Market volatility has caused big headaches for investors this year. Earnings, Russia-Ukraine Uncertainty, Inflation, Rates, and a variety of catalysts are spooking the market every week.

With so many macroeconomic conditions and major headlines floating around, the market could drop or pump at any given moment. Moves are more violent, so you HAVE to know how to manage risk properly.

Trading is not just about what you make, it’s what you keep. Today, we are going to cover our top tips for managing risk day trading volatility that you can implement immediately to keep you profitable and safe this year:

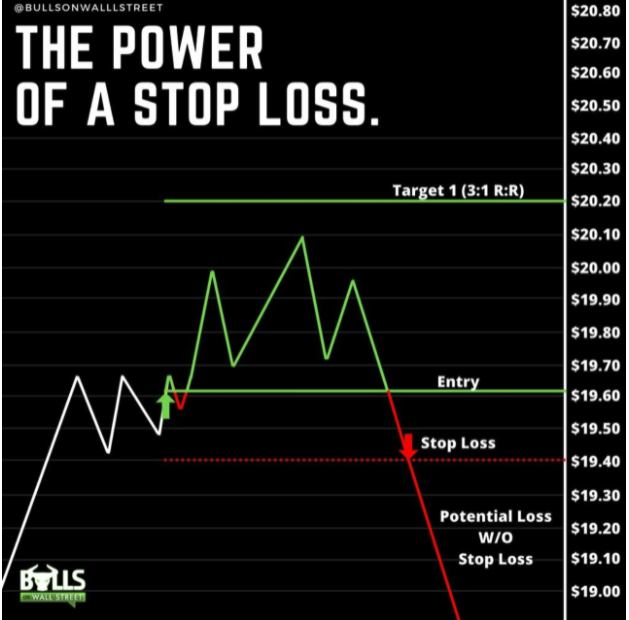

Use Hard Stops

Using hard stops during volatile macro markets or even on individual names that are super volatile themselves is way underutilized for some reason. A great thing to do is to sell a portion of your position into quick spikes, and then keep raising your stops to ‘trail’ the position as it moves in your direction. This is called scaling out, and is one of the best methods to use for day trading volatility.

Without a hard stop in place, even if you look away for a few seconds, the floor could drop from under you… fast. Exactly what you see in this photo could happen, so make sure to set hard stops, sell a portion of your position into spikes, and trail to maximize your position.

Be Selective and DON’T Over Trade

Opportunity may seem like it is everywhere. But, that doesn’t mean you should spread yourself thin and try to trade everything. Focus on a few A+ setups that fit every bit of your criteria, and trade that. Don’t settle for B setups during volatile times.

It is not the time to trade anything and everything. Be selective so you don’t get caught in ugly situations, and so you can maximize the moves.

Be Patient At The Open

On a regular day, the stock market open is the wild west. It is the most volatile time of the day, with tons of eyes on the market and money is trading hands every which way.

In volatility, DON”T be the guy pressing the gas pedal full throttle at the open. Don’t blow through your daily max loss in the first 10 minutes and then miss an A+ set up later in the day.

Opening sessions in volatile market conditions are 10x more violent than regular opening sessions. Wait for the market to confirm its direction, and ride that trend. We always tell our students to wait out the first 10 and 15 minutes before making a trade.

Only 5 Seats Left in Our Next Live Trading Boot Camp

Click Here to Save Your Boot Camp Seat