Most fail to comprehend the exact nature of the relationship between the Federal Reserve (aka the ‘FED’) and the stock market.

The Federal Reserve is the central banking system of the USA. Having a basic understanding of its function and how it affects markets will give you a huge edge over most retail traders.

So why do people pay so much attention to it in recent years? Because it controls the money supply in the US and interest rates, which have been shifting dramatically in the past 18 months.

Nowadays though, people see the FED as a major market mechanism, which truly it is. Let’s start by defining what the Federal Reserve is:

What is The Federal Reserve?

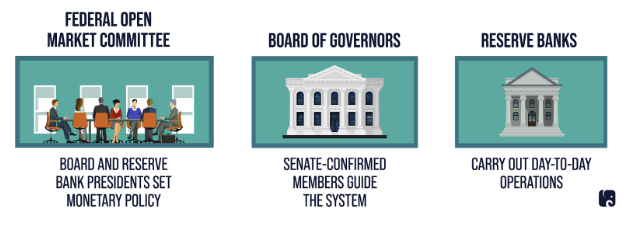

The Federal Reserve was created in 1913 following a series of tough financial panics, its purpose was to establish central control of the monetary system in order to alleviate financial crises.

It is the center for monetary policy in the United States. It controls the tightening and loosening of monetary policy in the country, and sets many key metrics like interest rates for example to combat inflation.

Basically, think of the Federal Reserve as being the controlling body of all things that have to do with fiscal policy, and the leader of the Federal Reserve is the chairman, Jerome Powell. This video dives into more detail:

How does the Federal Reserve Affect the Stock Market?

Being that it controls monetary policy, the Federal Reserve has a major impact on the US stock market. The announcements, debates, and policies they release have major short and long-term implications on the entire economy. The main thing that investors and traders focus on when Jerome Powell and the FED release information, is what they are doing with interest rates.

Typically, when the Federal Reserve cuts interest rates, it causes the stock market to go up. When the Federal Reserve raises interest rates, it causes the stock market to go down. That is usually the reaction, and interest rates and adjusted to try to control things like inflation.

Here’s another good 3-minute video explaining the relationship further:

Why do we care about Jerome Powell?

Now that you know how important the Federal Reserve is and how drastically it can affect the overall market, you can probably piece together why Jerome Powell is so important, and why every trader always wants to know when he’s speaking.

Powell is the chairman of the FED, meaning whenever an announcement is being made, he is the one speaking about it publically. He is sort of the ‘spokesperson’ for the FED, and has a lot of influence on the decisions the regulatory body makes as a whole.

If you look at Powell’s schedule (which you can find on tools like Finviz, and even on the Federal Reserve website), you can see he travels a lot and speaks a lot about different topics regarding the FED’s outlook on fiscal and monetary policy, as well as their plans for the future.

Knowing the times he will be speaking as a trader and investor is crucial, because at any given time he can either say something material that can affect the market, or allude to some major announcement or change coming up. Jerome Powell is an extremely important person to know as a trader and investor, as ultimately, his words can drastically affect the market, and your trade in an instant.

Make sure to always know where he is, what he is speaking about, and when he is speaking. If you see a major release about monetary policy, rates, and fiscal policy coming up shortly, as well as any major FED meetings, it is best not to hold positions into that news, and look to trade when the announcements and speeches conclude.

What to Pay Attention to in 2023

The question on everyone’s minds this year is when is the Fed going to start cutting interest rates. This of course is dependent on the trend of inflation. If the monthly CPI reports indicate the inflation is downtrending, the Fed will get hawkish, meaning they will be more open to entertaining the possibility of lowering rates.

In our Live Trading Boot Camp, we dive into more detail the exact strategies that will give you success in the 2023 market conditions, so you will know how to trade as the Fed adjusts its monetary policy and markets shift. The class also gives you LIFETIME access to all future boot camps, so you are always on top of what strategies are working best in any given market!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp