Earnings season is here. It is the best time of the trading year to grow your trading account. Companies will see a ton of range, volume, big breakouts, and breakdowns during this time of year. For momentum traders like us, it is the perfect catalyst to get a stock to make a huge move. If you do not understand how to capitalize on these setups you will be missing out on huge opportunities to make big gains in a few minutes or hours. Let’s talk about two recent earnings breakouts from this week and what made them A+ plays:

Aligning on Multiple Time Frames

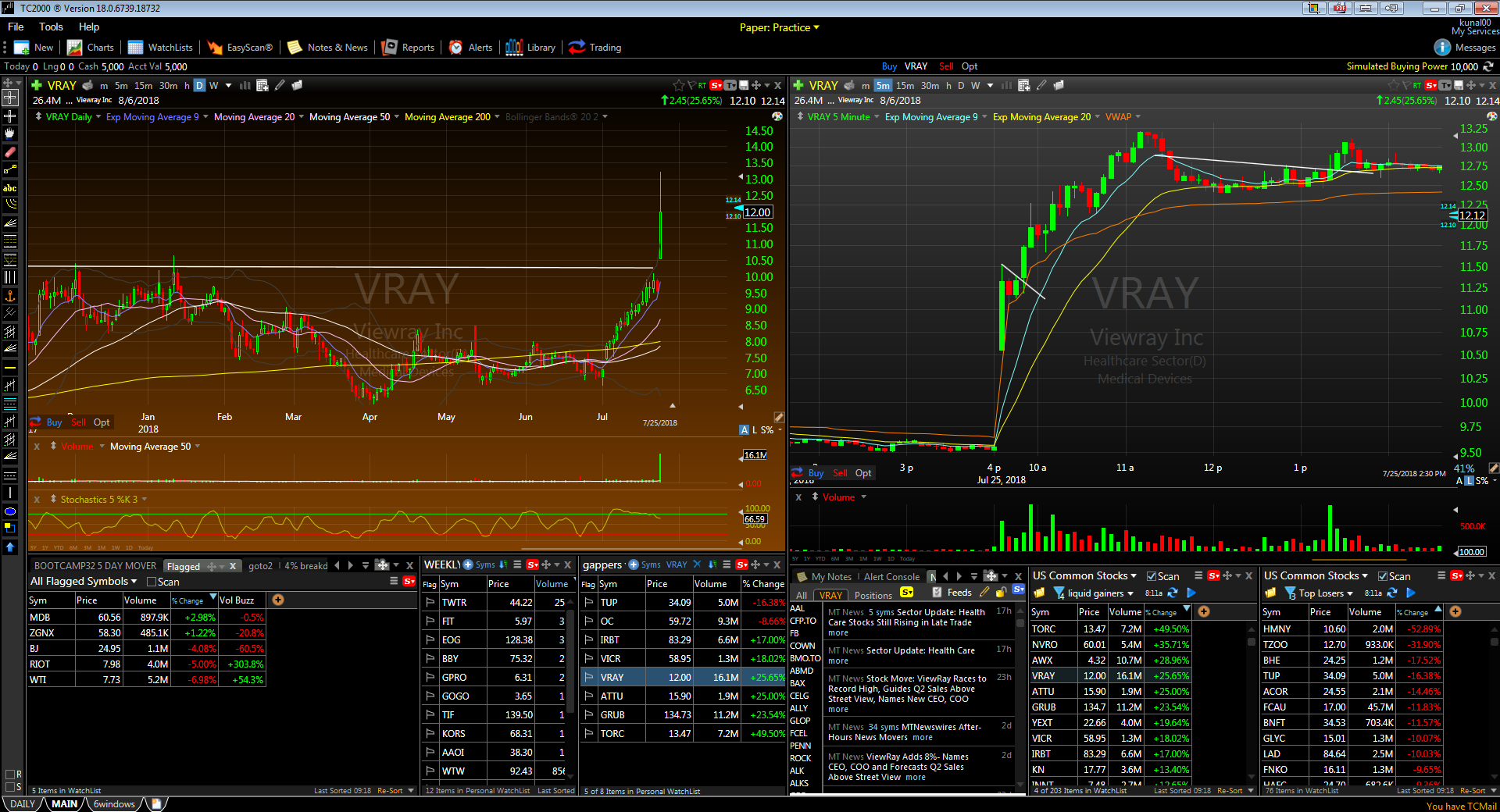

The most important component of trading earnings breakouts is being able to align the setup on multiple time frames. This is what causes explosive moves in stocks like VRAY and GRUB this week. When you combine a setup aligned on multiple time frames and an earnings catalyst, you are looking at A+ scenario.

The earnings catalyst is the best catalyst because earnings calls are the time that most big investors make a decision about their position in a company, or consider taking a new one. As a result, most companies will see a ton of volume and range come into their stock the day after (and often for several days) they announce their quarterly earnings results. Let’s look at two recent earnings examples from earlier this week:

VRAY

VRAY is a picture perfect earnings breakout. The breakout level, $10.50, had already been tested twice before it gapped over that level on the earnings release on Wednesday. Once the market opened, there was no resistance levels ahead. VRAY also gave us a picture perfect ORB (opening range breakout) to give us tight risk and pattern to get an entry above the breakout level. Notice also how much volume traded on the first 5 minute candle. It demonstrated high relative volume early on, indicating that the stock would have a high probability of making an explosive move that day.

GRUB

GRUB was not quite as picture perfect of an earnings breakout, but still gave us a HUGE move after setting up at the open. You can see by its daily chart it still had the $120 resistance level ahead when it opened. However it quickly punctured through that, and gave us a great quick pullback buy opportunity after it pulled back to the VWAP on the 3rd, five minute candle. This pullback was over the $120 resistance level, which made it perfect because there was really no resistance ahead to stop it, and is why it ran all the way to $138. When you are aligning an intraday setup with an earnings breakout play, always be sure there are no nearby resistance levels ahead of the setup to cause the stock to potentially reverse and fail to follow through.

Learn How To Trade Earnings Breakouts At Our 60-Day Trading Bootcamp

We teach all of our students how to capitalize on earnings breakouts in our 60-Day Trading Bootcamp. We also teach them how to capitalize on earnings breakdowns, which in my opinion are even more explosive than earnings breakouts. Our next bootcamp starts July 31st. Contact us here ASAP if you are interested in joining.