Recent IPO stocks are the best kind of momentum stocks. IQ has been on the top of my watchlist since it IPOed in late March. In the BOWS chatroom we caught a great trade in IQ a few days ago, after it broke out of its flag pattern from the last couple weeks. Let’s talk about how to trade IPO stocks, and how you can capitalize on them in the future:

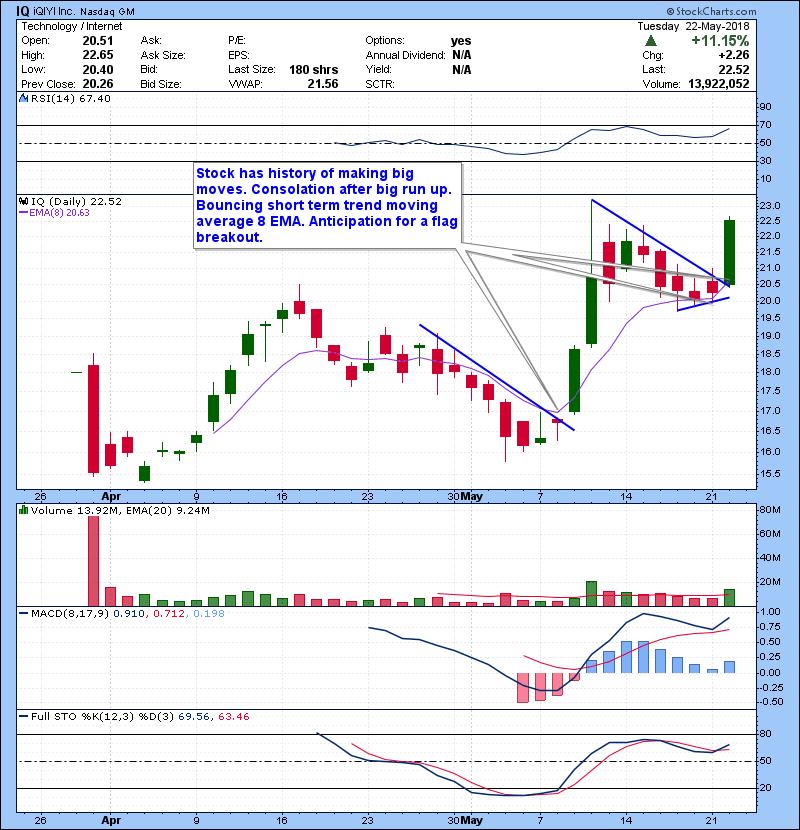

IQ Daily Chart

IQ Daily Chart

IQ has the perfect daily for a momentum stock. Because it’s a recent IPO, there is not much price history. There is no real resistance besides the recent highs at 22.5-23. Once it clears that level, its blue skies ahead. You can see its’ textbook bull flag on its daily chart. When you see a pattern like this on a recent IPO like IQ, it should be on top of your watchlist.

A few weeks ago it had monster run from 17 to 23 in two days. It has already demonstrated its ability to make big moves intraday, and has been consolidating bullishly in the higher part of its range from the recent push. It has also been pulling back on light volume compared to the run-up, which is a bullish sign.

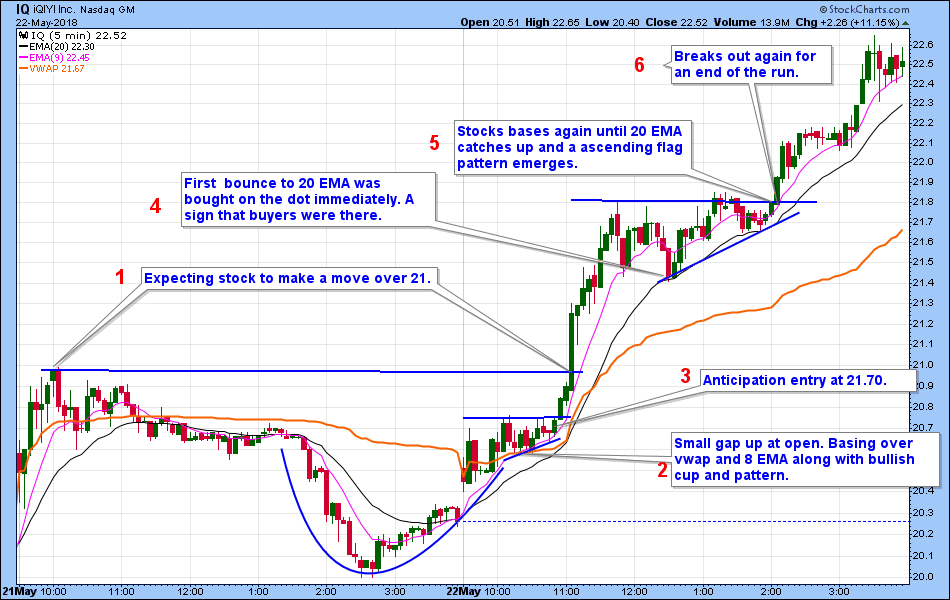

Our IQ Daytrade

Here is my IQ trade with my commentary:

21 was the key level I was looking for to break to confirm the flag breakout. At the open IQ was basing and grinding up slowly with its 8 EMA so I took a feeler in anticipation of a break of the 21 resistance level. Once we got over that 21 level, it was likely to go on a big run as there was no resistance until the $22.5-23 level.

You always want to pay attention to how a momentum stock reacts on its first pullback and after breaking a resistance level. IQ had a very orderly pullback to its 20 EMA, which gave an opportunity to add for an end of day breakout. The stock will be on watch for more momentum in the upcoming days, now that it is above all-time highs.

How To Trade IPO Stocks

IPO stocks are the best kind of stocks for momentum traders like us. They typically have great range, solid liquidity, and tend to have great follow through in either direction.

Why do IPO stocks typically make such big runs? Simple answer: very little price history. This means there are very few resistance and support levels on the daily chart, meaning there is very little reason for an IPO stock to reverse once it starts a trend. Some other good examples of recent hot IPO stocks are DBX and LFIN. Learn more about how to trade IPO stocks in this video here:

Free Trader Assessment

If you want some direct feedback on where you are as a trader and your trading goals, you should take our free trader assessment for advice on how to take your trading to the level. We can provide more details into finding and trading IPO stocks.