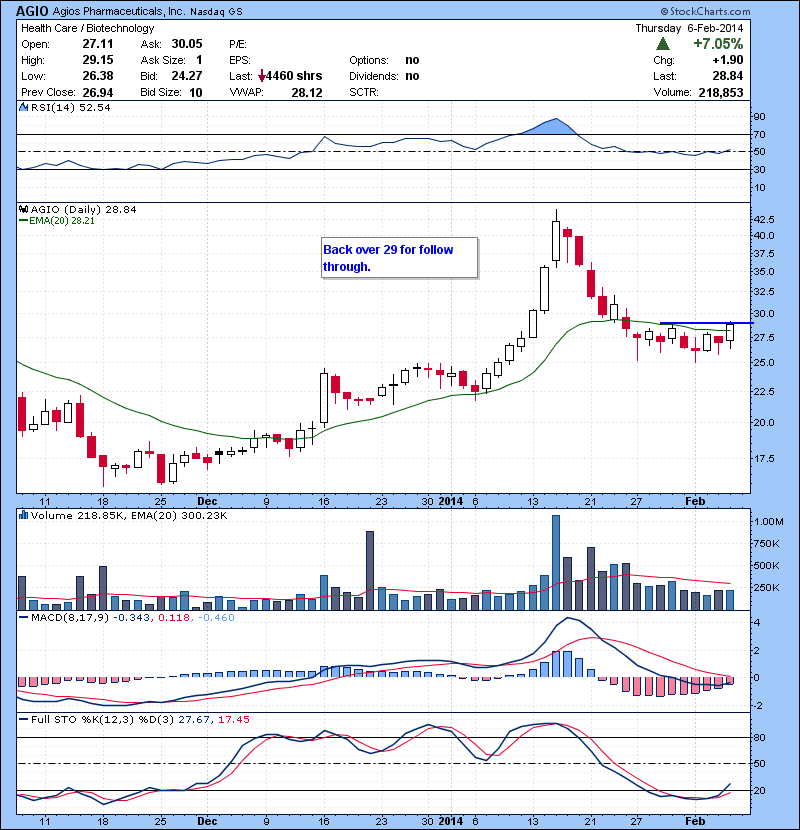

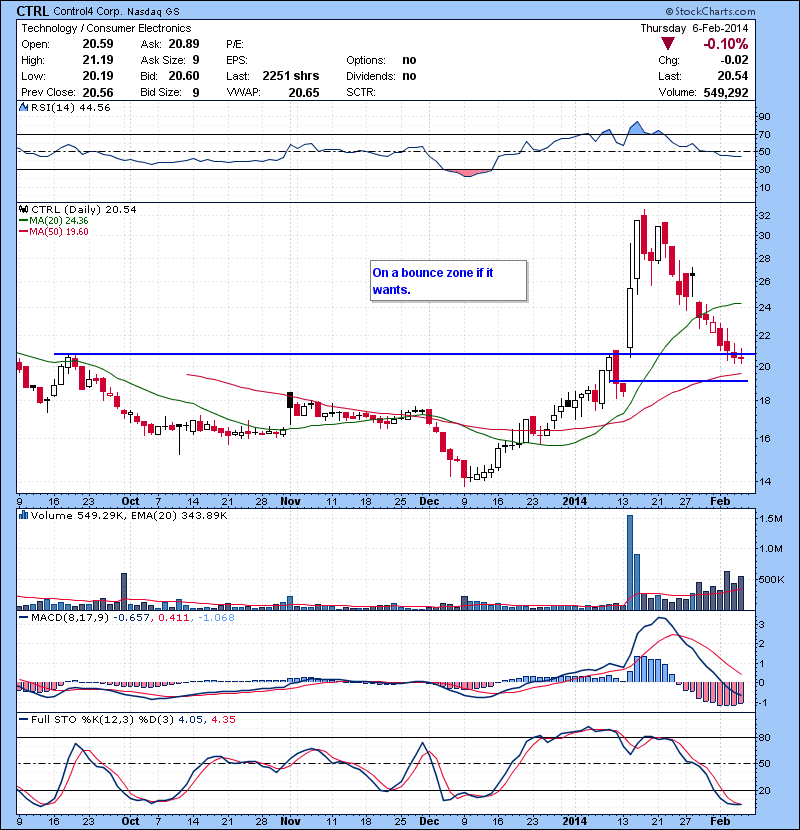

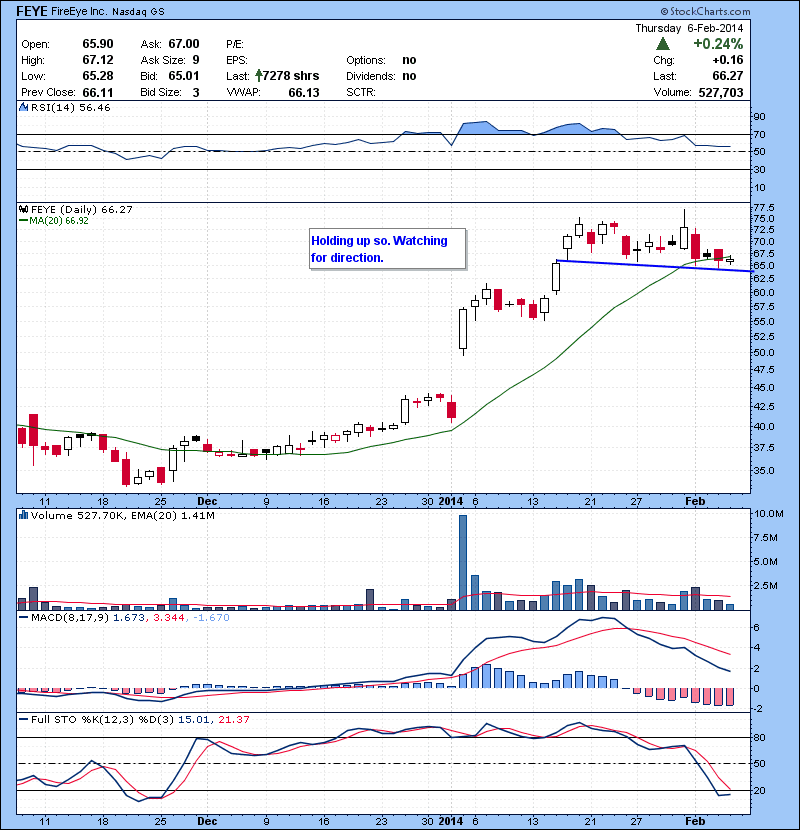

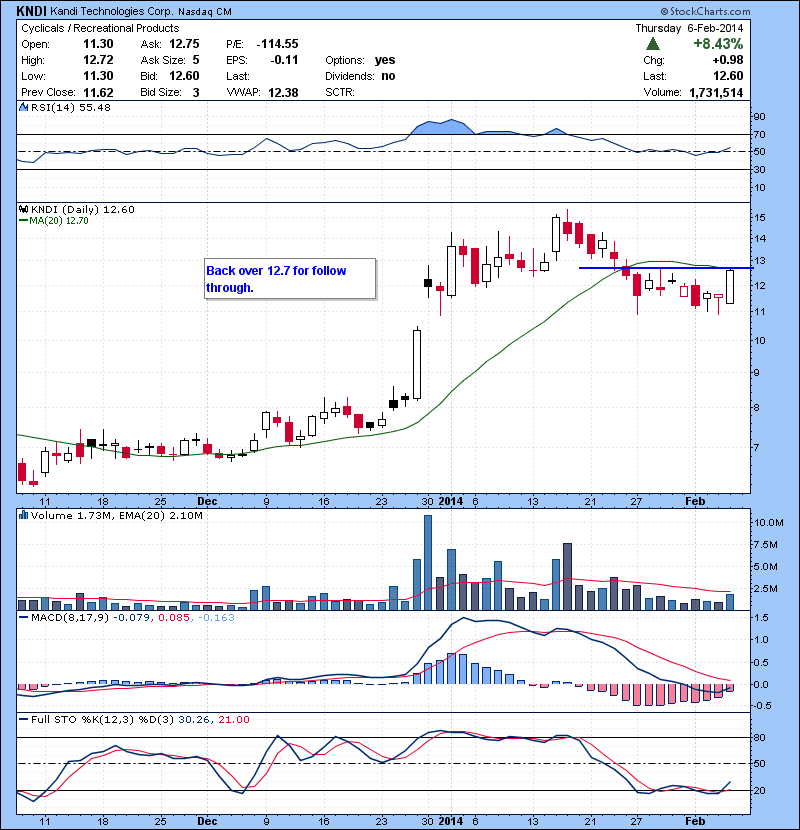

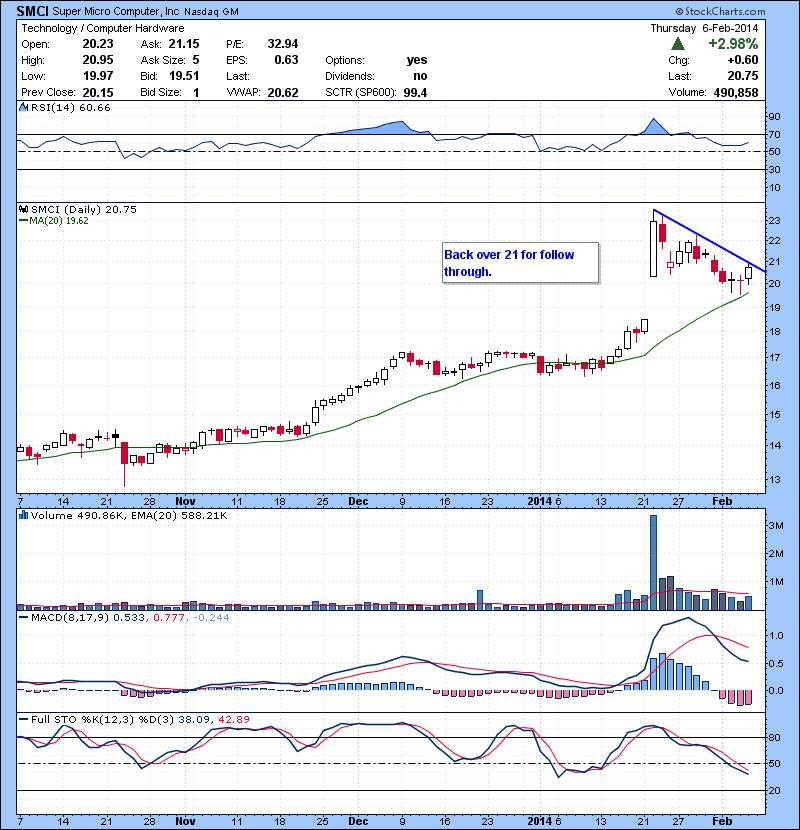

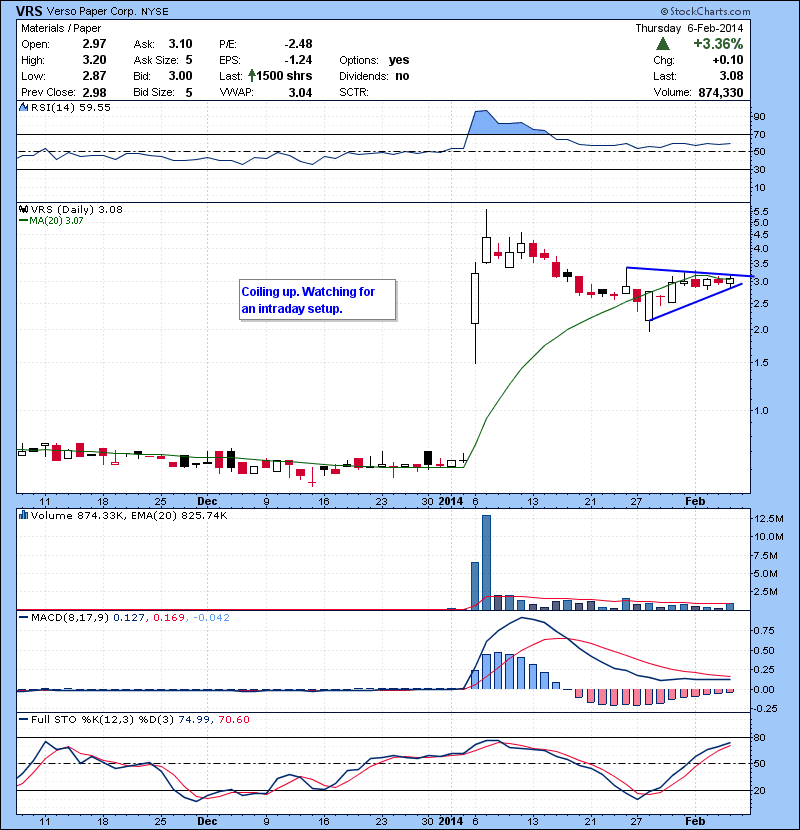

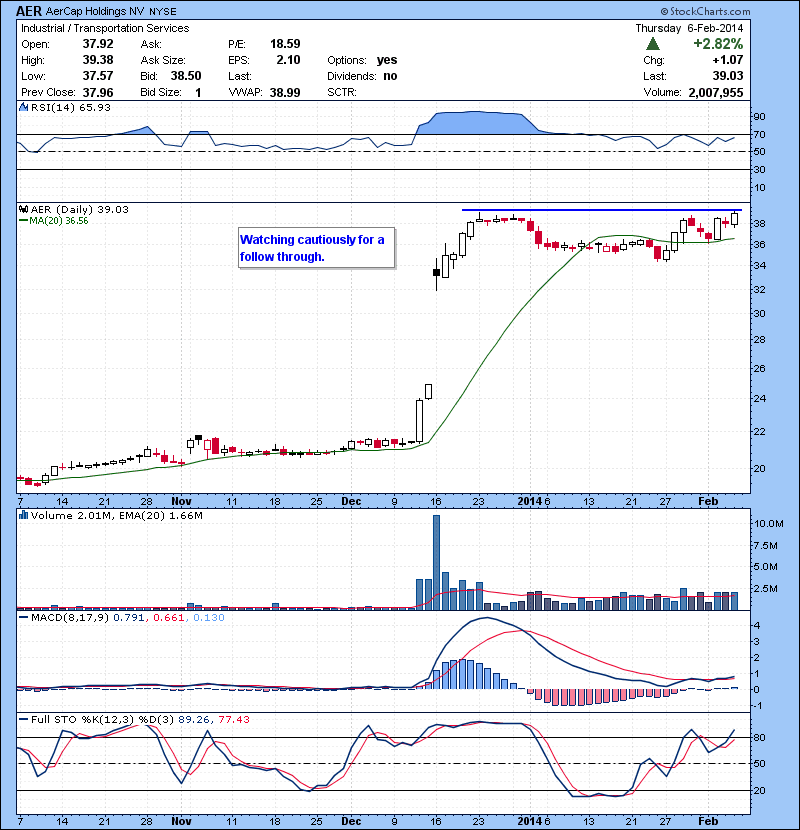

Bounce day in the Market, a follow through will take S&p-500 to 180 overhead resistance area. In terms of individual daily chart setup, there isn’t much out there. Much damage were done and it will take some time to heal. We will most likely stick with earning runners for short term day trades in the chat room.If you are struggling with your trading the you need to join our 60 day bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. The class is one of a kind. See why you should sign up for the course here and email me thenyctrader@gmail.com.You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders.

Follow me on Twitter and StockTwits @szaman