Trading volatility is a different ball game. We saw it enter the markets for the first time in a while this week.

Despite what the last 9 months have depicted, stocks do NOT go up every week.

Learn how to adapt to changing market conditions. There will be days where you’re afraid to look at your portfolio. This blog will show you how to trade during volatile market conditions:

Keep Size SMALL

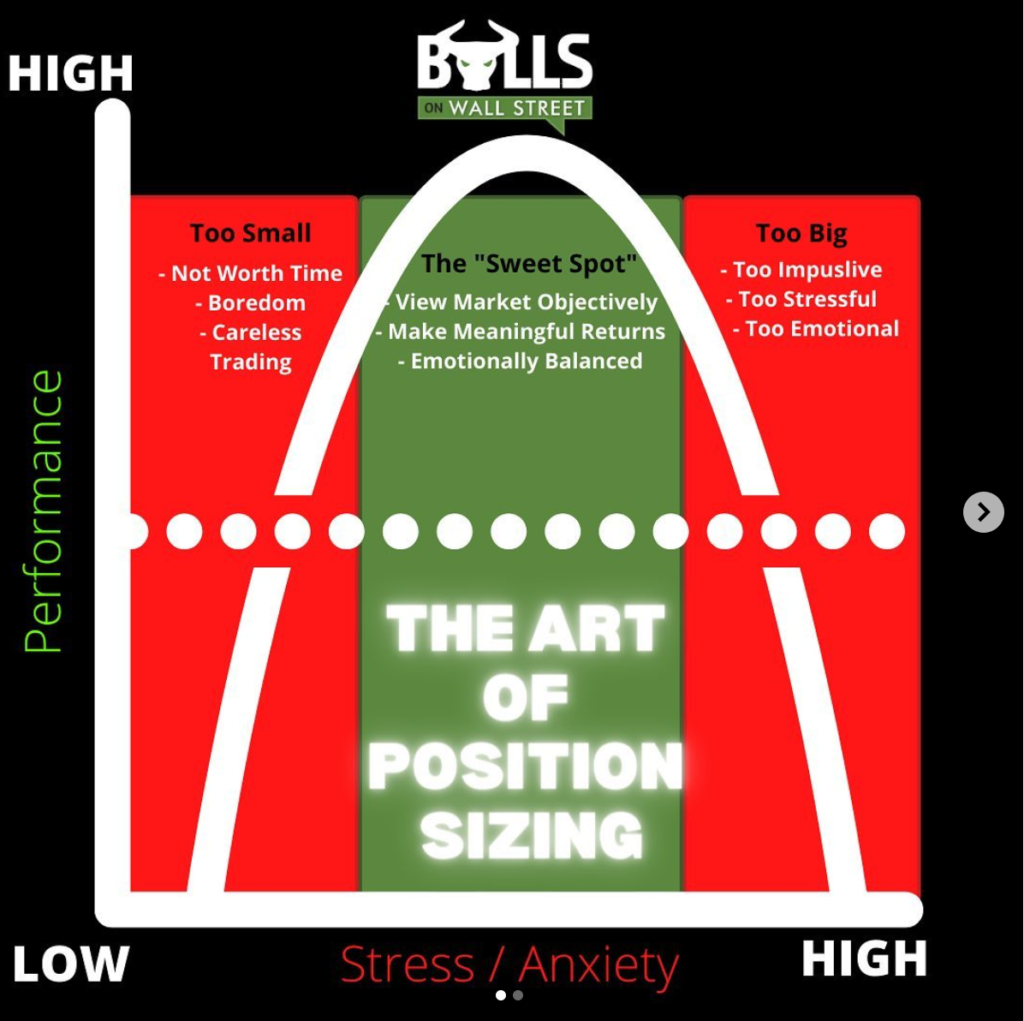

Many new traders are under the impression that increasing position size will automatically make you more money. In volatile markets, trading large position sizes can actually make you less money.

The increased range and swings in your PNL will make you more emotional. As a result, make poor trading decisions. You will see some wild swings in your PNL, and you will focus on the money instead of the market’s trend.

You don’t need to trade that much size to make good money when you have this kind of volatility. Range expands on all stocks when the market pulls back. Keep wider stops, and allow your trades to work.

Scaling In and Out of Positions

My favorite trick to capitalize in volatile market conditions is to scale in and out of my positions. This means that I will buy and sell ¼, ⅓, or ½ my positions, instead of buying and selling the whole thing each time. This useful in volatile market conditions when there a large swings in each direction.

I find that scaling helps newer traders stay less emotional and keep losses small. There is nothing worse than getting a big move in your favor, not taking profits, and then having it completely come back to your entry price and turn into a loss. Taking ½ or ⅓ of your profits allows you to get some cash flow, while also keeping yourself in a position to capitalize on a bigger move. Here is an example:

You can also scale in with your entries. This allows you to keep your losses small if you are not on the right side of the trend. If you only take ½ of your planned position size at first, if it turns out you were wrong you are taking a very small loss. These are key concepts when you trade volatility.

Next time when you get on the right side of the trade, you can add the second ½ of your position and have a much bigger winner. This will keep the risk vs reward ratio strong, and make having a high win percentage less important.

Know and STICK to Your Trading Style

Know who you are as a trader. Know how much heat you can stomach (based on your account size) and your overall skill level and mental mindset is an absolute necessity in this market to know how you should be participating or not participating in this market volatility.

If you have kids or work things that are concentrating on this is also a good time to just sit back and watch and sharpen your knives. It is a common misconception that volatile markets are where people make the most money. In my experience, the best markets are trending markets with almost no volatility as stocks just go up every day, and the bias is obvious!

Those are the markets where you really want to push the pace for 95% of traders even decent ones. Stay safe! Better times are coming!

Killer week in the chatroom the last few days. Everyone did an exceptional job recognizing the shifts in trends and being nimble. If you are new, it is okay to just sit and watch and learn. Be patient, build up your skillset, and wait for your niche setups.

Join Our Next Live Trading Boot Camp

Mindset is the focus of our Live Trading Boot Camp. Learn all the day trading and swing trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp.

Click here to join our next Live Trading Boot Camp!