There are successful traders who use Level 2 a lot in their trading strategy. There are other traders who only use for placing orders and gauging liquidity. I happen to be one of those traders that don’t use in my trading strategies as a buy or sell signal.

Many different ways to trade profitably. The main message of this article that you don’t HAVE to use and analyze Level 2 to become a successful trader. After working with 1000’s of students, I’ve found that Level 2 will actually often do more harm than good for their trading.

Many traders might benefit by hiding it while they trade to avoid overthinking their positions. Before we talk about the different uses of Level 2 in trading, let’s start by defining what it is.

What is Level 2?

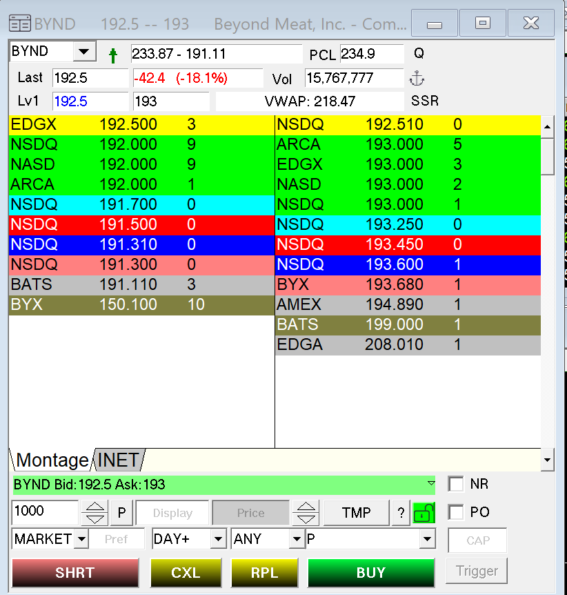

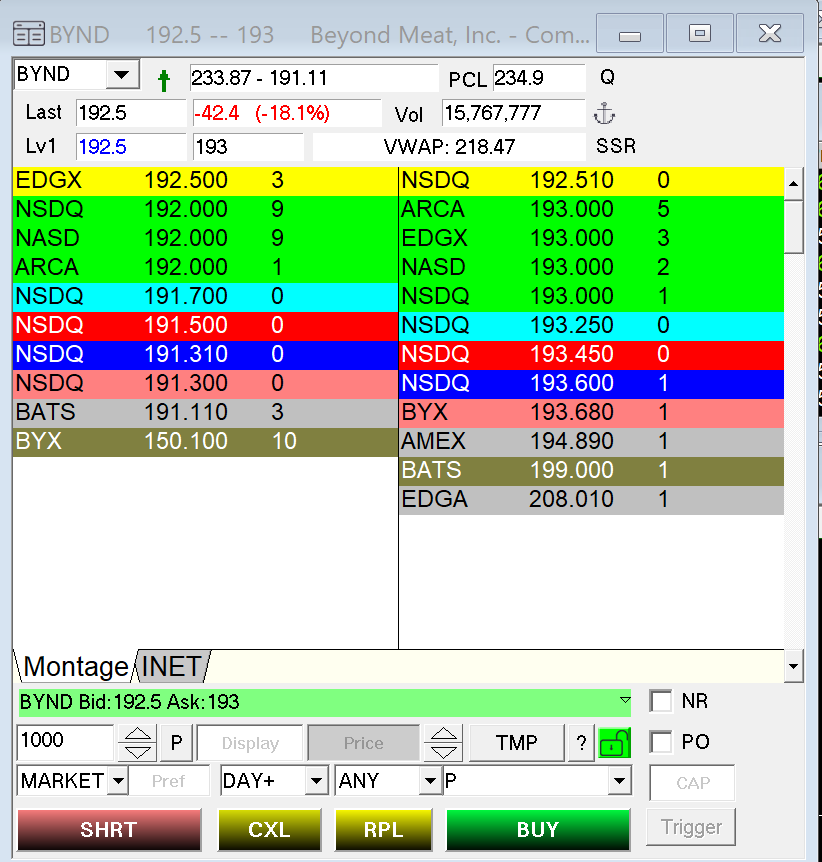

Level 2 is simply referring to the order book for stocks that shows the buyers and sellers for a given stock. This is what a typical Level 2 montage looks like:

You can see the bid side on the left side of the book, and the ask side on the right. The bid side is simply the highest price individuals are looking to buy a stock. The ask, (also referred to as the offer) is simply the lowest price individuals are willing to sell the stock. The spread is a term to refer to the difference between the bid and ask prices on Level 2. Large spreads will often be problematic, as you may get slippage entering and exiting your positions. It useful to use Level II to gauge liquidity of a stock, and where to place your orders to enter and exit a stock.

Ways of Using Level 2

Some traders also use Level 2 to estimate and gauge supply and demand in the markets. Some traders will look for large size on the bid or offer to indicate which way the stock will head. They will also look at one side of the montage stacking up as an indication of high levels of demand or supply looking to enter the market. I’ve found that these uses for Level 2 overcomplicate my trading. Level 2 quotes are often manipulated by market makers.

Buyers and sellers can hide the amount of size they are trying to offload. If you look at the $BYND montage above, the NSDQ market maker on the ask is hiding is size, and you have no idea what he’s trying to unload. Sometimes players will flash large bids and large offers and then quickly pull the order. In my opinion, there is not much that you can see in Level 2 that you cannot already see by just looking at the stock chart!

When you are trading a very liquid stock, like $AMD for example, the montage is moving so fast that you can barely gauge any information by analyzing it. You will just create indecision from trying to figure out if the Level 2 is acting bullish or bearish.

Overthinking Positions

In my experience, Level 2 will usually cause new traders to overthink their positions, and add a lot of unnecessary stress into a trade. They will be long a stock, see a big offer showing 100,000 shares on the Level 2, panic, and then unload their position because they think the stock will tank.

The stock will then just briefly dip, the seller removes his offer, and the stock starts to spike through resistance. The frustrated trader gets even more emotional because he missed the big move he was anticipating, and got shook out just because he was over-analyzing the Level 2.

Some people might say that you should use signals like that to do the opposite, as in go long when someone shows a big size on the offer. That could work, but sometimes market makers do that and actually tank/spike the stock. For me, analyzing Level 2 brings too much overthinking and complication into my trading.

I am a simple man. I like to keep my trading the same way. Worrying about Level II for a lot of traders just makes them overthink things more than they need to. Successful trading comes from simplicity. Many of my students have benefited a ton from hiding their Level 2 once they are in a position.

Summary

The main message of this article is that you don’t have to use Level 2 in your trading beyond as a way of looking at the spread in a stock. If you have found a way of using it to make your trading profitable, keep doing that. There are many ways to make money trading stocks.

But if looking at Level 2 makes your trading more complicated, I would hide it once you are in a position. I’ve found that the best traders keep things simple. And I believe hiding Level 2 for most newer traders will improve their trading performance and simplify their trading day.

Last Chance to Take Advantage of Our 4th of July Discounts

These deals expire tomorrow!