Excuses will never help you achieve your goals.

In trading, it is easy to play the blame game. After working with 1000’s of students over the past 12 years, we have heard it all.

If you find yourself making these excuses, change your mindset ASAP. Get out of your own way.

These 5 excuses are the most destructive to your trading career:

The Market is Rigged

This is the most common excuse of traders who struggle with consistency.

The market is random. It's not easy. But that doesn’t mean you cannot have an edge. Be the casino.

The casino always wins in the long run cause they have a statistical advantage. The gamblers playing slots may win once or twice, but in the long run, their profits will always end up back in the casino. They just need a large enough sample size for their edge to show.

Sure, institutions have advantages over retail traders. Brokers don't care much for us either. But it isn’t enough to stop you from becoming a consistently profitable trader. Become the casino, not a gambler. The game is what it is.

I am Not in Control of My Trading Results

An internal locus of control is essential for becoming a consistently profitable trader. You cannot succeed in trading, business, or life without being accountable.

You WANT it to be your fault. If it’s your fault, you can fix it. The more accountable you are, the more control you have over your trading career. Focus on what you can control versus what you cannot:

Focusing on improving the controllables will improve the outcomes of the uncontrollables.

I am Unlucky

Self-fulling prophecies are real. If you believe you are unlucky, bad luck will befall you.

“The harder I work, the luckier I get”.

Let’s compare two traders. One trader spends an hour the night before scanning, reviewing charts, journaling, and building his watch list for the next day. Another trader goes out drinking until 2AM, wakes up at 9:20, and then hops in his chatroom for hot stock picks.

Which trader is likely to make money the next day?

Maybe the degenerate makes money and the prepared loses.

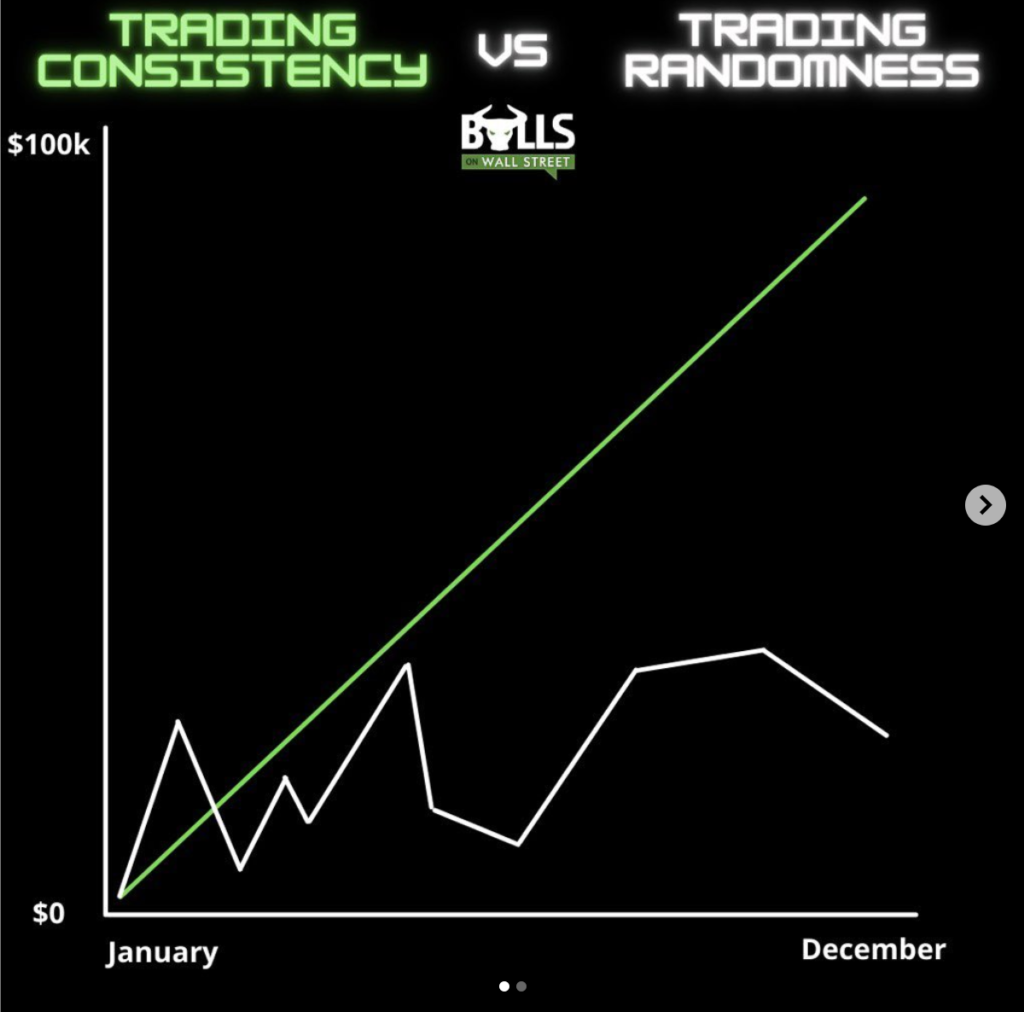

But what if each trader does this routine for 3 months straight, who do you think will be up more? Eventually, randomness will dominate the unprepared's trading results, and consistency will find the dedicated trader.

Stick to a proven process and routine, build the right habits, and watch how “lucky” you get.

Market Makers Are Taking Out My Stops

Dumbest excuse I’ve heard for people not using a hard stop loss.

No one on wall street cares about your 100 shares of Tesla. They aren’t going to dump half a billion in stock to tank it to take out your stop. Stop keeping your stop loss so tight. Give your trade room to work.

Use a hard stop if you struggle with taking big losses. It will make the trade so much less stressful. Your risk is defined, the worst-case scenario is known. The trade either works or it doesn't.

I Don’t Have the Time

It’s never a question of time. It’s a question of priority. What is more important than building up a skillset to create another stream of income?

And not just any stream of income. A stream of income that has no ceiling on it. No boss, no employees, very little overhead. All you need is wifi and a computer in terms of equipment.

Even if you can dedicate just 1 hour a day to studying. Make it a daily priority. See the potential of mastering this difficult, but life-changing skill.

Summary

The person in the mirror is the only person who can make you become a profitable trader. Excuses don't grow your wealth. It's a similar process to succeeding in business, fitness, or to achieve any other worthwhile outcome in life.

Get educated, find mentorship and a community, and then execute. Find a trading buddy to hold you accountable every day. Dedicate yourself.

Join Our Next Live Trading Boot Camp

Mindset is the focus of our Live Trading Boot Camp. Learn all the day trading and swing trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp.

Click here to join our next Live Trading Boot Camp!