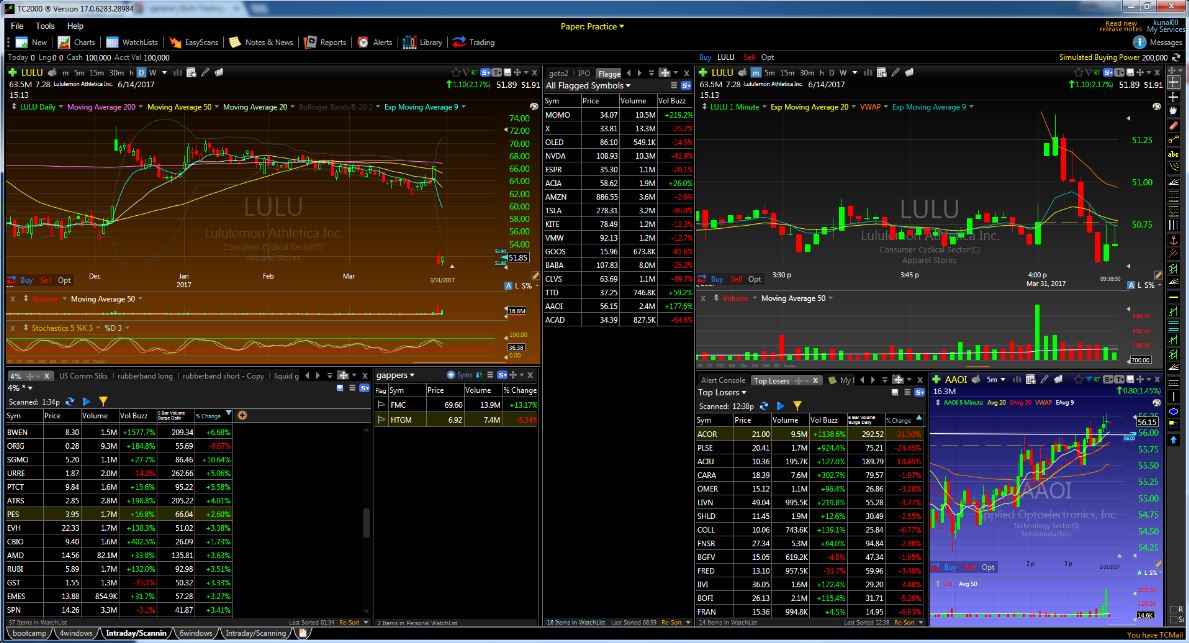

On March 30th, we played LULU for a Gap and Go, but in the short direction. But not too long ago we posted an article saying that momentum stocks can still have enough juice to run for a second day. Well, we kept LULU on our watchlist to see if it had more potential to fall lower. So on March 31st, when we saw weakness in the morning we went for it.

LULU Gap Down

Now this was a quick scalp trade as $LULU found support at the exact same spot as it did the previous day, $50.50. So before I entered the trade, I needed to make sure that I had a strong enough edge to make the trade worth taking.

Taking a look at the 1 minute chart, the stock popped up to $51.40 early on. But it also setup an Opening Range Breakdown pattern underneath the $51.15 level. Once the stock broke under I entered for a short. I lost a few cents to slippage but got in at $51.10. Immediately the stock tanked all the way down to $50.50 and I scaled out along the way. Once the stock started to bounce, I exited all of my shares and I’m not surprised. If you take a look at the price range from the previous day, LULU bounced off of support at this exact level, $50.50.

Although this was a short scalp trade, it’s always worth it to keep momentum trades on your radar for another day. This was actually my first trade of the day. Starting off the market with a calm, calculated, and profitable trade sets you up for the rest of the day. If you really want to learn every aspect of my trading system though, the Bulls Bootcamp is the way to go. It’s an intensive 60 day course to teach you exactly how I trade and why. To learn more or signup, email me at kunal@bullsonwallstreet.com today!