One of our student/member wants no know about earning season.

Earning season comes after end of every three months period. Usually earning season begins one to two weeks after the end of three month quarter. In January through February, April through May, July through August and October through November. There are analysts to cover a particular stock and have an estimate of what the next earning number might be via their research. An earning beat happens when the earning number exceeds analyst’s estimates. You can find upcoming earning dates , estimates and actual earning via various financial sites on internet such as Nasdaq , Yahoo Finance or Briefing.com .

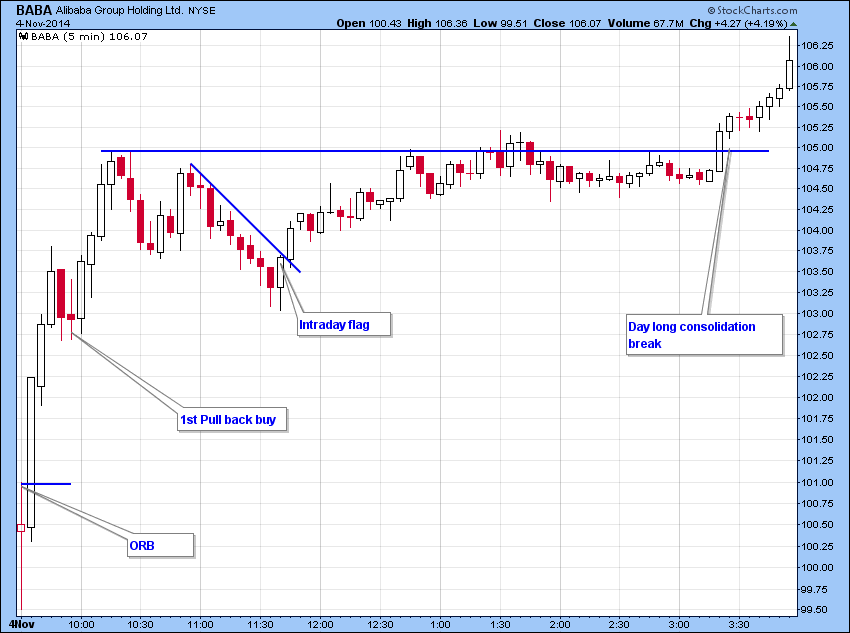

Traders want to see if the earning number was a surprise with actual number is way beyond what analysts had expected . In our chat room trading stocks with earning is one of our “Go to” trading setup during the earning season. As a short term trader we are not really interested about what the actual earning number is ,what we are interested in is the reaction in price after the earning news. Ideally for trades, we want to see low float stock (Less than 100 million shares available for trading) with a beaten up chart as investors gave up hope based on previous bad earnings or news, it can also be recent IPO stock that has been trading for less that two years. We are interested in stock that just reported earning and gaping up 2-3% premarket with strong volume. Once the market open and the stock gaps there are various trading strategies that can be used to trade that stock. We use ORB, 1st pullback, intraday flag or Day long consolidation strategies in our chat room to trade the earning plays . These strategies can be used both to buy stocks with positive earning news or shorting stocks with earning disappointment.

Check BABA, a recent IPO stock that came out with earning on November 4th and had a great run on earning day. Intraday chart on November 4th followed all our strategies and provided many opportunity for trades. If you would have bought the ORB at 101 and held some the stock was hitting 119 on November 10th !

If you want to learn strategies like this,you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders.

Also if you are interested in our trade alert services and chat room , take a free trial! check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman