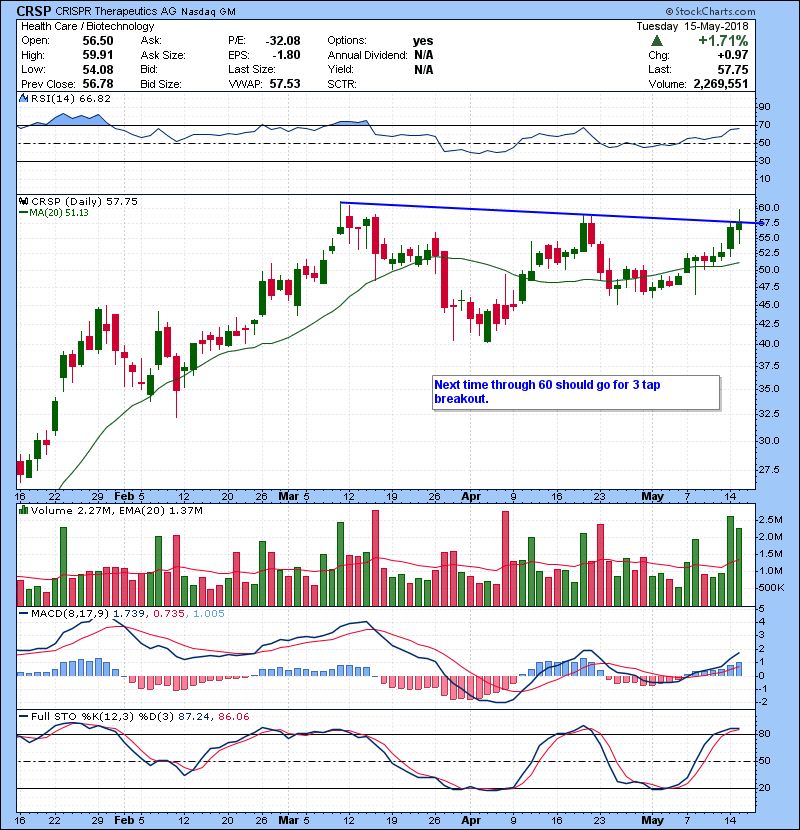

We recently caught a great trade on CRSP in the BOWS chatroom. When trading momentum stocks like CRSP, you have to plan ahead in order to capitalize because the stocks move so fast. The trade also provided an excellent example of the importance of aligning breakouts on multiple time frames. Check out the CRSP daily below:

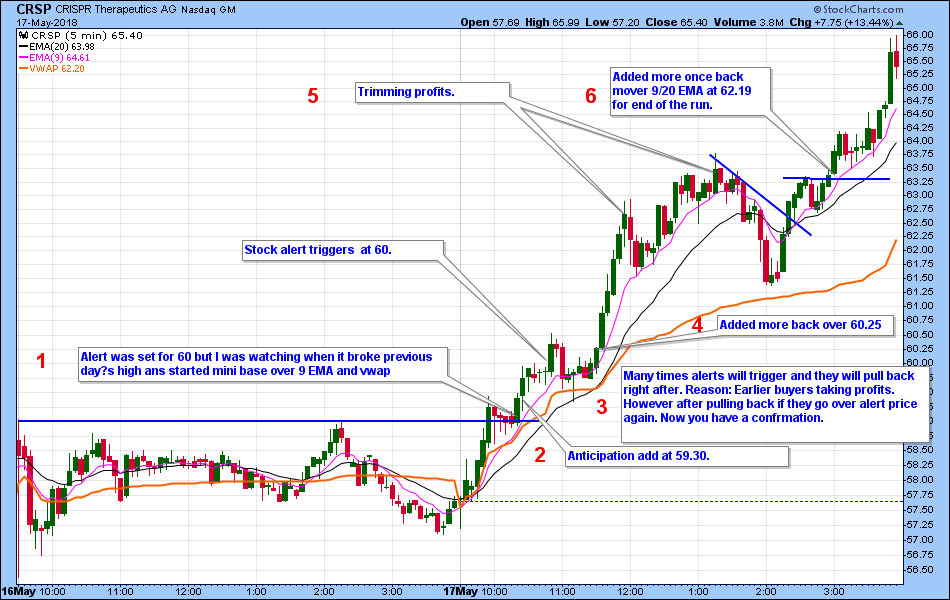

CRSP was on our watchlist going into the 16th (I put out my trading watchlist on the blog the night before most trading days). There was plenty of time to make a trading plan. You can see on the daily that the $60 mark was a key level of resistance. It has been holding a nice flag on its daily, and we have seen multiple tests of that $60 level as well. It had been basing in the high 40’s and high 50’s the past month, forming an obvious higher low on the higher time frame. This bullish action put the stock on my radar this week after it tested the 60 level again on the 15th. The only question was whether the stock on the following day would give us a setup playing with that key $60 level to enter and manage our risk. Check out our CRSP trade and my commentary below:

Add To Your Winners

You can see that CRSP gave multiple flags to find an entry throughout the day. When trading momentum stocks like CRSP, you can get some great risk reward on your trades and catch some big winners by adding to your positions. It trended most of the day with 9 EMA after breaking out over the $60 resistance, which is very common for momentum stocks.

Breakout Retest

CRSP is a good example of a stock retesting a breakout level after breaking out. This is perfectly normal for stocks to pullback to retest, so do not panic if a stock doesn’t immediately start ripping after breaking daily resistence. What you can do is add to your position after the stock reclaims the breakout level, giving confirmation that the daily breakout is ready. You should also pay attention to whole psychological numbers when trading momentum stocks as well. Breakouts through psychological numbers will often be more explosive, and you will often get huge rips like CRSP did.

Learn How To Capitalize on These Plays With Our 60 Day Bootcamp

Bulls on Wall Street teaches exactly how to execute these types of trades along with many other trading setups in the 60 day bootcamp course. As a veteran trader I encourage you to educate yourself if you want to take trading seriously. I highly recommend the bulls bootcamp which starts May 22nd. Contact maribeth@bullson.ws to sign up.