One of the biggest causes of failure for new traders is not being able to maintain a positive expectancy with their trading. Most traders can pull together a good week or even a green month. But most fail to be able be profitable over a longer period of time.

This is often the result of traders jumping in stocks where they have no trading plan, or no strategy with an edge. It is very easy to deviate from your go to setups in choppy markets (like the overall market has been the past few months). Let’s talk about some ways to survive choppy markets, and how you should be trading in the current market environment:

How To Know If A Trade Is Worth Taking Or Not

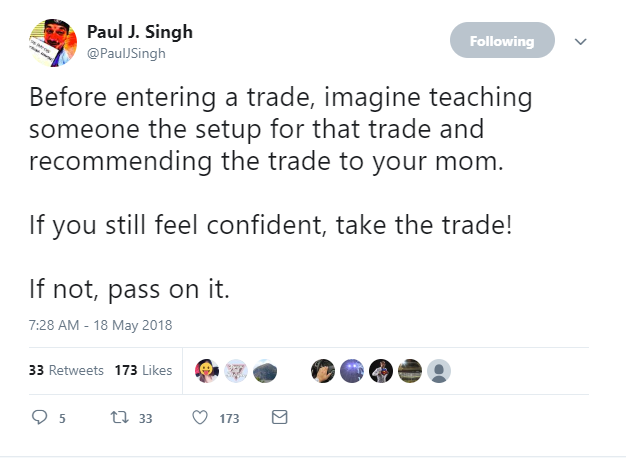

If you have any doubt whether a trade is worth taking or not, think of this:

Traders are only as good as their next trade.

Trending Markets = Obvious Bias

The best trading setups are obvious, and are usually slapping you in the face. Don’t overthink or over complicate trading. An uptrend is an obvious series of higher highs and higher lows. A downtrend is the opposite. If you cannot tell whether a stock is an uptrend or downtrend on whatever time frame you are looking at, you will almost certainly get chopped up if you trade it. An easy way to identify a choppy stock or ETF is when one is constantly breaking over and under its moving averages. Trending stocks will usually trend with their moving averages, and you don’t need crazy analysis to figure which way the stock is going.

SPY vs USO

Take a look at the SPY daily chart below:

In 2018 do you see an obvious trend in the SPY? Since the January grind up and the large February correction, there really has been no obvious trend in SPY. SPY hasn’t really been able to hold a trend in either direction for longer than a couple of weeks. It hasn’t been an ideal market environment for swing trading high beta names the past few months. Compare this with USO and the energy sector:

USO is on a very obvious uptrend. It has been trending with its Daily 50 MA for around a year now. This is the kind of chart you want to see on stocks you are looking to swing trade.

Preserve Your Mental Capital

You never know when an A+ setup will appear. No one can control trading opportunities. Therefore, staying away from sub-par setups and boredom trades is a must. It is hardest to not force trades when you are red or flat on the day. But if you are so drained or you have hit your daily max loss by the time your A+ setup rolls around, you will be even more upset. There can be a huge opportunity cost to over trading in the morning if your setup ends up showing up in the late morning/early afternoon. In choppy markets, you need to be staying on the sidelines and patiently waiting for your setups.

Free Live Training On YouTube

Tomorrow I will be doing a free training where I will share my favorite 11 stocks to watch in the current market environment. The webinar starts at 4:30PM EST tomorrow.