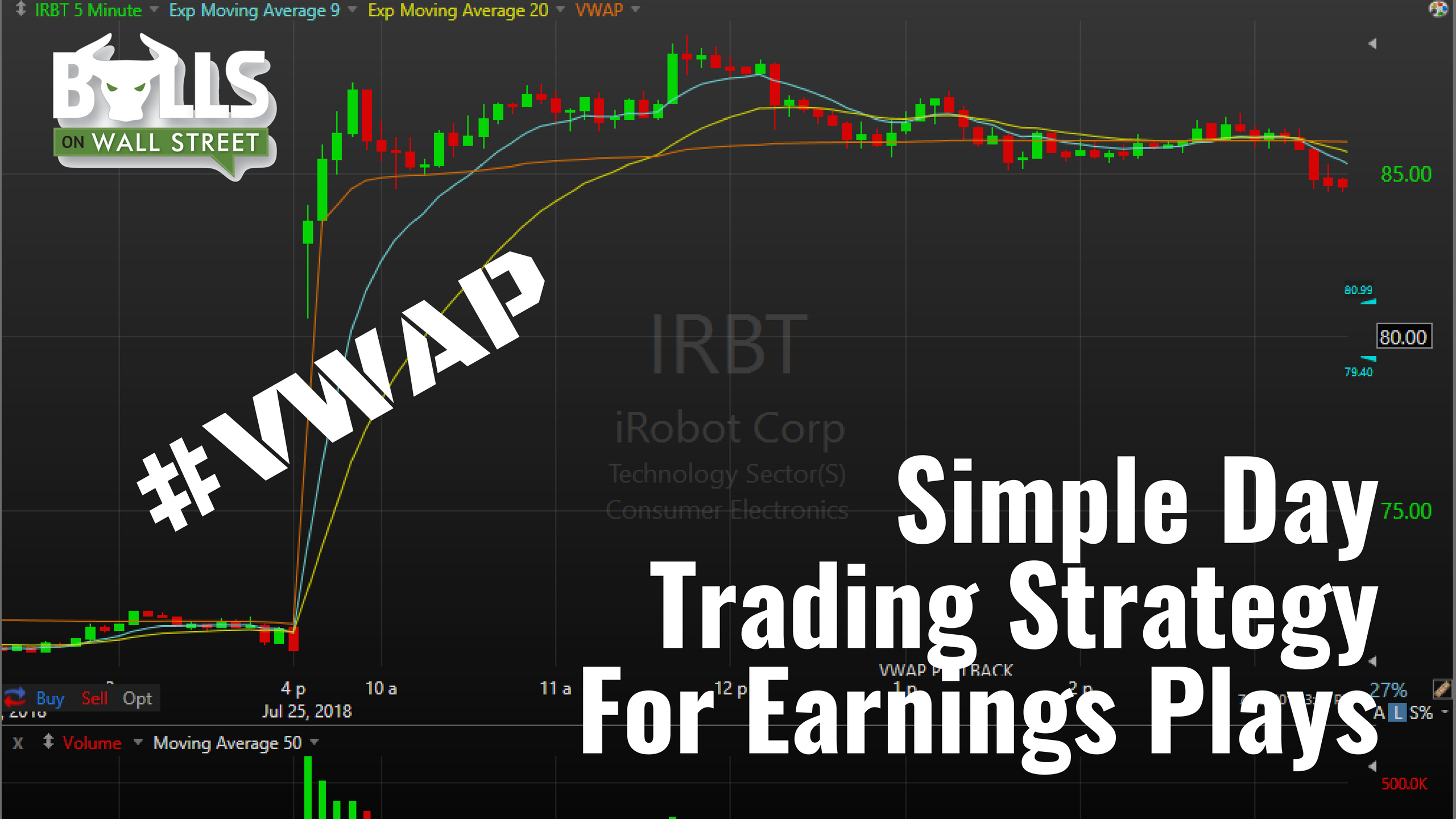

$IRBT was an earnings play that gapped up big on Wednesday in response to better than expected quarterly earnings results. The move in the stock Wednesday morning after the market opened didn’t really offer a great setup to get a good risk vs reward entry point. It happens. Not all stocks will set up and give us an entry point early in the move. That doesn’t mean we can’t trade the stock. After waiting for it to flag we can use our flag strategy combined with the VWAP indicator to get a pullback entry and got us a nice 5% gain on the trade in just several minutes. See the full trade recap in the video below:

Not All Stocks Will Set Up At The Open

Sometimes stocks will just go straight up at the open, without really giving a pullback or anything to give an entry. This is essentially what IRBT did at the open. You must have the discipline to not chase or get FOMO when a stock you are watching makes a big move without you. All stocks pullback eventually, so there is no reason to get emotional and chase a stock if it doesn’t pullback at the open. You need to have an array of setups that will give you low risk, high reward entries after the market open for these scenarios. This is why we use the VWAP to play pullbacks on stocks that have just made a big move.

Using the VWAP To Play Pullbacks

The VWAP stands for “Volume-Weighted Price Average”. It essentially shows you the average price that everyone has entered the stock during that trading day. It is a great indicator to use after the market opens to play pullbacks, and give you an idea of a stock’s trend. A momentum stock trading above VWAP, in general, is considered to be bullish. When it is trading under the VWAP, it is considered to be bearish.

It will often act as intraday resistance and support as well. When we traded IRBT this week we waited for it to pullback to the VWAP to get a low risk entry to capture some of the momentum in IRBT. It’s crucial when you use VWAP to play pullbacks that you wait for the stock to show signs of holding the VWAP area.

Wait For the Stock To Show Signs Of Holding A Dip

You never want to be blindly buy stocks dipping towards the VWAP without waiting to see how they react to that level. You want to see the stock hold the level for a few candles, to show some sign that it will act as support. Nothing in trading works 100% of the time, and you significantly increase the probability of a VWAP pullback working if you wait to see how the stock reacts to the level first. If the stock just dumps right through the VWAP like it wasn’t there, there is no capital loss on your part because you are waiting for the stock to hold that level before putting your capital at risk.

Learn Everything About the VWAP At Our 60-Day Trading Bootcamp

We teach all of our students how to use the VWAP indicator in our 60-Day Trading Bootcamp. Our next bootcamp starts July 31st. Contact us here ASAP if you are interested in joining.