Orderly grinding down action continues in the market. No sign of panic or capitulation type action yet except for biotech, some of the bio names saw absolute blood bath on Thursday.

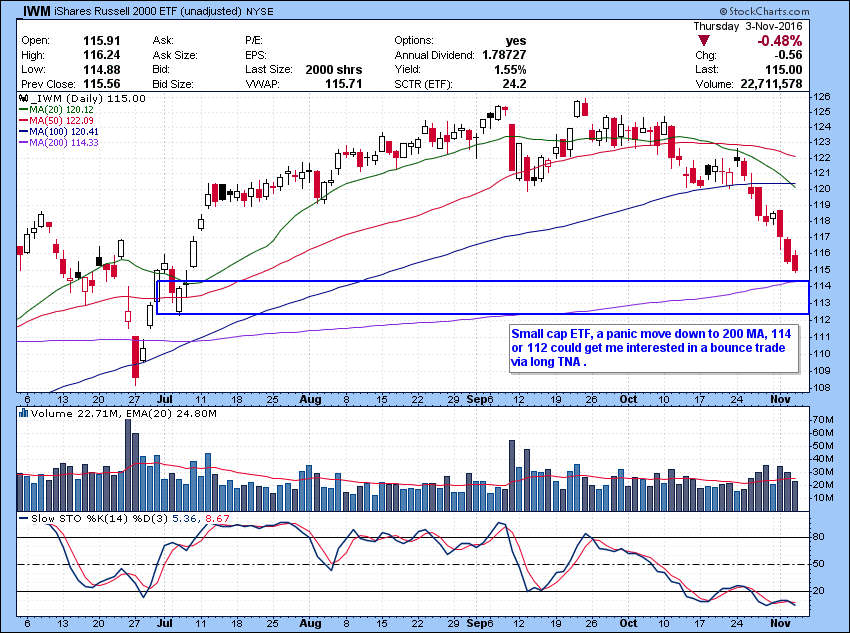

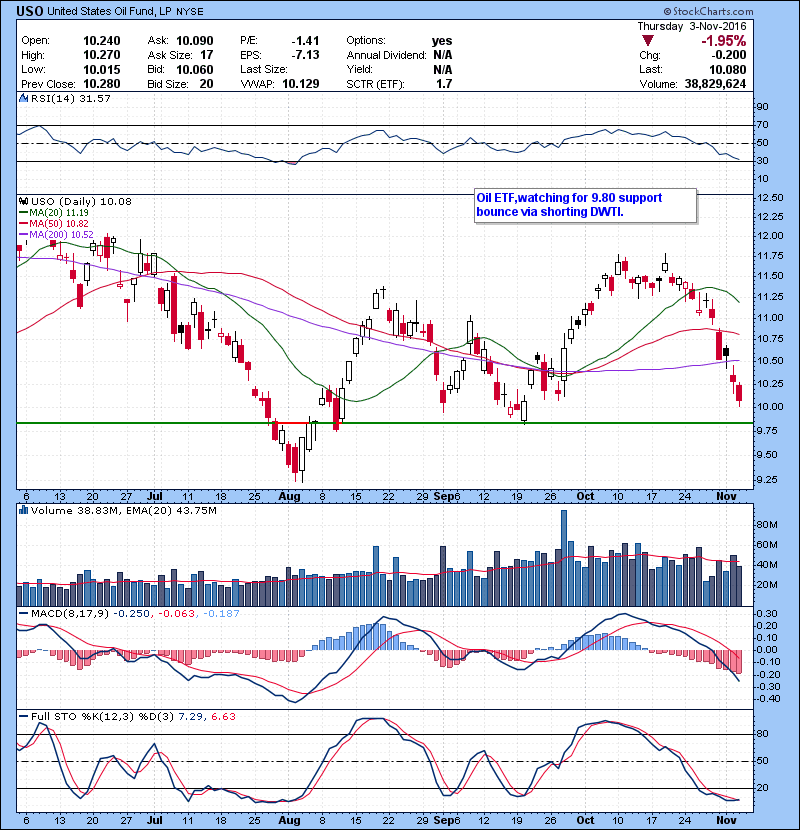

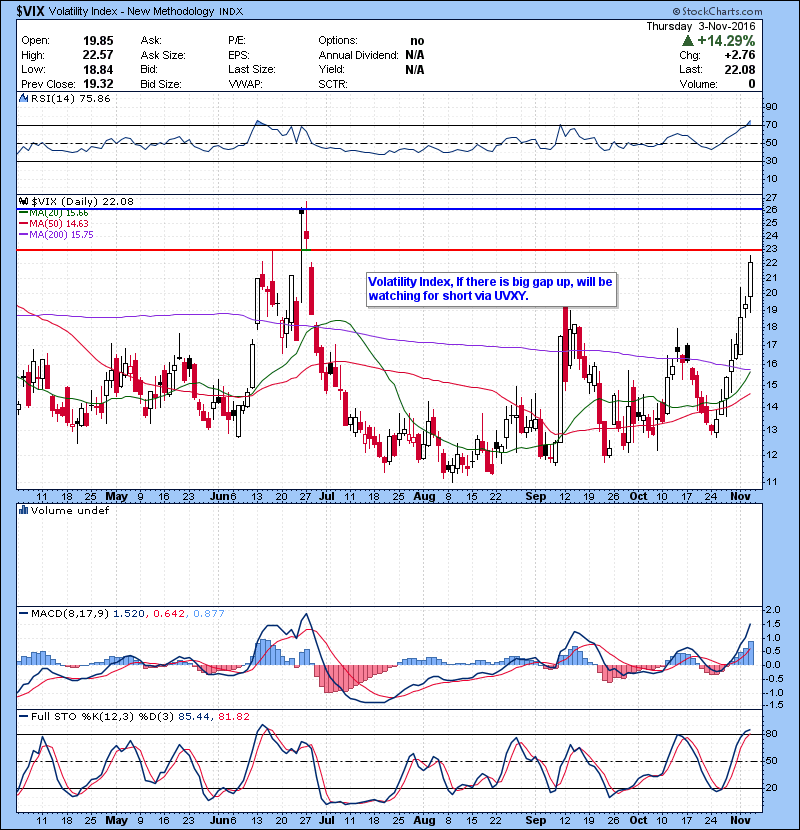

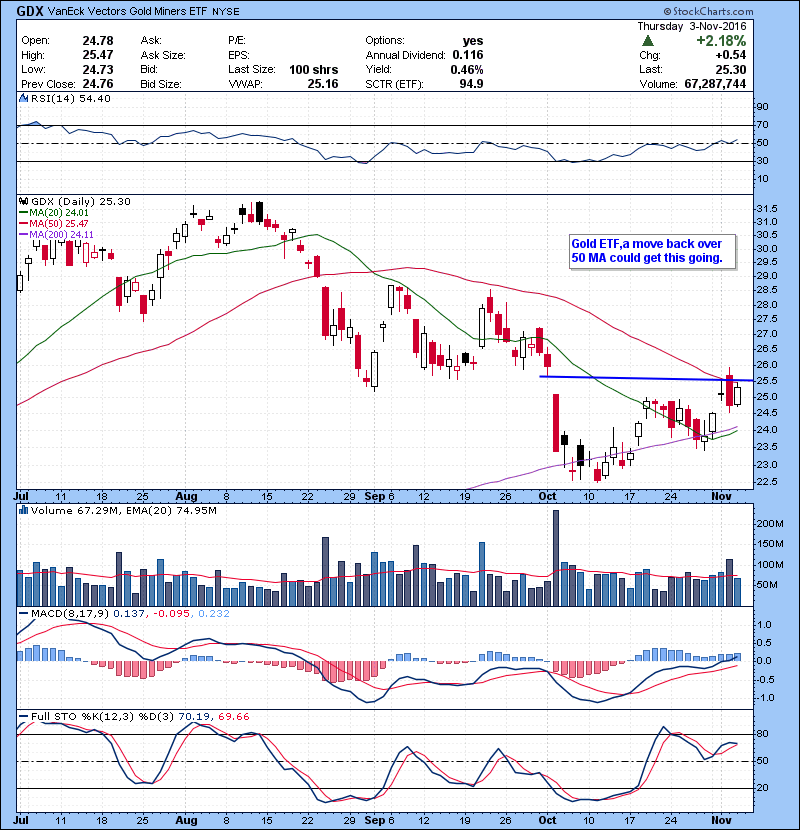

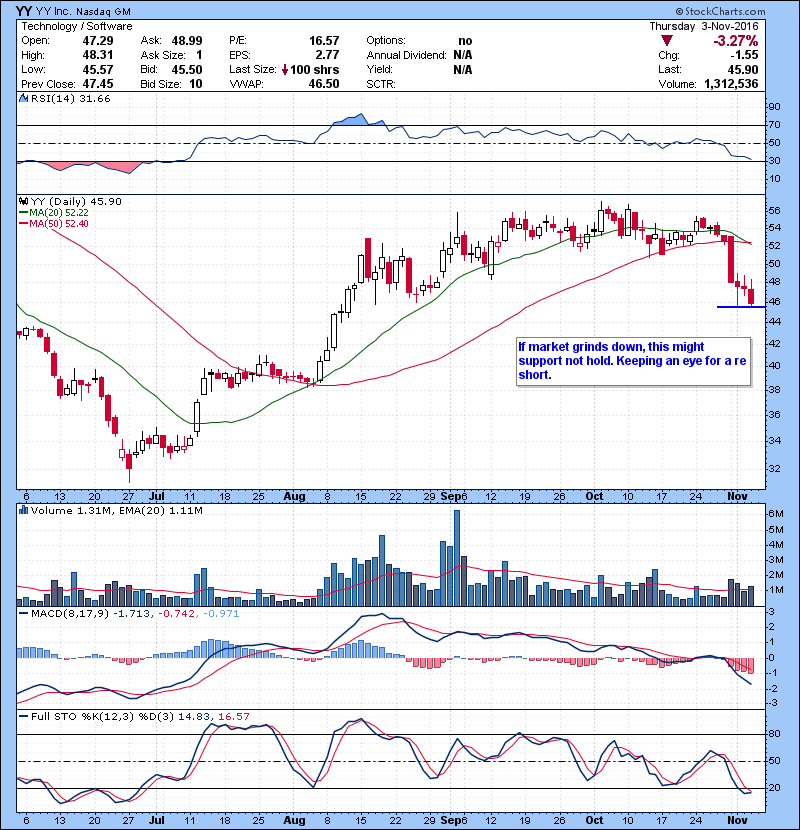

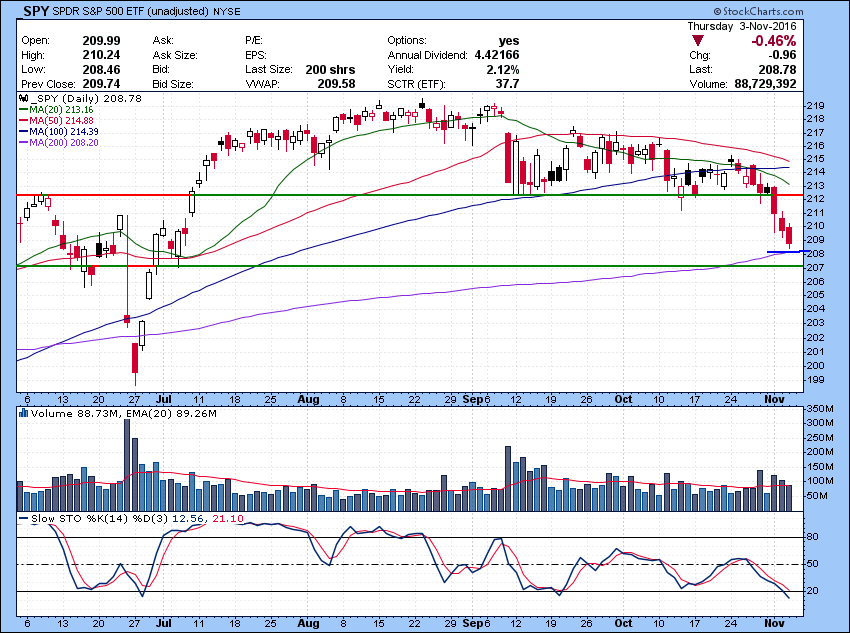

No surprise here as far as this type of correction, as I have been talking about “tell tell” sign all October.Specially, poor action on individual stocks compare to main indices, lack of leadership, lack of positive reaction after decent earning from big name stocks.Final draw was when small cap IWM broke support on last Thursday. As far as when market will bounce, ideally we need to see a big panic type capitulation move on indices. Not sure when that will happen this or next week after or ahead of election on Monday. Many eye on SPY 200 MA,208 for a bounce, ideally i would like to see it overshoot to 207 on a violent move to nibble some long via SPXL. Not sure if ut will hit that number but always good to have game plan. We are mostly sticking with trading ETF’s names. They trade much better on volatile market than individual stocks. So watch list contains bunch of ETF’s. Check out our trading courses. starting again thismonth. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of

@kunal00 while he trades live everyday.