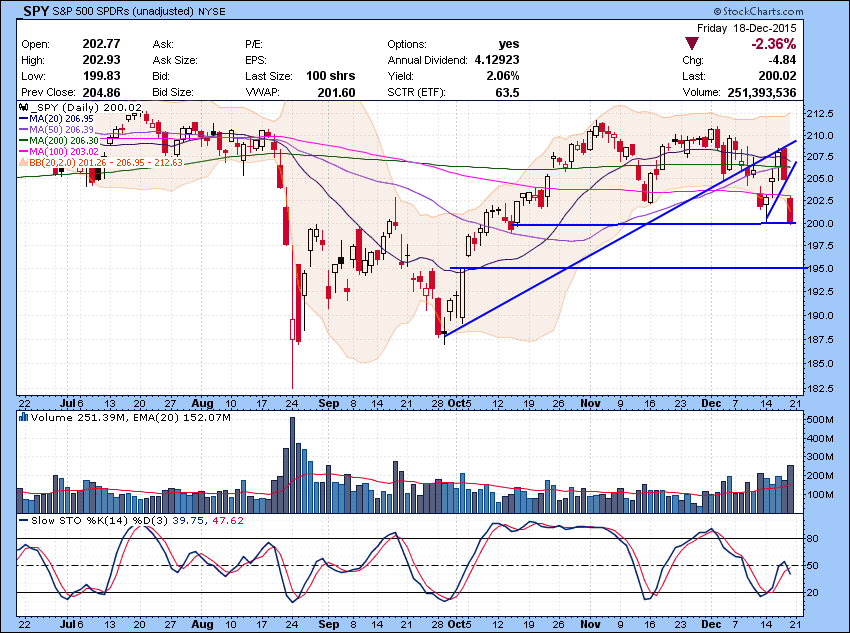

Bear flag scenario played out in the market after fading at resistance and a close below all moving averages on Thursday.

SPY back to that 200 support area but support becomes irrelevant on multiple test. However, SPY is now getting oversold and completely out side of Bollingar Band. No bounce here has a possibility to lead to crush mode. Next support is on gap fill, 195 area. Solar stocks holding up relatively well, we had some success shorting them on Friday but no home run. I will be watching few them like SEDG, RUN for a quick short if market continues to get weaken. Watch list mostly contains few names that are holding up well. If Market bounces, these will likely be first to make a move to the upside. Volatile action out there, if you don’t know or not sure how to trade, just stay aside and wait for better times or you can join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.