What’s the BEST daily routine for traders in the morning?

Do you roll out of bed 15 minutes before the market opens, hop in your chatroom, and ask what stocks you should be trading?

Or do you wake up early, have written trading plans, and know exactly what you’re doing during each phase of the trading day?

Routines are the biggest difference between winning and losing traders. Having the right routine makes success a HABIT. You’re doing everything you need to be doing without even thinking about it.

Here are 3 things you need to create the best daily routine for yourself before the market opens:

1. Build and Refine Your Watch List

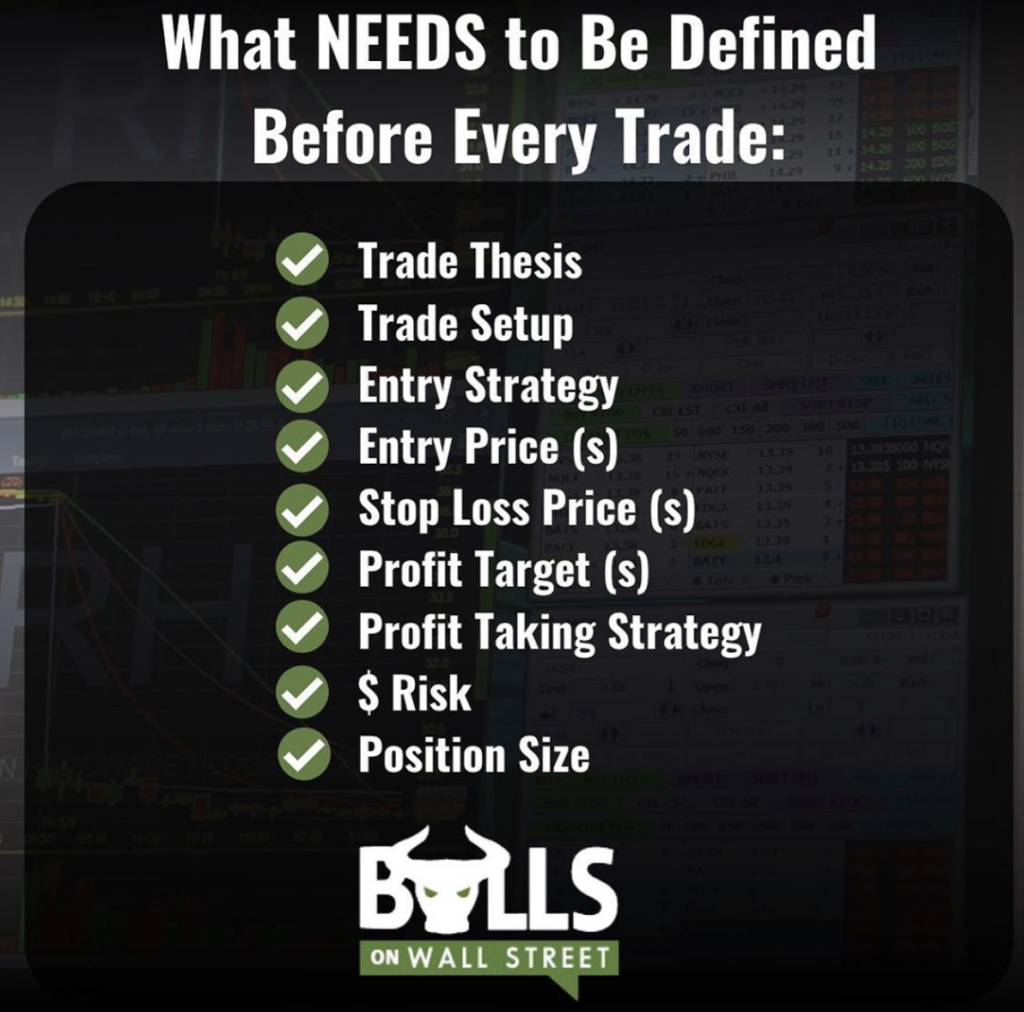

Most traders don’t do this right. They have tickers they are watching for the trading day, but they don’t have trading plans. No plan, no trade. There is no point in watching stuck unless you know:

Don’t take any trades unless you have all of this pre-defined. Print out that graphic and keep it on your trading desk. For every stock on your watch list, have all of this written out BEFORE the trade is taken. This will take your trade management to the next level.

2. Review Your Trade Journal

The best daily routine for traders is reflection. Without reflection, there is no progress. And what is not measured, cannot be improved. Study your trades either the night before you go to bed.

Study your best trades: What worked well? Was this trade replicable? What do all of your winning trades have in common?

Study your worst trades: What do all of your worst trades in common? What patterns of behavior caused this? What measures can you take to prevent this from happening again?

Focus on the PROCESS behind your trades, not just the outcome. You can make bad trades where you make money and good trades where you lose.

3. Study BIG Winners

Momentum stocks are what you should be on the hunt for. Ask yourself: Where can you put your capital that will give you the best return in the shortest period of time?

Study stocks that were in play yesterday. Is there a reason for them to continue? To reverse? To trade sideways and chop?

Study explosive stocks. Know the characteristics that these stocks have in common. Once you learn these characteristics, you will be able to get in these explosive stocks BEFORE the move is made.

Get Early-Bird Pricing Our Next Live Trading Boot Camp!

We will show you exactly how to build the best daily routine for yourself in our Live Stock Trading Bootcamp. Early-bird pricing ends on April 1st!