In trading, it’s not you versus other market participants. The battle is you versus yourself.

And the main enemy you face is your trading emotions.

If you don’t have strategies to manage your emotions, you will never be able to become consistently profitable.

Today’s blog we will talk about the most powerful trading emotions you will face, and how to conquer them:

Why Do Trading Emotions Hurt You?

You will never know for sure what will happen to a market. The uncertainty creates fear in traders who cannot adopt a probabilistic mindset instead of a fixed mindset.

Money is an emotional topic. Money can turn into anything you want. As a result, all our conceptions about money and wealth are projected onto the market.

“That trade would’ve been my mortgage.”

“I want this trade to retire me.”

“I cannot afford to lose on this trade otherwise I cannot make rent.”

All of these statements reflect how your perceptions of money and possibility will influence your trading decision-making. Let’s now get into the different emotions you will face as a trader:

FOMO

Fear is one of the biggest obstacles for traders. Why? Because everyone hates losing money or hates missing out on an opportunity to make money.

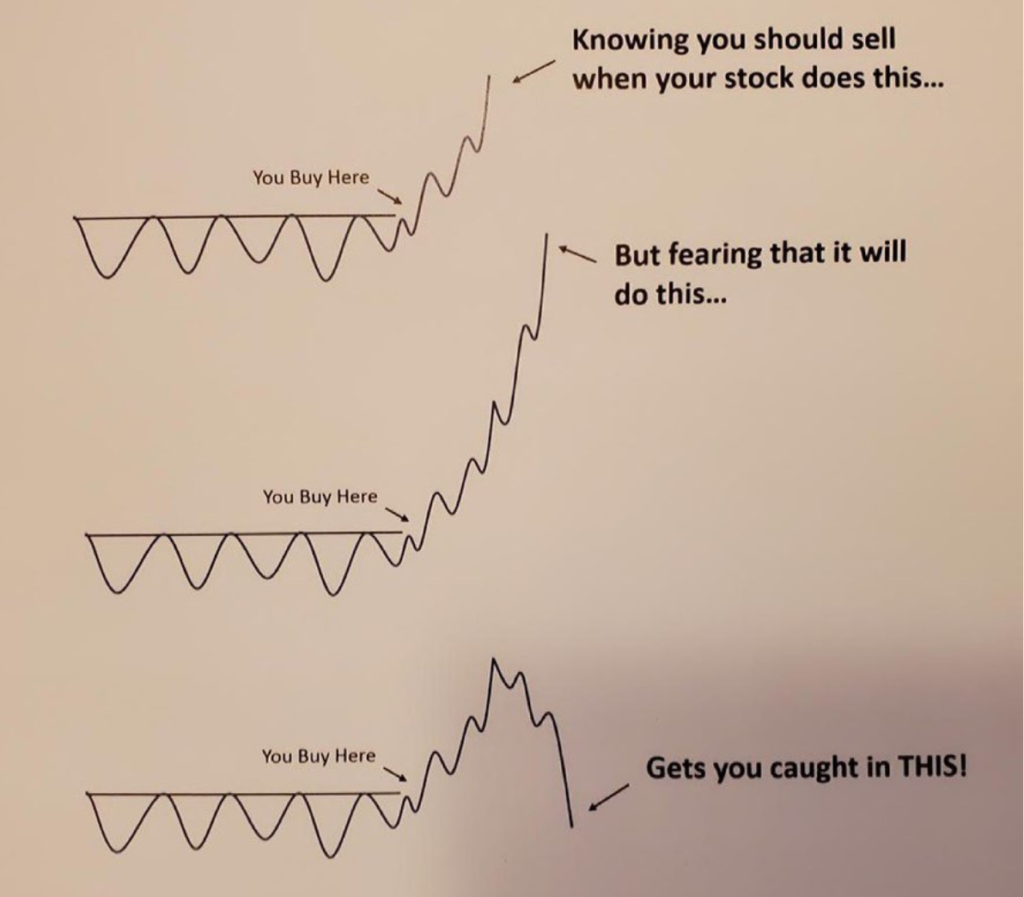

FOMO gets even the most experienced traders. Fear of missing out is one of the most powerful driving forces in the markets. The average retail investor buys high out of FOMO, and sells low out of fear. The best traders do the opposite: Buy low when everyone is panicking, and sell high into strength when the FOMO traders are going crazy.

Fear of Loss

No risk, no reward. You can be in a winning trade unless you take the chance of it being a loser. In order to become a successful trader, you need to conquer your fear of losing trades. You have to risk it to get the biscuit.

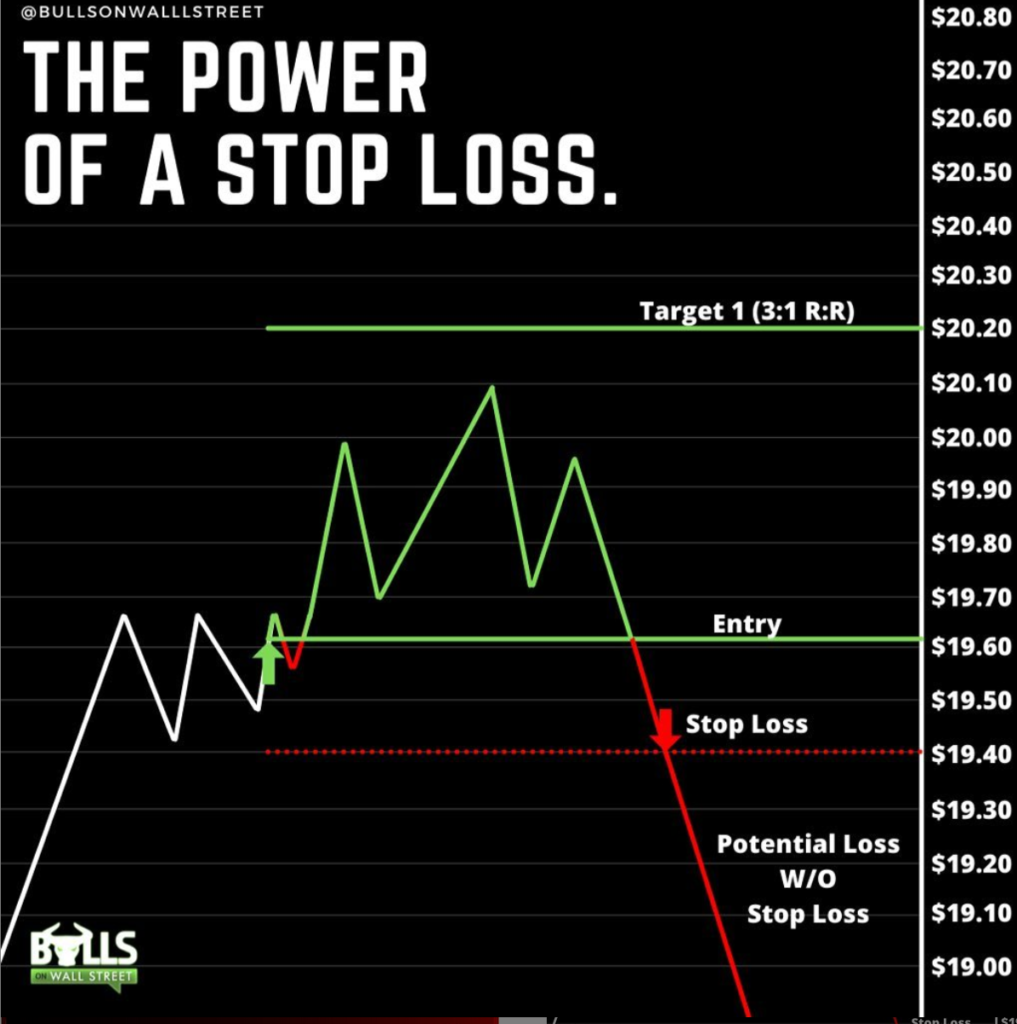

Use a stop loss to reduce your fear of losses. This will define the worse case scenario. Accept how much money you will risk on the trade:

Fear of Being Wrong

No one likes being wrong. But when you step in front of the computer, there is a chance every day that a trading thesis will not align with a market’s price action. When you are wrong, get out quick. You are not trading to be right all the time. You are trading to grow your trading account. You cannot avoid losing trades. But you can contain them.

Greed

The common new trader trap: Getting in a trade and expecting a black swan event. Black swans are 1/1000. Base hits are a high probability event. 2-5% gains add up. Lock in profits once you get the move you were waiting for:

Look at the $GME and $AMC plays from earlier this year. How often do stocks go up 1000% in a week? Once a year at best. 99% of the time if you buy a stock with that kind of expectation, you will never be able to put on a profitable trade. Profits aren’t profits until you sell or cover.

Denial

What defines a bagholder. A general rule of thumb for new traders: If you’re afraid to look at position, it’s time to get out. Stop hiding from your losing trades. Stop turning day trades, into swing trades, then into long term investments.

How to Manage Emotions

Now you know the emotions you need to battle as you enter the markets.

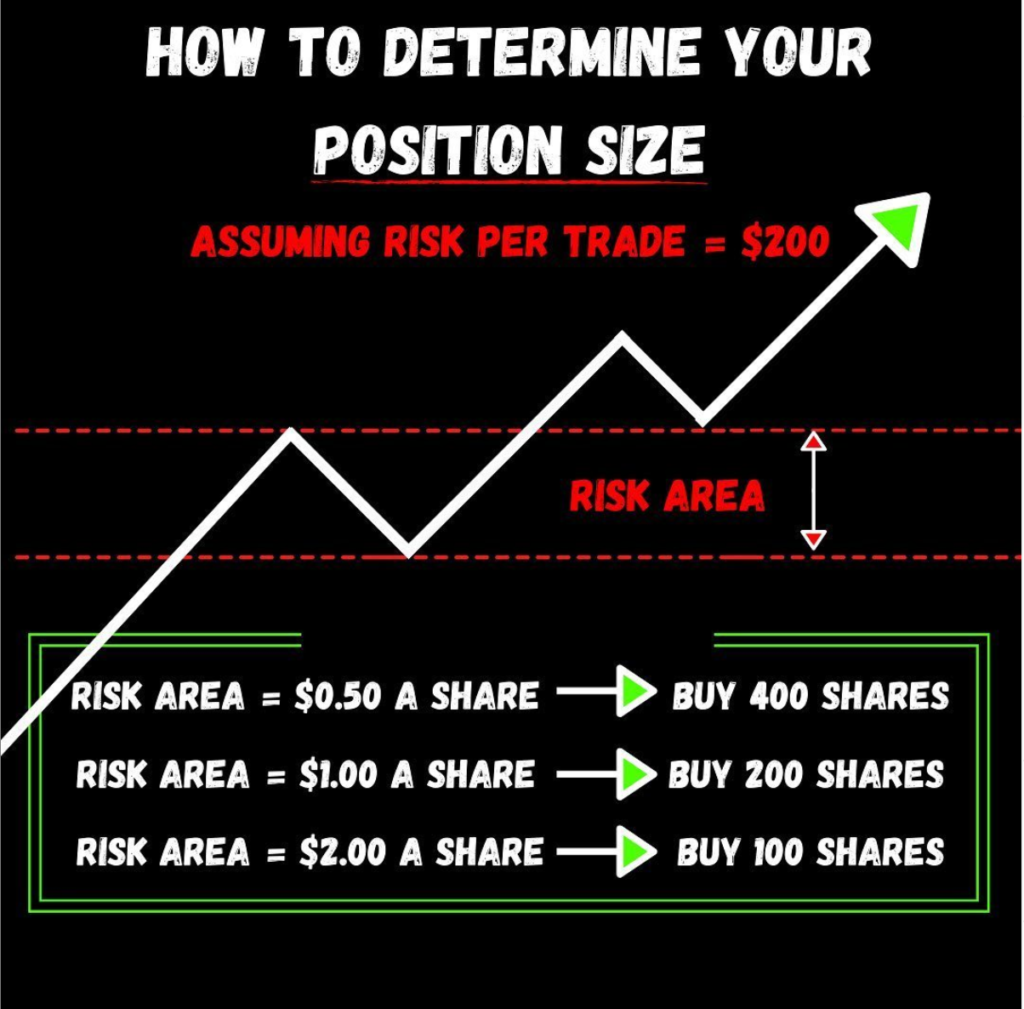

Lowering your position size is one of the BEST ways to reduce trading emotions. A ton of trading fear comes from attachment to the money you are putting into a trade. If you lower your risk, you will have last emotional attachment to fluctuations in your PNL. Use this formula to determine your position sizing, and make sure you’re only risking 1-2% of your portfolio per trade:

Planning Your Trade

Watch how much having a trading plan makes difference in your emotions. Planning eliminates uncertainty, and eliminating uncertainty reduces emotions.

All of these things need to be defined before you take a trade:

Hope this gives you some insight to how to combat trading emotions! Don’t hesitate to reach out with any questions!

Join Our Live Trading Boot Camp

Join our Live Trading Boot Camp