The majority of traders kick off their careers with small accounts with under 25k, with most even starting with less than 10k.

So, the question is, how do you grow a small account effectively? What are the best types of stocks to trade? What strategies do you use?

Restrictions like the dreaded PDT rule that makes things tough, and there are thousands of trading services trying to sell you their strategies all over social media.

But what is the best for a new trader with a small account?

Here at Bulls on Wall Street, we focus on trading liquid large-caps & mid-cap stocks. Myself, Szaman, and Paul Singh have all traded in this niche and taught it to students for over 15 years. This is our bread and butter.

In short, this is the most stable niche to focus on and allows you to exponentially grow an account in the safest and most high probability manner.

Let’s dive into why:

Less Volatility & More Stability

Yes, even with tons of uncertain geopolitical & macroeconomic events going on in the world today, large-cap and mid-caps are still way more stable to trade than small caps & options. Small cap stocks have huge volatility. They can drop 20% on you in an instant, halt, and then jump right back up 40%. This is not an exaggeration.

With large caps and mid-caps, yes you will have volatility and sharp drawdowns occasionally, but they are much less frequent and less severe. You also do not have halt risk like in small caps, which can blow your account up in an instant especially if you are using leverage on a small account.

Mid & Large Cap Example

Every new trader’s objection to trading large caps is that they are too expensive. This is not the case if you find a large cap with liquidity and range like in the graphic above. If you took 100 shares of this stock at $108, that would cost you $10,800 in buying power. Most brokers give you 2x-4x buying power, so you could take this trade if you had only a $3000 account, while only risking $130. It would be an aggressive trade for that size, but your reward if you won would be $400.

All without the halt risk and insane volatility of trading a small-cap. You cannot take an $11,000 position in a volatile small cap stock when your account is this small, because it could potentially put you down $1000-$2000 in the blink of an eye if it goes against you.

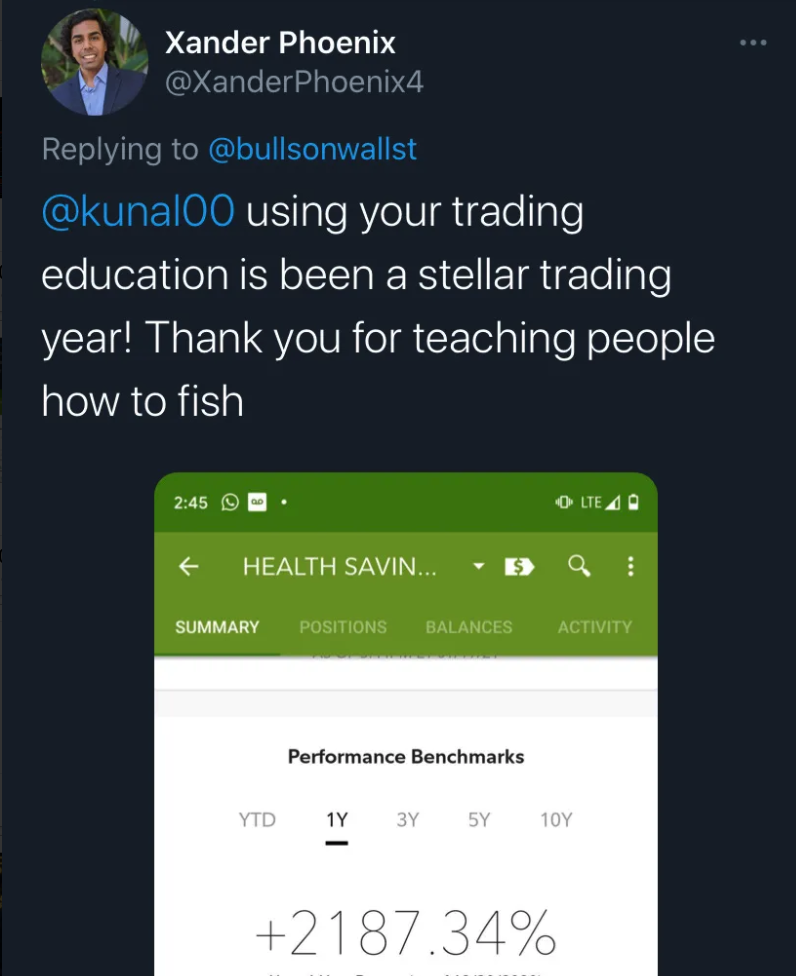

Our students like Frank have seen huge success in this niche. He grew his trading account 2187% in one year focusing in this niche!

This obviously won’t happen to everyone, but it shows you the potential of where you can take a small account if you can execute correctly.

More Liquidity

Even though you are trading a small account and aren’t going to be trading that many shares of a given stock at one time yet, trading liquid stocks can keep you from getting caught in some nasty situations and on the and end of wide bid/ask spreads that instantly put you at a loss.

Small caps liquidity can dry up at any given moment, leaving you in the dust wondering how to get out of your position without taking a bigger loss than you anticipated because you can’t find a buyer or a seller at the right point. There is a lot of manipulation in small caps due to the low liquidity issue, and with most large caps & mid caps you just don’t have to worry about liquidity randomly drying up and leaving you holding the bag.

Less Trading Fees

Every single dime matters with trying to stack up a small account. Trading small caps on the short side makes you incur tons of hard-to-borrow fees, which put you down on a position before you even had the chance to trade it. Plus you are buying and selling thousands of shares when you trade small caps, which incurs large ECN fees and add up fast.

With large and mid caps, you avoid those fees and just pay a small regular commission fee, and nowadays, most brokers are even free. And when you are trading with a small account, you are only trading a few hundred shares at most which have minimal ECN fees.

Simply put, our strategy and mentorship will put you in the right spot to not only grow a large account, but a small one. You can get great range and volatility for growing a small account trading mid and large cap stocks, without dealing with the higher risk and large fees of trading small caps. If you want to learn specific strategies we use to trade mid and large cap stocks, make sure to apply for our next Live Trading Boot Camp!

Save Your Seat for Our Next 60-Day Live Trading Bootcamp (Get Early-Bird Pricing)

We don’t sugar coat it. Becoming a consistently profitable stock trader isn’t easy, or an overnight process. That’s why our 60-day Live Trading Boot Camp is designed specifically to help struggling traders overcome their weaknesses, and expedite their path towards profitability.

Contact us ASAP to save your seat in our next trading boot camp!

Click here to save your seat for our next live-trading bootcamp.