It doesn’t matter how experienced you are as a trader, there is a 100% chance you will encounter a trading drawdown at some point in your career.

Chances are you are reading this blog because you are in one now, searching for a way out of it… fast.

Lucky for you, we have some great tips on how you can snap that losing streak quickly, and get back on the winning path. Let’s jump in:

Defining a Trading Drawdown

Let’s start by defining what this is. There are signs that indicate you are heading for one before it gets too bad. You NEED to know these in order to prevent them from destroying your account, and then you cannot use the strategies we detail in this blog.

This video lesson from Kunal Desai, a veteran trader with over two decades of experience, will define what a trading slump is, and signs to watch for that you’re heading into one:

-

Understand What You’re Doing Wrong

This sounds simple, but it goes deeper than just analyzing your trades from a bird’s eye view and saying ‘oh my risk reward sucks’ or ‘oh I can’t long stocks’.

You have to take a deeper dive into the specific problems that are holding you back.

- Look at your stats during your losing streak on every setup and find out which ones, in particular, you are losing on.

- Check your notes on every trade you made recently and find out what recurring patterns are causing you to lose.

- Categorize your mistakes and figure out what’s recurring

- Think back to what personal habits have changed in your life over the past few days/weeks.

- Have you got less sleep?

- Arguing with your spouse more?

- Not focusing on nutrition/dieting like you used to?

All of these things above can affect your trading performance in a BIG manner.

After you take a deep dive into your stats and determine what is specifically causing you to lose consistently, write down a game plan and stick to it for 2-3 days going forward.

-

Trade Familiar Stocks & Set Ups

When you’re in a drawdown, you have to stick with what you do best. Tying back to the previous point, all of your trading journal data will show you what stocks and setups you perform best on. During trading downs, narrow your stock and setup selection to JUST these few setups and names. Don’t be a jack-of-all-trades when you’re cold.

-

Size Down

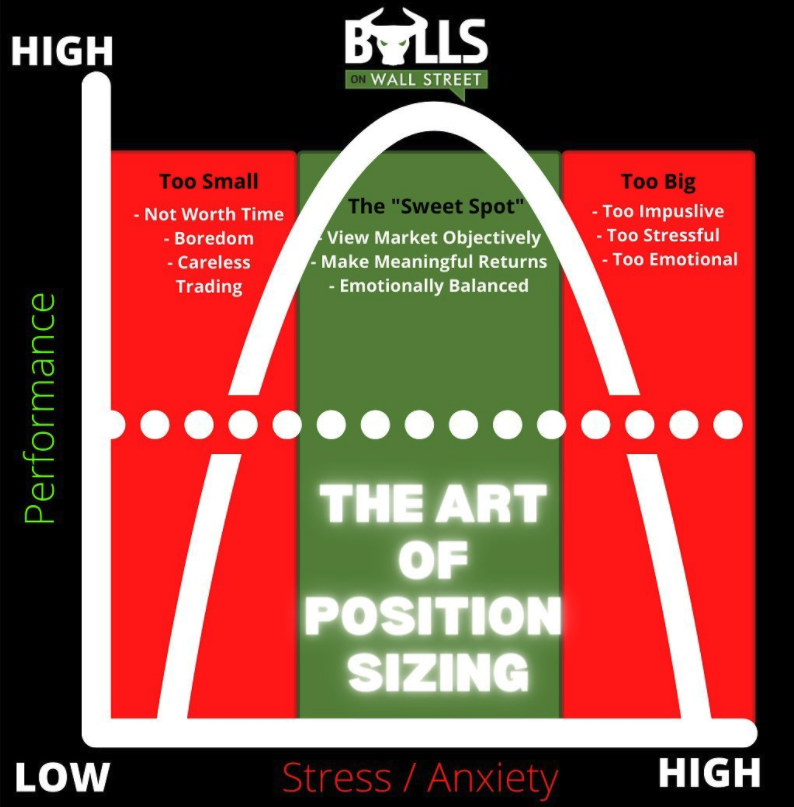

A lot of traders don’t realize that the sizing they are putting on their trades can be the biggest culprit of a losing streak!

Whenever you see 2-3 red days in a row, you immediately need to review your risk-reward profile, sizing parameters (how much you are risking dollar-wise per trade), and cut your risk by 25%-50% per trade until you catch your stride again.

Having too much size on trades or even sizing up during a losing streak to try to ‘make everything back fast’ is a dangerous game.

Not sure if you are taking too much size on a trade? This graphic below will help determine that for you:

-

Take A Mini ‘Vacation’ & Step Away

During a losing streak, this is way easier said than done. The urge to get back to the screens, continue trading even harder, and breakthrough the losing streak is high.

BUT continuing to force trades during a losing streak is the absolute worst thing you can do. It will propel you into a deeper, darker place mentally and financially. Step away, take a break for a day or two, clear your mind, and come back stronger.

5. Network

This is why it is so great to have a community like we have here at Bulls on Wall Street. We have hundreds of full-time traders communicating back and forth in the group, providing feedback to each other, and overall just showing a willingness to help others move forward.

Showing your trades to someone else who can review your trades and habits with a clear, objective mind will give you some great clarity on what you may be doing wrong. Talking through the losing trades with others will help you see things from a different perspective and make necessary adjustments to your game plan going forward.

Don’t struggle on your own. Everyone has trading drawdowns, so check your ego at the door, network and be open to sharing the setback with others.

Join Our Next Live Trading Boot Camp

If you are serious about becoming a full-time or part-time trader this year, apply to see if you qualify for our next boot camp. Limited seating.