We’ve gotten some great feedback about our new day trading chatroom so far!! I’ve gotten some requests to do a trade recap of some of my recent trades. So here is a breakdown of some of the trades I took yesterday, and an overview of my thought process behind each trade:

$JNUG: Nailing it Long and Short

Gold recently had a major, multi-year breakout over the $1370 resistance level. Gold miner ETF’s like JNUG have started to find high relative volume and range, making them amazing vehicles for day trading. JNUG is a 3x leveraged gold miner’s ETF, and it is one of my favorite instruments to day trade when Gold starts to trend and find momentum.

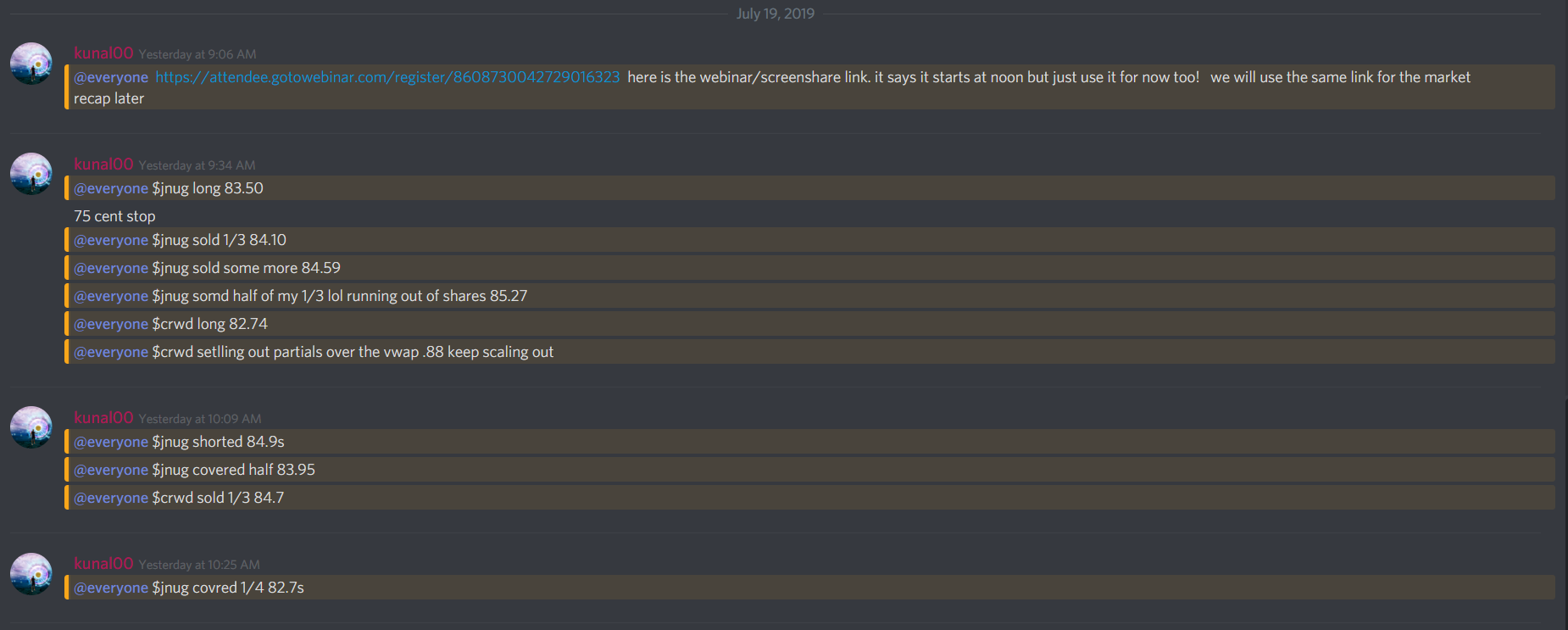

It is a leveraged ETF, so it is great for day trading, but not what you want to swing trade or invest in long-term. Yesterday I hit JNUG long and then flipped short during the market open:

Let’s take a look at its intraday chart and I’ll breakdown my thought process and trading plan:

JNUG yesterday was gapping down from its prior close. This is the ideal scenario for a R/G (red to green) setup. JNUG had a strong day on Thursday and went up about 20%. It had demonstrated that there were momentum and trend in the name. At the open once it tested its VWAP (Volume Weighted Price Average) and held I got long at $83.50, with tight risk under LOD (low of day). I scaled out into strength (took most of it off too soon in hindsight!) in the $84-$86 range.

Recognizing the Fizzle Potential

But after such a big move the day before, it needs to have a pullback to offer a high probability long trade. The gap down was the pullback that was needed, and what gave me conviction for the long bias at the open. But you can also see by its daily that it had two big up days prior. It would be hard to expect a long to follow through much beyond yesterday’s HOD (high of day).

Once it started to reject yesterday’s HOD and fail to hold over the level, it was signaling to me that it was about to pullback. Once it cracked VWAP and could barely find a bounce, I knew that the backside was in. I got short when it pulled back to retest VWAP and scaled out into the next flushes.

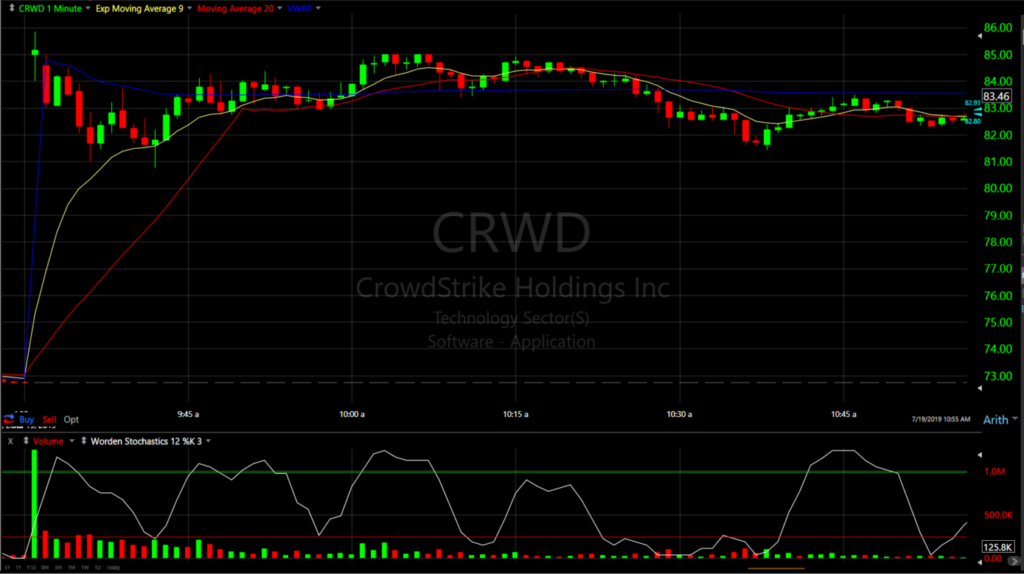

$CRWD Trade Recap

CRWD was gapping up big in response to a strong earnings report. It was at all-time highs, so my bias was to the long side, especially since it was a recent IPO with a strong uptrend. Here is a look at its intraday chart:

My thought process was that the selloff at the open would get bought up eventually. Sell-offs at the open are actually a good thing sometimes when you are looking to long something, as it offers you better risk vs reward entries, and an opportunity to get in at lower prices.

I got long at $82.74 once it started to settle a bit and work out the sellers. My plan was to scale out into strength. I took out 1/3 at $84.70, and my plan was to hold the rest for a pushover HOD. We were never able to get enough momentum to break HOD, so I took off the rest of my shares once it broke back under VWAP. This will be on the top of my watch list next week for more momentum to the long side.

Summary: Biggest Take-Aways

- Have a Nimble Bias: Price Action is King

- Mark Out Key Levels on the Daily BEFORE Taking the Trade (Knowing where JNUG’s HOD is, and understanding the potential for it to act as resistance)

- Have a Trading Plan and STICK to It: Entry, Stop, $ Risk, First Target, Exit Strategy

Click here to learn more about our new day trading chatroom.

Get Started With Our Free Trading Kit

Our trading kit is the best free resource out there for new and struggling traders. It includes

- Intro to Trading Course

- Comprehensive Trading Handbook

- Trading Consultation