Today we shorted $car for a small gain. I wanted to review the trade. There are two types of gap fills that can happen in stocks.. both types of gap fills make for profitable trades.

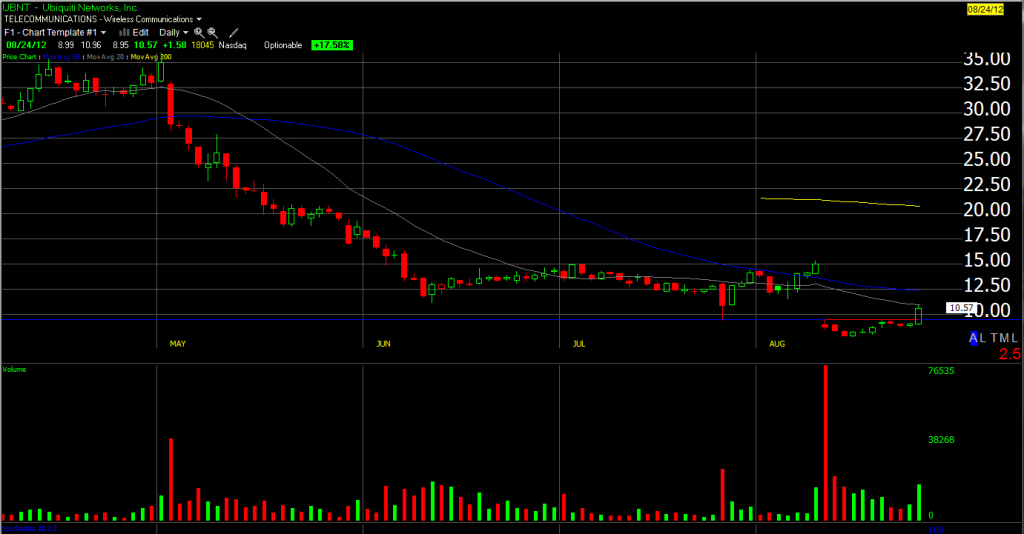

1. Gap fill thats occur on the daily chart that occurs after a period of time, not in a single day. Something such as $UBNT . The stock gapped down on bad news from 14 all the way to 9.57. It remained below this 9.57 mark for several weeks before it later came back to begin to fill the gap

2. Gap fills that occur intraday e.g CAR. This type of gap fill.. the stock either gaps up or down on news.. then comes all the way back where it opened and begins to fill the single day gap that the stock made on the chart. In the case of CAR the stock opened at 16.77.. ran to 17.9 before coming all the way back and filling the gap. We shorted at 16.77 on the way back down.. and watched as it drifted down into the 16.3’s.. filling its gap.