We saw an ugly close to the stock market in 2021 and everyone was reassuring the bulls that the January Effect would make everything okay.

That has not been the case this year so far.

The January Effect is a potential seasonal increase in stocks during the month of January. Many traders and investors attribute the January rally in prices to increasing buying in stocks and other asset classes following the drops that typically occur in December when investors dump stocks engaging in tax-loss harvesting to offset capital gains from the year.

But everyone is wondering why we haven’t seen a strong rally this year, and why we are actually seeing the opposite happen. In this blog we will dive into it:

Why Didn’t The January Effect Happen This Year?

Now, the January Effect is a ‘wall street proverb’. It is not a 100% set-in-stone rule. Over the course of the month of January, we won’t have an increase in price every single day, and there is no guarantee it will happen. The market is volatile and shifty and really doesn’t care what time of year it currently is, what month, day, or week. It will act based on technical analysis and supply and demand.

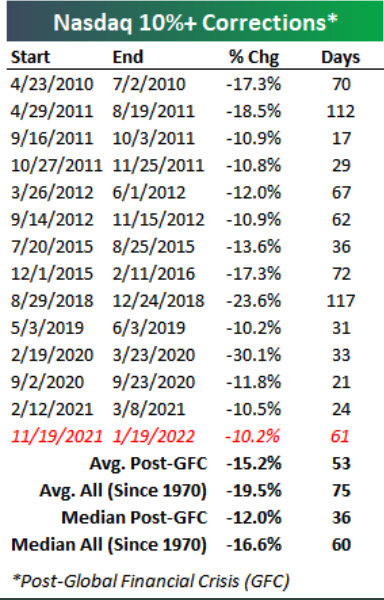

And in this particular year, we just came off the back of one of the strongest stock market rallies of all time. We were due for some kind of correction, and these corrections have not been out of the ordinary in the past decade:

This correction has lasted much longer than any 10%+ correction in the past 3 years. It is a time to be cautious, and maintain realistic expectations of the current market conditions were in.

How to Manage Trading Expectations

Even if the January Effect does hold up to be true by the end of this month, you still have to balance your expectations. Nothing in trading plays out perfect in trading the way you think it will after reading a few books or taking a few courses:

Keeping typical seasonal trends and behaviors like the January Effect in the back of your mind can be helpful, but it shouldn’t be the sole thing you make or judge your trades on. In trading, price action is always king. Often when the consensus expects something to occur in the markets, the opposite happens. The best you can do as a trader is to take high probability setups and most importantly, manage your risk.

Managing Risk in Volatility

Given that the January Effect hasn’t gone as planned so far, it becomes more important than ever to manage your risk aggressively right now. We are seeing heavy distribution in the markets, and the $QQQ and $SPY are failing to hold key support levels. Watch this important video lesson to help you manage risk in these challenging conditions, and stay ahead of the curve: