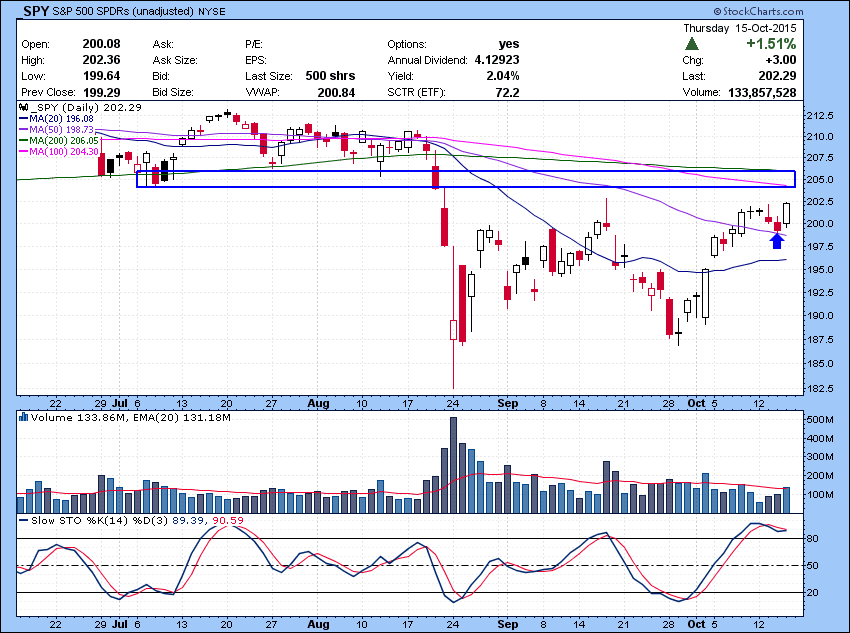

Impressive rally by the Bulls after SPY found support at 50 MA as i pointed out as a possibility in the last post.

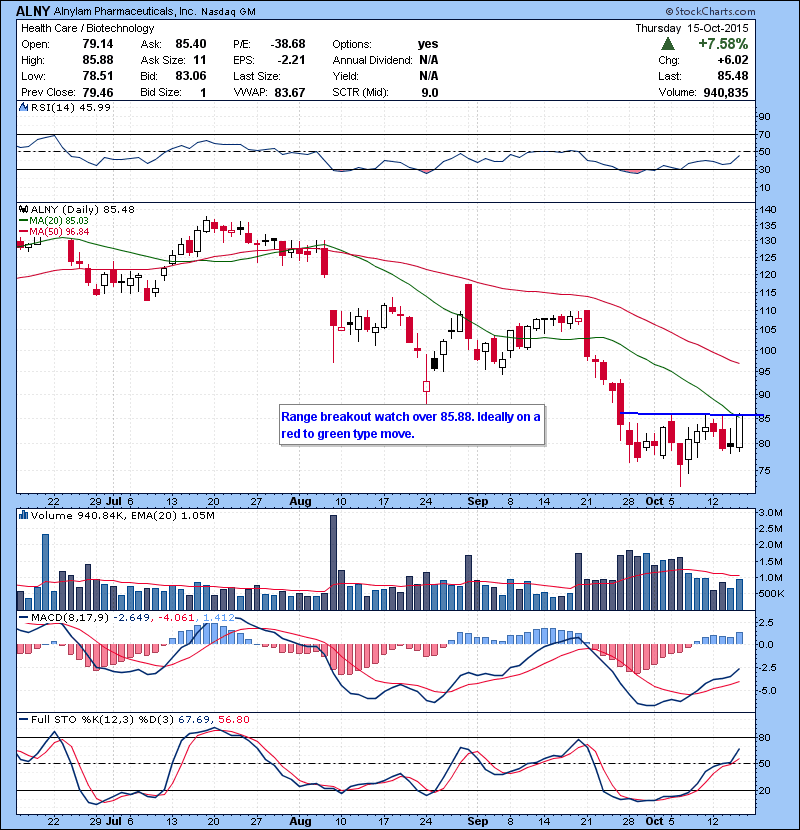

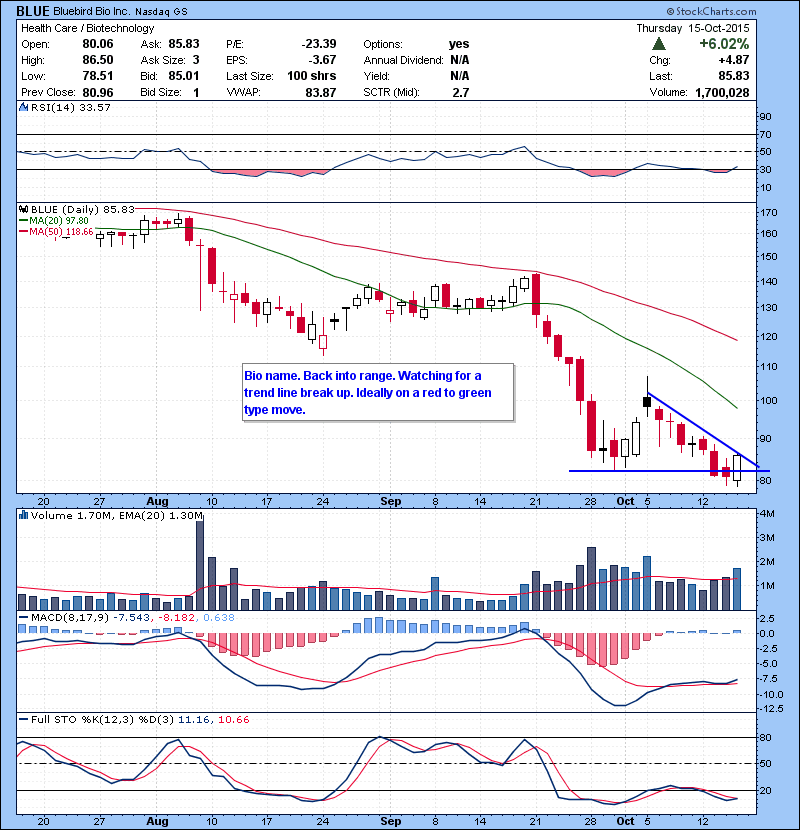

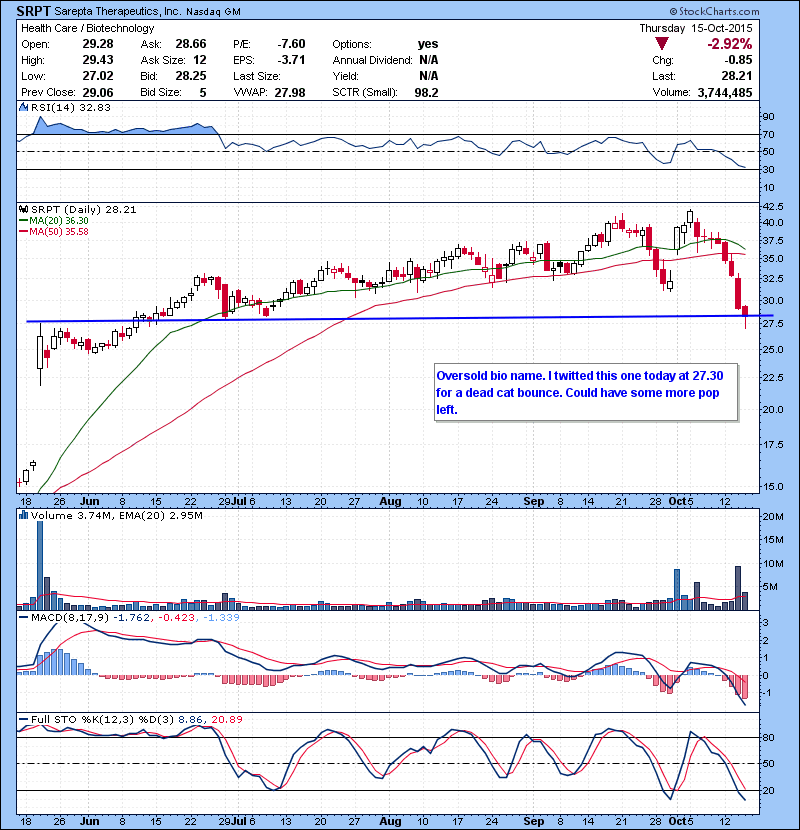

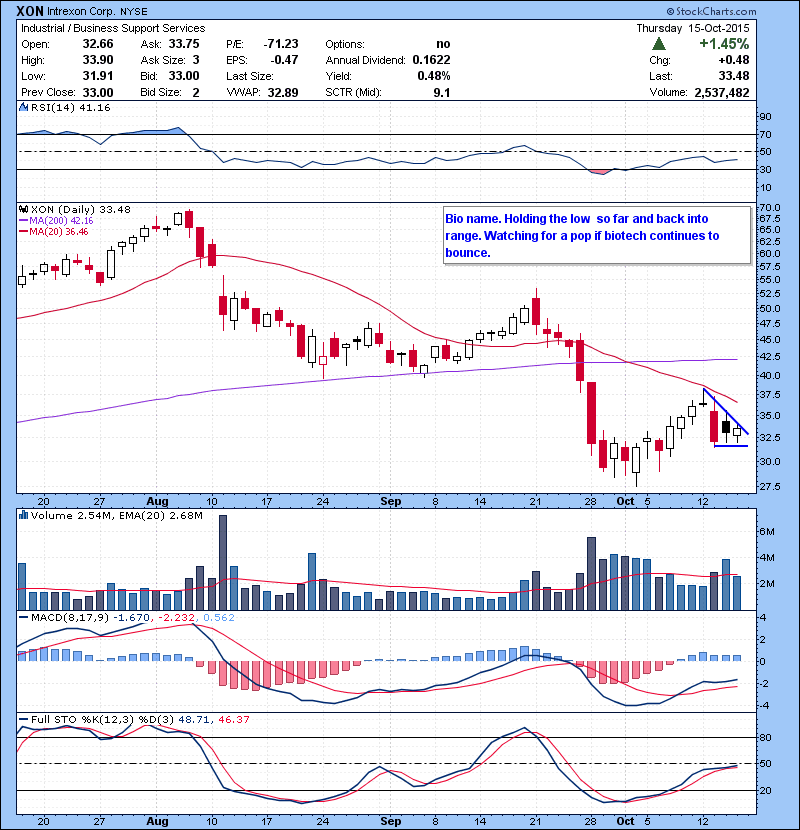

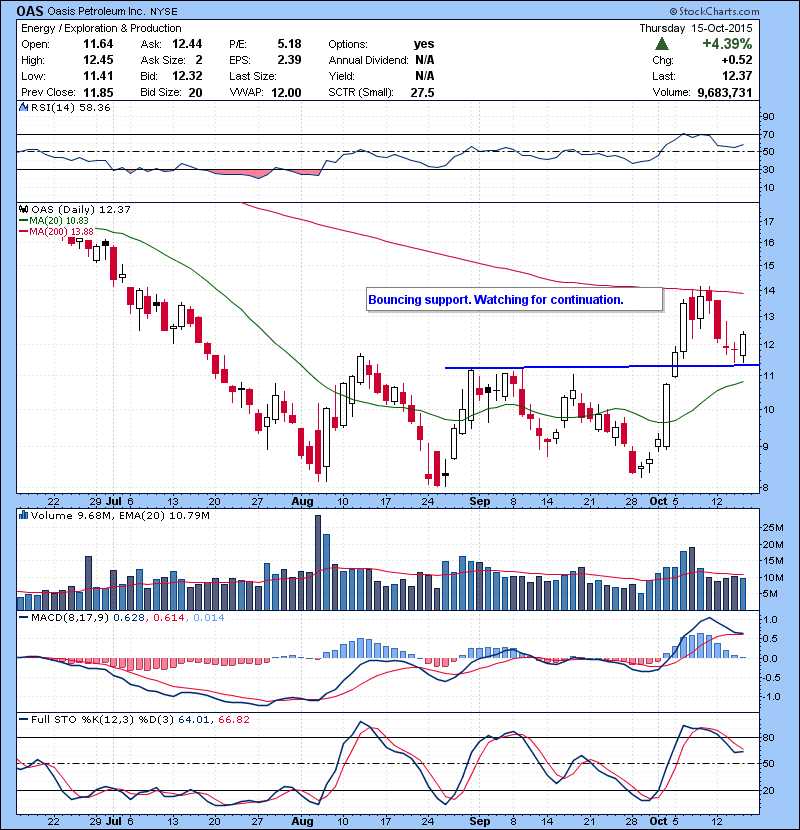

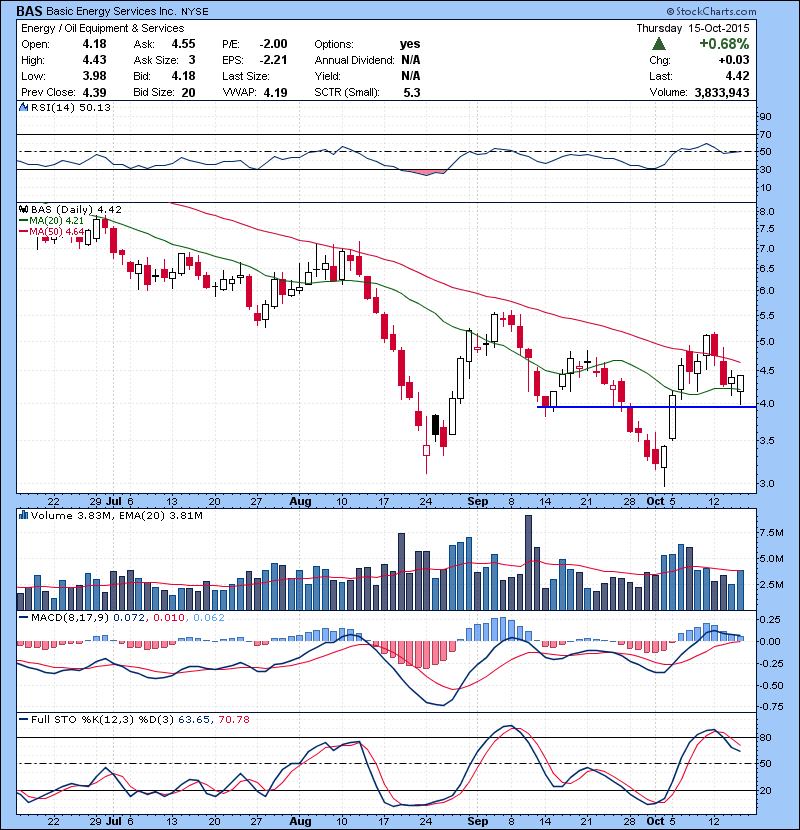

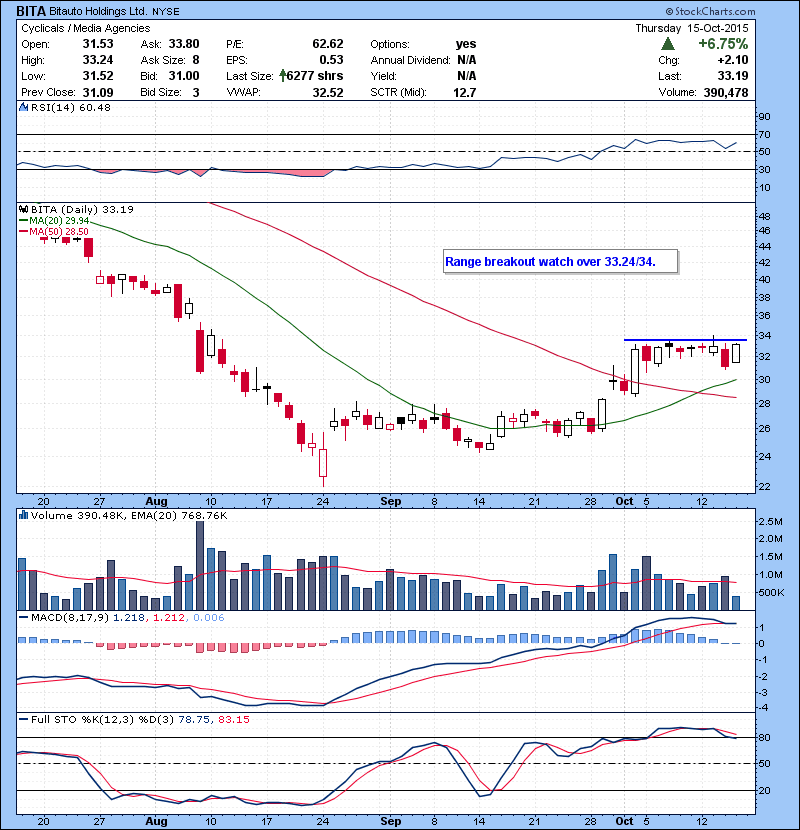

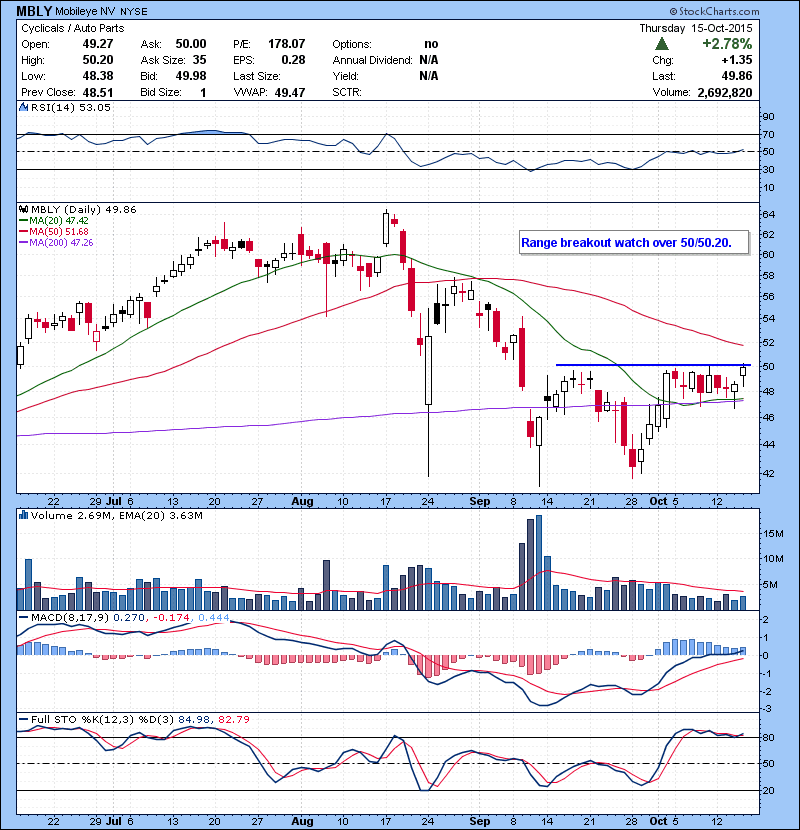

Nice breadth action as pretty much every sector participated in the rally. Bulls are clear to take on SPY congestion zone 203.204 and 206 area. If market survives October then bullish seasonality comes in play for the rest of the year. Biotech finally caught some bids and trying to come out of a bear flag pattern. Oil stocks had orderly pullback and bounce so far. I have talked about , watching for a bounce in oil names. Watch list names OAS, BCEI , SGY bouncing nicely as expected. So I will be focusing on those two sectors again Friday. Ideally a red to green type move at open would be great ,as some the bio names had some extended run on late Thursday. Some decent trading opportunities so far this week with both long and shorts.If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.