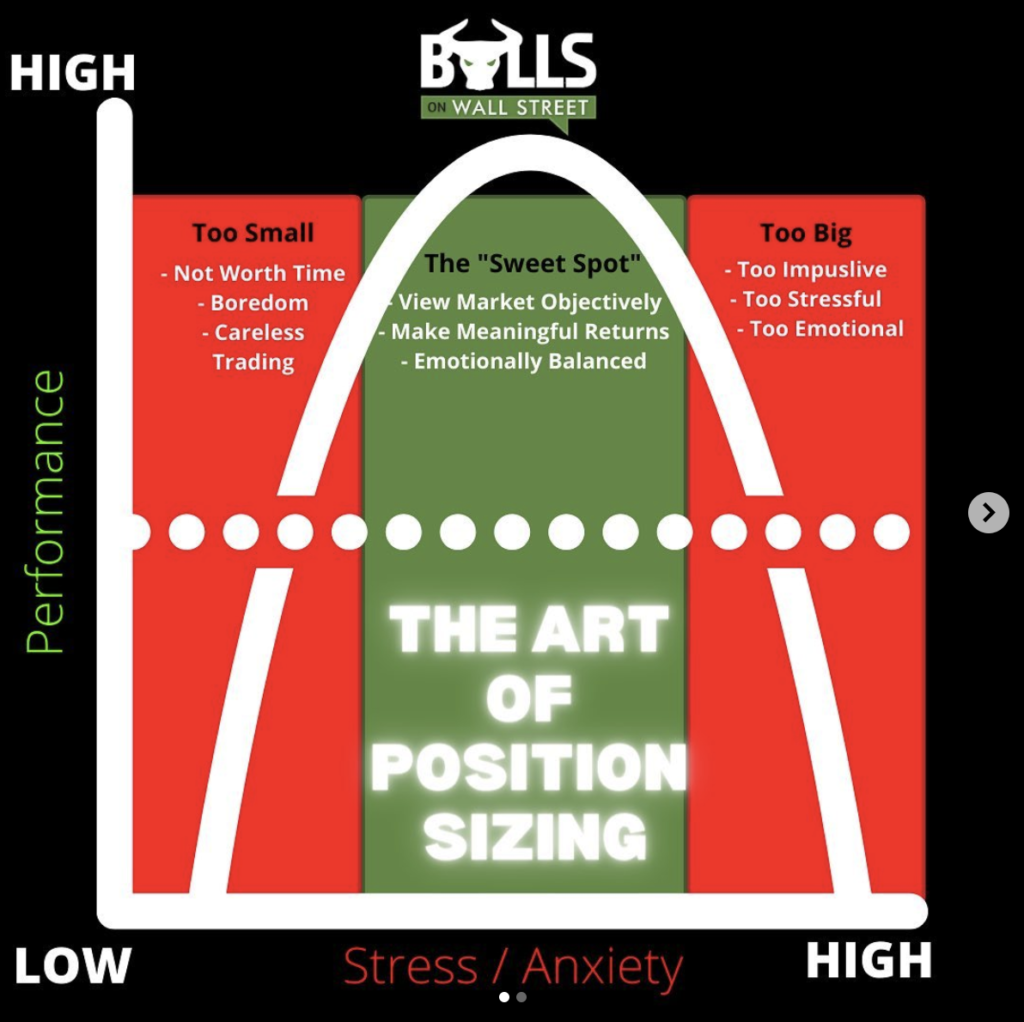

When you assign value to unrealized gains in the markets, it can cause you to take profits when you shouldn’t. While this is effective for curtailing greed, in the long run, early profit-taking has disastrous consequences for your long-term PNL. Learn to find that “sweet spot” with your position sizing:

Take profits based on price action, not what the unrealized gain is.

You Stop Out Prematurely

Have you stopped out before because you were scared, just to watch the stock reversed on you and go to the moon!

If you’re jumping in and out of positions, it’s because you’re fearful of the money being risked. Cut down your size to eliminate this fear. Pre-define your risk before every trade: Are you truly okay with losing $200? If that makes you nervous, lower that number.

Losses Cause You to Adjust Spending Habits

Only risk what you can afford to lose. A trading loss should not cause you to change what type of fuel you get at the gas station. Or what type of food you buy.

You can only be a successful trader if you trade what you can afford to lose. NEVER trade with money you need to survive on. You will not be able to view the market objectively and let our trades play out.

Anything can happen in a trade. Even a strategy with an 80% win rate has a 20% of losing on any given trade. Trading with money you can afford to lose allows you sit back and view markets objectively.

You’re Afraid to Take a Loss

We’ve seen it happen too many times. Traders freeze up, and the loss gets so big that they cannot bear to realize it. Eventually, usually by force from the broker, the trader is liquidated and realizes a massive loss.

This is the opposite of what can go wrong with stopping out pre-maturely. Stopping out too late. This ties back into trading with money you can afford to lose: What you are risking on a trade shouldn’t make you so emotional that you freeze up.

Struggling with managing your trading positions correctly? We have multiple classes dedicated to this important topic in our 60 Day Live Trading Boot Camp:

Join Our Live Trading Boot Camp

Early-bird pricing ends this week! Sign up before